Technical update: LAMITO extended (Tasman v4)

28 June 2021 (Tasman v4)

On this page

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

Don't forget to refresh your scenarios

This release includes a technical update, so if you have any existing cases in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before the release on Monday 28 June 2021. This will ensure that all your scenarios are consistent. Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios and use the latest legislation. If you are unsure when your results were created, see How to check when your results were created.

Low and Middle Income Tax Offset (LAMITO/LMITO) extended to 2021/22

According to Treasury Laws Amendment (2021 Measures No. 4) Bill 2021, the Low and Middle Income Tax Offset (also known as LAMITO or LMITO) has been extended to the 2021/22 financial year (it was previously supposed to end in 2020/21). This change has also been updated in pathfinder.

LAMITO is calculated based on an individual's taxable income. To see if LAMITO is applied in your scenario:

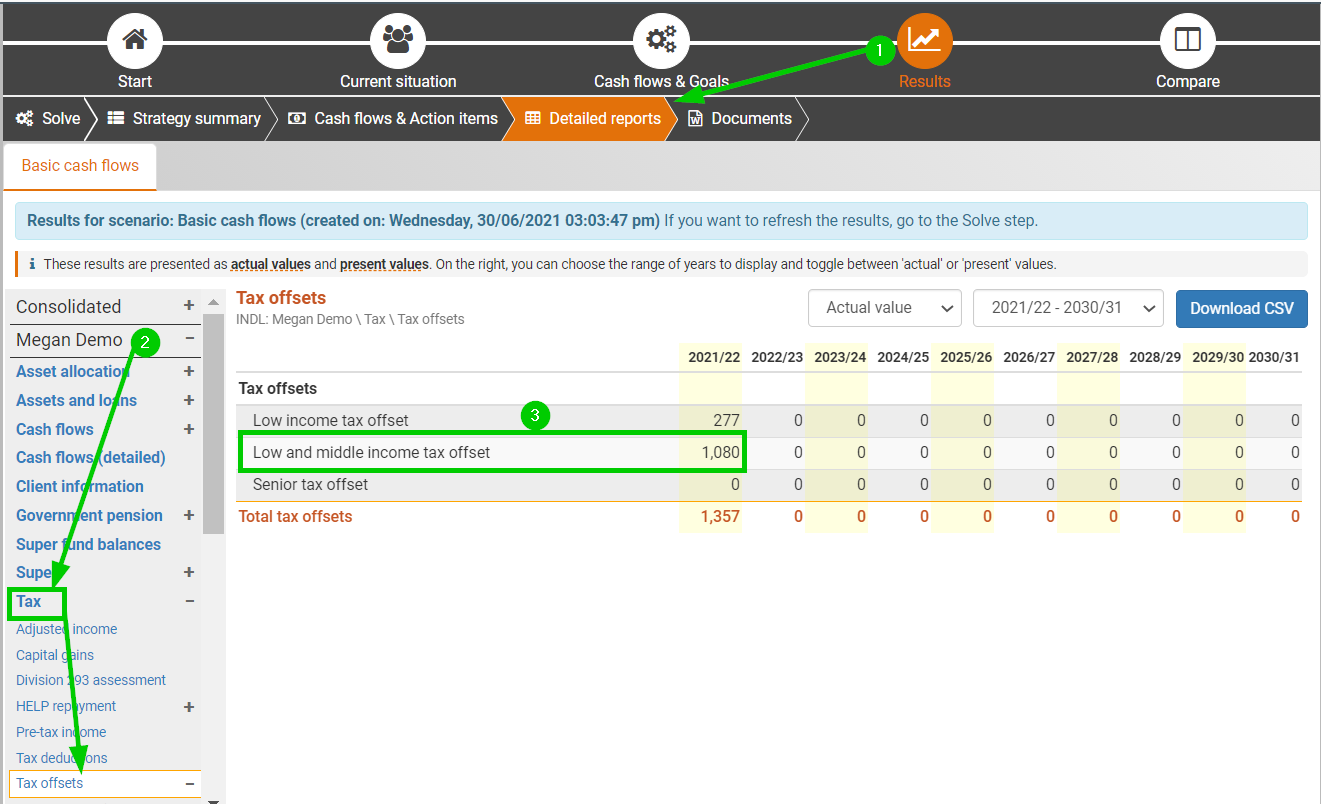

Go to the Detailed reports sub-step (under the Results step on the top menu)

On the left menu, choose: (Individual name) > Tax > Tax offsets

On the 'Tax offsets' report, there is a line for 'Low and middle income tax offset'

.png)