New Pathfinder Release (Moose) - control offset accounts and set minimum account-based pension

11 August 2025

Release summary

The focus of this release was to make it easier to model and see surplus cash.

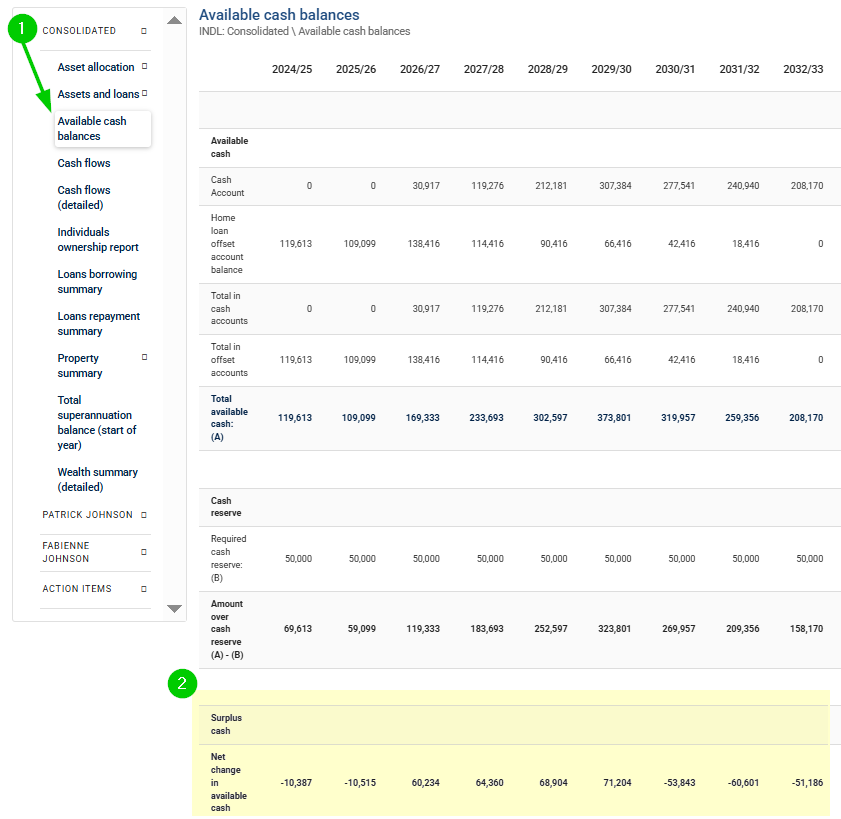

A ‘Surplus cash’ section has also been added to the Available cash balances report.

All these new features are now available in existing and new cases. For old cases, the new fields will be available, although you will need to review them to ensure that the field you were expecting has been set.

New features

Superannuation accounts - New option to set ‘Minimum Pension Only’

With the new ‘Pension payments’ field, you can set pension withdrawals to be only the minimum required percentage, which, in combination with the other available options, can prevent large super withdrawals, help make projections in retirement look more tidy and minimise transfers of funds between couples with different investment profiles.

To use this field:

Go to the Cash flows & Goals > Review super funds step

Find the super fund, and select the fields as follows

Custom options = More options

Option for withdrawals = Control withdrawals/pension

Pension payments (TRIS/ABP) = Control pension payments

Pension payment amount = Minimum pension only

You should also review the other fields in this section to ensure that the results are what you expect for when the pension is started, how much to roll over, whether lump sums are allowed and whether or not funds can be rolled back from the Pension phase to the accumulation phase.

When using this option, please also note:

If the super fund is drawing a Transition-to-retirement income stream (TRIS), then this option will also only draw the minimum for the the TRIS phase

If the individual is not receiving an ABP or TRIS for the entire year (e.g. because they only become eligible to start a pension for the latter part of the year), then the payment will be scaled accordingly

Offset accounts - new options to prevent deposits and/or withdrawals

For offset accounts on secured loans, there are two new fields to allow you to control deposits and withdrawals. These fields can be useful if you would prefer to direct surplus cash to a cash account or another offset account.

To use these fields:

Go to the Cash flows & Goals step, and find the loan

For the Offset account options field, choose ‘Set Offset Account Deposits/Withdrawals’

You can then choose to not allow deposits and/or withdrawals

Please note that:

If you set ‘Do not allow withdrawals’, then no withdrawals will be made, unless it is required to keep the offset account from exceeding the loan balance.

If you want to keep the offset account balance the same as the original balance, then you can turn off deposits and withdrawals.

On a new loan, if you set ‘No deposits to offset account,' then the offset account won’t be used at all.

Available Cash Balances Report - New ‘Surplus Cash’ Section

A new Surplus cash section has been added to the Available Cash Balances report (under Detailed Reports > Consolidated). It includes a new line called Net change in available surplus cash (which covers cash accounts and/or offset accounts in the case:

This value is positive when the combined total in cash and offset accounts is increasing (e.g. due to saving).

It’s negative when those balances are decreasing (e.g. to fund expenses or goals).

This line makes it easier to get a snapshot of how much cash is building up or being drawn down year-by-year, because it takes the net change in the cash and offset account balances, and is not affected by transferring funds between different cash/offset accounts.

This report is available in all cases, although for cases started before this was released, you will need to click the Start solve button to refresh the results over time.

Notes for existing users

Bug fix for Superannuation - ‘Must receive super guarantee’ and Pension options can now be used together

On Super funds, these combinations of two options options can now be used in conjunction with each other:

'Must receive super guarantee; and

'Never start pension' or ‘Start in certain year’

Previously, the pension option could be ignored. If this affected your case, you just need to click ‘Start solve’ again to refresh your results.

.png)