Default start date for analysis is now 1 July 2023

Optimo Pathfinder's default start date for analysis has been changed to 1 July 2023 (i.e., the 2023/24 financial year). This only affects cases created on or after 1 April 2023, as we find that in the last three months of the financial year, it is neater to start cases in the next financial year.

Accordingly, our sample cases now also begin on 1 July 2023.

Adding cases with the new default start year

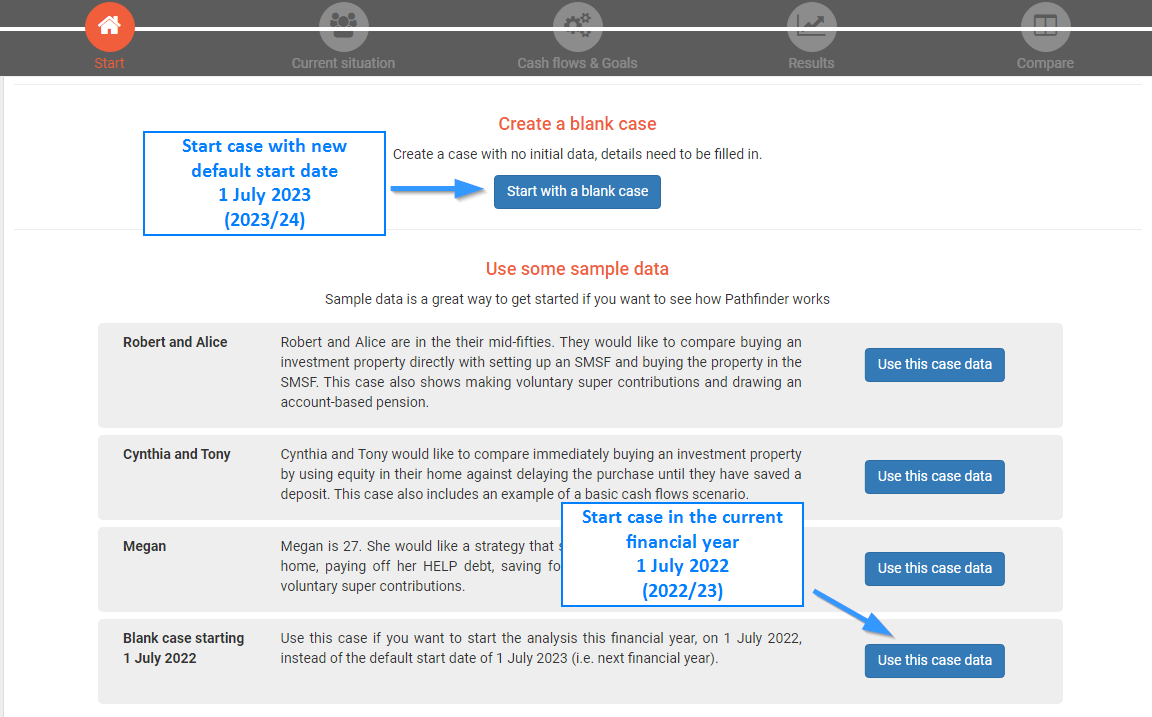

From 1 April 2023, when you add a new case:

The analysis will start on 1 July 2023

The results and reports will start from 2023/24 and will no longer include 2022/23.

When doing data entry in Pathfinder, please be mindful that 2023/24 may still display in some drop-down menus even if it isn’t included your case’s analysis. So, if you want to choose the first year of analysis make sure you actually pick 2023/24 and not just the first year on the list

How to start a new case with the non-default current financial year (2022/23)

If you would like your case to include 2022/23 because, for example, there are some important actions you would like your clients to take before the end of this financial year, then, before you start your case, at the Start step, click the 'Blank case starting 1 July 2022' button (instead of 'Start with blank case' at the top). Note that you must do this at the beginning, so if you have entered data and then want to change the start year without clearing your data, please Contact Optimo Financial.

Options to adjust old cases

Any cases created before 1 April 2023, will be unchanged and will continue to have the 2022/23 financial year.

Please Contact Optimo Financial, if you would like to change the start date for an existing case. If possible, we would prefer for you to ask us to make adjustments to the case before you start entering more data. Some occasions where you might want to change the date include:

The case was created before 1 April 2023, and you would like to move the start date forward to 2023/24.

The case was created after 1 April 2023, and you would like to move the start date back to include the 2022/23 financial year. e.g. the individuals would like to do something important before the end of the financial year, such as making super contributions while they are still eligible.

As an organisation, you would like to flip to the next financial year on a different date from 1 April.

Please note that you should allow 1 working days for changes to be made to your case.

.png)