New Pathfinder release (Qian v1)

Monday 4 May 2020

This release is named after 2nd Century BC explorer Zhang Qian. He was dispatched by the Han Dynasty court to lead the exploration of the lands of Central Asia, including the Fergana Valley.

Release overview

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

Second Beta release for SMSFs

A BETA release is a software development term for a software version that is fairly close to the finished product that is made available to users to try under real conditions. It is an opportunity for you to try a new feature sooner than if it were 100% complete, and is a chance for Optimo to gather more feedback and so we can incorporate it into the final version.

In this release, we've significantly improved the modelling for SMSFs:

Fees and expenses are now paid in a proportion that reflects the split between members and phases

The modelling at an individual level is now as tidy as the total SMSF balances

Overall, we've reduced the limitations on the modelling, but while were are still in Beta, please be aware that not everything is covered, yet.

Summary of what you can model in SMSFs

In Pathfinder, you can model an SMSF with:

one or two members

investments of cash or shares/managed funds

You can't yet model and SMSF with:

Properties

Loans

Three or four members

Complex requests outside the scope of the current interface

More than one SMSF

For more details, see the SMSF page on our help docs.

Improved SMSF modelling

The model can handle any option you choose for controlling cash and shares/managed fund assets

For cash and shares/managed fund balances, you can freely choose options to control by dollar value, balance or percentage, and the model will work well. Previously, we encouraged you to only use the 'Control by %' options.

Fees and expenses in the SMSF are now proportioned between members year-by-year

Fees that are entered on the SMSF (i.e. set-up, administration and audit fees) and cash flow expenses paid from the SMSF (e.g. adviser fees) are now calculated and allocated to members year-by-year and proportional to their shares of the SMSF in that year. This is more accurate than our previous modelling which proportioned fees to each member based on their balances at the start of the analysis (which was an issue if the proportions changed a lot over the course of the analysis).

SMSF Fees and expenses are now allocated proportionally between the accumulation and pension phases

Fees that are entered on the SMSF (i.e. set-up, administration and audit fees) and cash flow expenses paid from the SMSF (e.g. adviser fees) are now calculated and allocated between a member's accumulation and pension phases year-by-year and proportional to their shares of the SMSF in that year.

This is more accurate that our previous modelling which would take the more conservative approach always paying fees and expenses from the pension phase, unless only he accumulation phase existed.

Asset allocations between members and pension/accumulation phases will be accurate on the individual reports (as well as the total SMSF balances)

If your SMSF has two members or has accumulation and pension phase balances, so, the ratio you'll see for a certain asset in the total SMSF balance will be the ratio you'll see for each phase for each member. This is more accurate than our previous modelling where an individuals' asset allocation could have different proportions from the total SMSF balance.

Payment of fees when the SMSF balance goes to zero

If an SMSF balance goes to zero, and it doesn't pay any insurance premium or cash flows expenses (e.g. advice fees), then it will now close automatically and you don't need to set an exact close date.

Restrictions (stay tuned for the next release)

To see the restrictions still in place, please see the SMSF help documentation.

For the SMSF BETA release, this specifically means that:

If your case has an SMSF, the results should be fairly robust, but you should be aware of the limitations listed here.

We appreciate your patience and welcome feedback

The Optimo Team is continuing to work on an improved methodology which will be in the production release (date to be announced)

If you are an existing user of Pathfinder, please also see the Notes for existing users section, below.

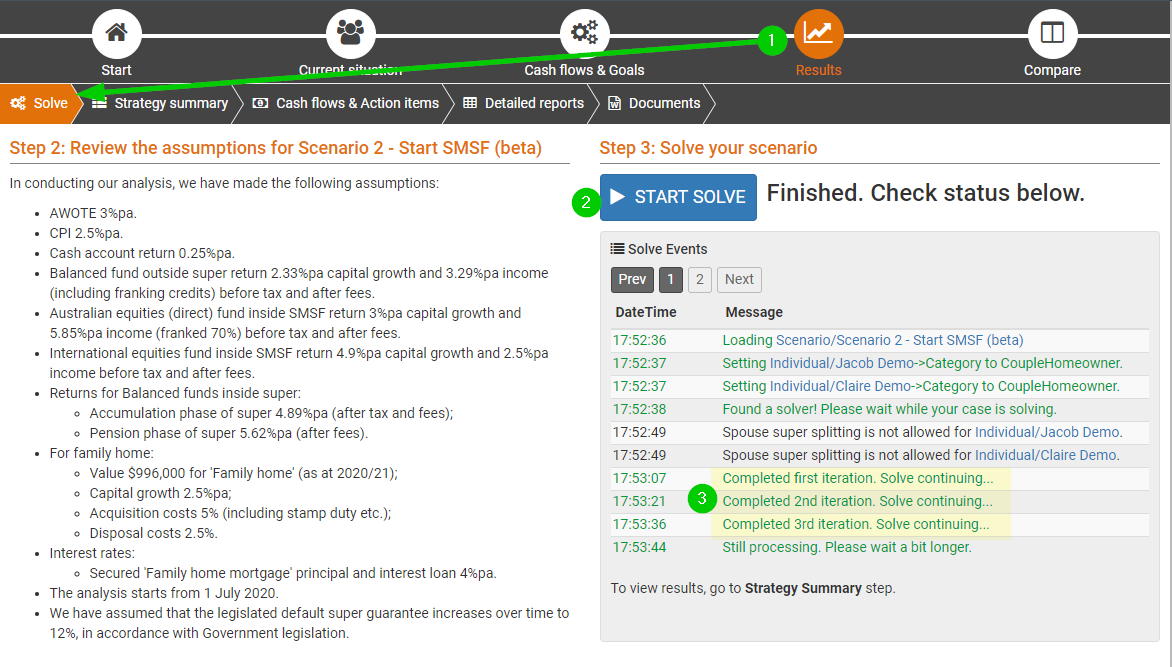

See how hard Pathfinder is working in the 'Solve events'

The more iterations Pathfinder needs to do, the trickier your problem is, and the longer it will take to solve. You can see how many iterations it is taking to solve your case by watching the 'Solve events':

Sneak preview or our next release

In our next release, you'll be able to model properties in SMSFs (a very popular request!). Stay turned for the release date, but the wait won't be as long as this release.

Notes for existing users - please remember to refresh your results for active cases

If you have any existing cases with SMSFs in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before 4 May 2020. This will ensure that all your scenarios are consistent and that all the charts work.

Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

.png)