SMSF (Self-Managed Super Fund)

How to add an SMSF

Items which should be entered under an SMSF:

The following information should be added under an SMSF:

SMSF details (name, administration/set-up/audit fees)

SMSF Member details (accumulation phase and pension phase balances) - up to two members can be included.

SMSF assets and liabilities

To add an existing SMSF:

Go to the Current situation step (top menu), then the Super & Trusts sub-step, then click the Add SMSF button (on the left menu)

On the main SMSF form, fill in:

the SMSF details: Name, administration fees

SMSF Member details, including each member's accumulation and pension phase balances

To add existing investments, stay in the Super & Trusts step, and click the Add investment to SMSF button (on the left menu)

To add new assets to an existing SMSF:

Go to the Cash flows & Goals step (top menu), and then the Review super funds sub-step

Find your SMSF in the Existing SMSF section, and click the Add new investment to SMSF button

To add a new SMSF:

Go to the Cash flows & Goals step (top menu), and then the Review super funds sub-step

Scroll to the end to the page and click the +Start a new SMSF button

On the main SMSF form, fill in:

the SMSF details: Name, administration fees

SMSF Member details

To add proposed investments to the SMSF, use the Add new investment to SMSF button (under the new SMSF details).

Modelling options for SMSFs

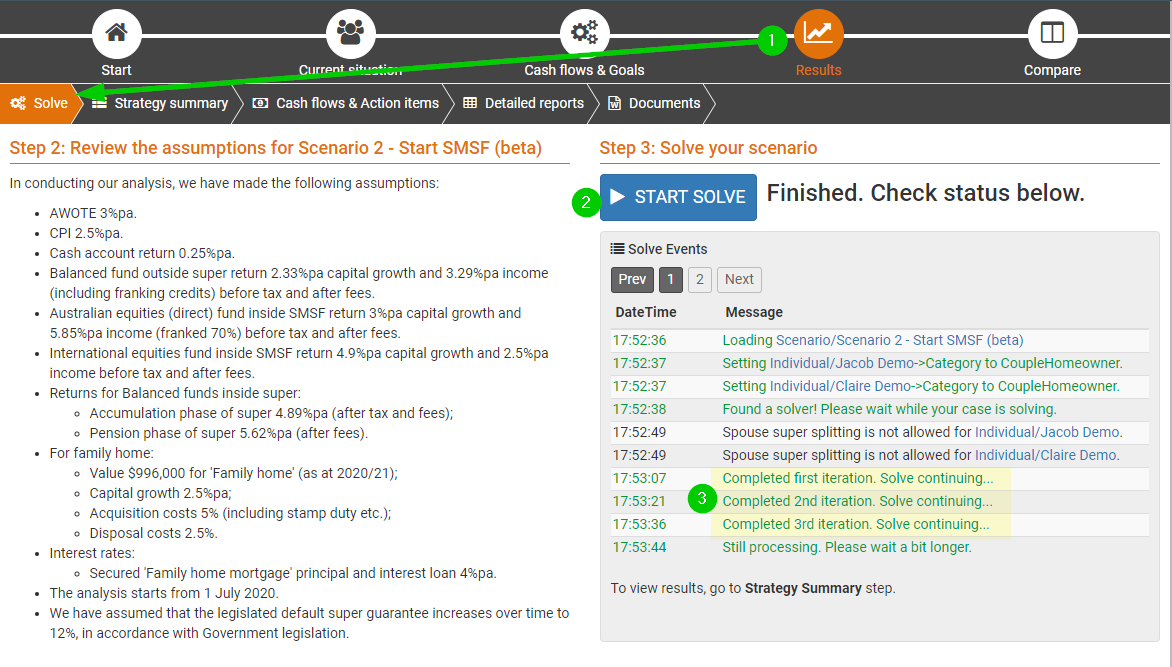

Improving solve times | Due to the complexity of SMSF modelling, you may need to wait longer for the results to be ready. While you are solving, you can see how hard the solver is working by checking the Solve events . The more iterations Pathfinder needs to do, the longer it will take to solve. You can see how many iterations it is taking to solve, and the time for each iteration, by watching the 'Solve events'. You can also check Tips for reducing solve times.  |

|---|---|

Start an SMSF |

|

Close an SMSF | You can set a year to close the SMSF if that is part of the strategy you want to model or if the SMSF balance is too low. In particular, if you check your results and see that the SMSF's balance is very low and only being kept open to pay fees and expenses within the SMSF, then it is best to set a specific close date for the SMSF to stop these fees being paid. To close the SMSF:

|

SMSF fees and expenses | The following fees can be entered on the main SMSF form:

If any other fees are being paid from the SMSF (e.g. financial adviser fees):

For more information, see the Expense in the help documentation. Please note that if you enter expenses as cash flows, then you should keep an eye on whether the SMSF balance is low or goes to zero in your results. If this happens, then you should set an exact year to close the SMSF (at the Review super funds sub-step (under Cash flows & Goals)) and re-solve the case. Otherwise, Pathfinder will continue to deposit funds into the SMSF just to meet the expense. |

General tips for setting options for assets inside super |

|

SMSF assets |

|

Keep assets in a ratio | 'Shares/managed funds' and 'Cash' held in super have a Control by % field option, that allows you to fill in a % of total unallocated funds field. When you fill in this field, Pathfinder will keep the investment in the set ratio relative to all other assets that also have the % of total unallocated funds field filled in. For example, if you set instructions as follows:

Pathfinder will keep the International shares and Australian shares in a ratio of 60:40, regardless of what the balances are for the cash account and 'Existing balanced fund' because neither of these options have the 'Control by %' option chosen. Pathfinder will make deposits to and withdrawals from the International shares and Australian shares in order to keep the specified ratio. |

Work out when to set up an SMSF once a minimum super balance has been reached | If you would like to set up an SMSF once a minimum super balance has been reached:

|

Voluntary super contributions | For more information on making contributions to the SMSF see Retirement planning goal (super contributions and pensions) |

Additional modelling options |

|

Results for SMSFs

See Superannuation and SMSF Results and Tax results (Individual and super).

Related items

Strategy Development Service (SDS) options

If the case includes complex analysis that you are not able to do in Pathfinder yourself, Optimo Support may be able to do some background adjustments to help you get the results you need. Depending on the complexity, this may be included as part of the standard support or additional charges may apply. For more details, please see Modelling outside the scope of Pathfinders' standard modelling.

Some examples of things that are outside the scope of Pathfinder's modelling and how Optimo support can help, are listed below:

Option | Details | Information Optimo Support needs | Examples where additional charges may apply |

|---|---|---|---|

Stop rollbacks from pension to accumulation phase | Pathfinder can roll funds from the pension phase back into the accumulation phase if it will optimise the projected net wealth at the end of the analysis. If you do not want the rollbacks to happen beacuse it makes the results look tidier and easier to implement, they can be switched off. For some reasons as to why the rollbacks happen, please see Understanding why funds are kept in in the accumulation phase of super instead of the pension phase |

| We can apply this for both individuals as part of support, however if the request is more complicated than that, additional charges may apply. |

More precise SMSF options for rollovers, lump sum withdrawals, when to start an account-based pension | If you would like to model something where the options are not available in the interface, then we can apply a background constraint. |

| If it is a simple change to one or two actions, then the change can be part of the standard support. However, if the request is for a large number of actions, then additional charges may apply. |

SMSF with three or four members | You can model cases with three or four members, but you should keep an eye on the results. For example, in the action items, assets may be listed as belonging to all members, rather than just the individual who owns it. |

| If the adjustments are extensive, then we may suggest you submit the case to the Optimo Financial SDS |

SMSFs with loans for shares/managed funds | Please see | ||

SMSF assets that have a negative growth | Pathfinder can only model SMSF assets with a positive return. | That you need to submit the case to the Optimo Financial SDS . Please include:

| We would need to figure out whether a workaround is possible. This would require you to submit the case to the Optimo Financial SDS, and then, if it is possible, we will provide a quote. We will confirm whether it is possible for us to model this for you. |

SMSFs that are the beneficiary of a Trust | This is not possible in the websolve, but a workaround may be possible in the SDS. | The name of the case that you would like to submit to the Optimo Financial SDS | We would need to figure out whether a workaround is possible. This would require you to submit the case to the Optimo Financial SDS, and then if it is possible, we will provide a quote. |

Reversionay pensions | This is not possible in the websolve, but a workaround may be possible in the SDS. | The name of the case that you would like to submit to the Optimo Financial SDS | We would need to figure out whether a workaround is possible. This would require you to submit the case to the Optimo Financial SDS, and then if it is possible, we will provide a quote. |

Starting a second pension for an individual in the same SMSF | In practice, it is possible for an individual to start a second pension in their SMSF without affecting the status of an existing 'Return of capital' account-based pension, however, this isn't possible in Pathfinder. | This isn’t possible in Pathfinder, so an alternative approach would be to add a second SMSF with the new pension and adjust the fees and assets across the two SMSFs so they don’t double up. | If you need a lot of assistance in setting up the workaround, then we may suggest that you submit the case to the Optimo Financial SDS |

.png)