Technical update: Budget 2020/21

Monday 12 October 2020

In this release

Don't forget to refresh your case results

The changes below will apply to all cases that are solved on or after 13 October 2020 (irrespective of the case creation date). If your scenario was solved on or before the release date of 12 October 2020, you can update your results by clicking 'Start solve' again. It is recommended that you re-solve all scenarios in active cases so your results are using the same technical data and are consistent. For more information, see How to check when your results were created.

Technical updates

Updates from Budget 2020/21

On 9 October 2020, the following changes to tax were passed in Parliament, and are now available in Pathfinder:

The second stage of the Government’s Personal Income Tax Plan has been brought forward by two years to 1 July 2020.

The low and middle income tax offset (LAMITO) is retained for 2020/21.

For the Low income tax offset (LITO), the maximum offset is changed from $445 to $700 for years 2020/2021 and 2021/2022.

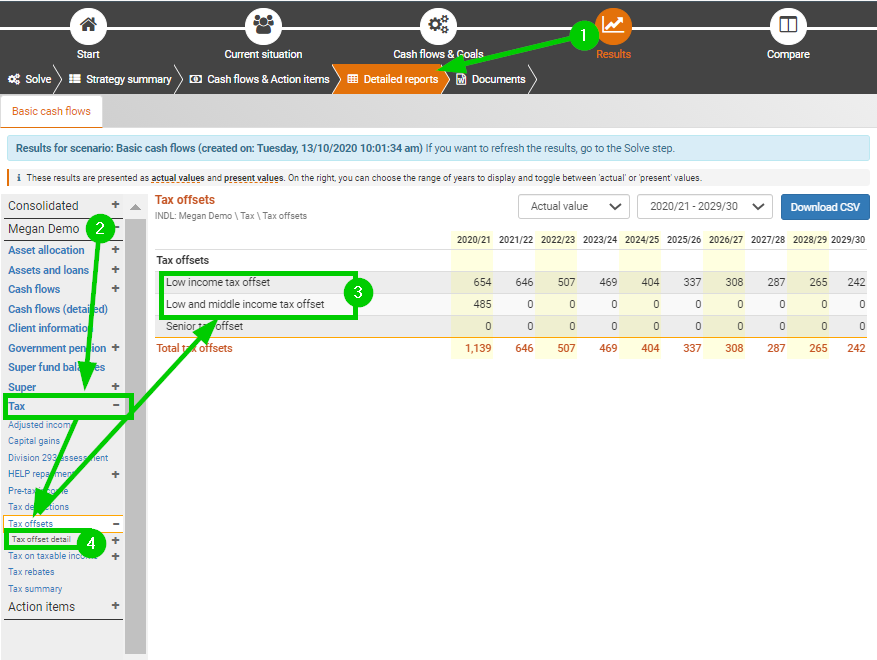

How to check LAMITO and LITO in your results

If you'd like to check the LAMITO and LITO calculations in your results:

Go to the 'Results > Detailed reports' step

On the left menu, click '(Individual name) > Tax > Tax offsets'.

The 'Tax offsets' report gives a summary of the LAMITO and LITO (including if they are zero)

The 'Tax offset detail' sub-report gives more information on how the offset was calculated

Update to Age Pension and Rent Assistance payments

'A guide to Australian Government payments' (September 2020) included the following changes which have also been included in this release:

Maximum government age pension payment and supplement for couple and single person increased as per latest publication

Rent assistance updated as per latest publication.

.png)