New Pathfinder Release (Qian v2) and legislative updates

6 July 2020

This release is named after 2nd Century BC explorer Zhang Qian. He was dispatched by the Han Dynasty court to lead the exploration of the lands of Central Asia, including the Fergana Valley in Uzbekistan.

Release overview

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

New SMSF modelling (BETA) - Popular request!

.png?inst-v=e9a3be73-7ceb-4c2a-9097-6f975dbaae4c)

Our SMSF model has been completely re-written! At first glance, you might think SMSFs look the same, but under the hood we’ve taken out the old SMSF engine, and replaced it with a brand new one perfectly tuned to do the best SMSF modelling you can get!

This release has all the features of the old SMSF modelling, but with some significant improvements in the new model, including being able to add properties and their mortgages in the SMSF. We’ve also done a bunch of tiny fixes that are too numerous to list, but they all add up to a significantly more robust model (take our word for it!).

Overall, we've reduced the limitations on the SMSF modelling, but while we are still in Beta, please be aware that not everything is covered, yet.

Summary of what you can model in SMSFs in the new BETA release

In Pathfinder, you can model an SMSF with:

One or two members

Investments of cash or shares/managed funds

Properties and their mortgages (new!)

Accurate modelling of asset allocations and fees between individuals and phases

You can't yet model an SMSF with:

Loans secured by shares/managed funds

Three or four members

Complex requests outside the scope of the current interface

For more details, see the SMSF page on our help docs.

What is a BETA release?

SMSFs are still a BETA release. A BETA release is a software development term for a software version that is fairly close to the finished product that is made available to users to try under real conditions. It is an opportunity for you to try a new feature sooner than if it were 100% complete, and is a chance for Optimo to gather more feedback and so we can incorporate it into the final version.

This rewrite was a huge amount of work, with the same amount of testing, but while we’re still in Beta phase, we appreciate your patience.

You can now include SMSF properties and their mortgages (popular request!)

You can now include properties and their mortgages in SMSFs (previously they were only part of our paraplanning service). In this release, the property ownership split is now calculated more accurately based on the proportions of the SMSF member balances. Previously, Pathfinder defaulted to a 50-50 split and required a manual change which was only available as a background adjustment. With this change, the ownership is automatically calculated accurately.

The modelling for SMSF properties and mortgages, also includes:

You can buy, sell or keep properties (although if you have a lot of properties, we recommend avoiding the ‘sell if optimal’ and ‘Keep for X years’ options to keep the solve times reasonable)

You can choose how you’d like to approach paying off the mortgage, including only making minimum repayments and setting a specific repayment year and letting Pathfinder calculate an affordable schedule of repayments.

No limit on how many properties or mortgages you include

If you were using Pathfinder before this release, make sure you also read the 'Notes for existing users' section, below.

Additional flexibility in the SMSF modelling

We did a quiet release in May 2020 where we released most of the SMSF improvements, except for the properties. So this release continues to include the following improvements to the SMSF modelling, which we released in May:

For cash and shares/managed fund balances, you can freely choose options to control by dollar value, balance or percentage. Previously, we encouraged you to only use the 'Control by %' options.

The modelling at an individual level is now as tidy and accurate as for the total SMSF balances:

Fees and expenses are now more accurately modelled so, year-by-year, they are paid in a proportion that reflects the split between members and phases

Asset allocations between members and pension/accumulation phases will be accurate on the individual reports as well as the total SMSF balances

If an SMSF balance goes to zero, and it doesn't pay any insurance premium or cash flows expenses (e.g. advice fees), then it will now close automatically and you don't need to set an exact close date.

Legislation updates

Superannuation Legislation Amendment (2020 Measures No.1) Regulations 2020

In this release, the “Superannuation Legislation Amendment (2020 Measures No.1) Regulations 2020” has been implemented and applies for analysis years from 1 July 2020:

The age at which the work test starts to apply for voluntary concessional and non-concessional super contributions has been increased from 65 to 67.

The cut-off age for spouse contributions has been increased from age 70 to 75.

More Flexibility for the work test

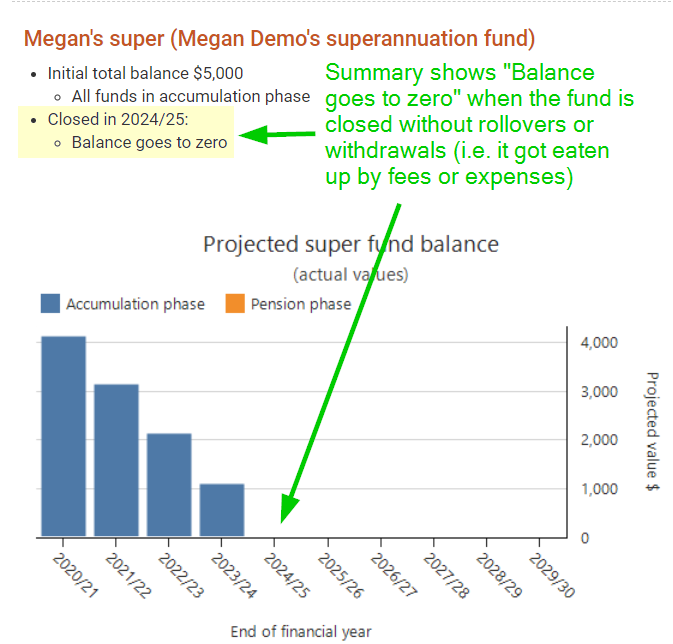

We have also implemented an earlier Bill ("More Flexibility for the work test") that allows from 1 July 2019 Australians aged 65 (now 67) to 74 with a total superannuation balance below $300,000 to be able to make voluntary super contributions and receive spouse super contributions for 12 months from the end of the financial year in which they last met the work test. If this rule is applied in your case, it will be mentioned in the action items:

(Please note that a related Bill allowing individuals aged 65 and 66 to make up to 3 years of non-concessional contributions under the bring forward rule has not yet passed the Parliament and hence is not implemented in this release).

Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2019

Limited recourse borrowing arrangements as enacted in “Treasury Laws Amendment (2018 Superannuation Measures No. 1) Bill 2019” have been implemented:

For an individual who has satisfied a nil condition of release (mainly retired or reached age 65), if they are part of a limited recourse borrowing arrangement commenced after 1 July 2018 then their Total Superannuation Balance is increased by their share of the outstanding balance of the loan.

1 July 2020 changes to various government payments, threshholds and tests

The following values have been updated in the technical database and apply from 1 July 2020:

FTB-A and FTB-B thresholds and payments for 2020/21 and beyond

Various values for the Age Pension (Maximum income and assets for full pension, lower limit for deeming rate)

HELP debt repayment income threshholds and rates

Schedule of fees and charges for residential and home care

Medicare levy thresholds

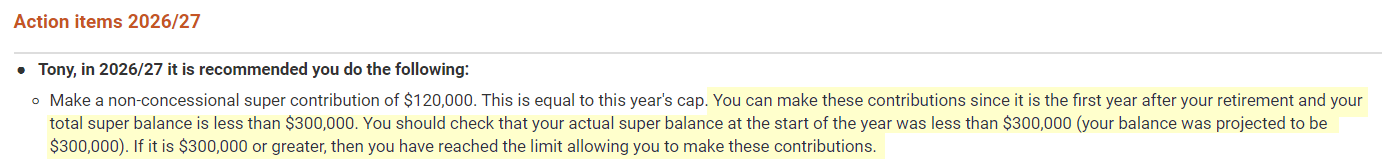

Improved strategy summary reports for super funds and SMSF member balances

In the results, at the Strategy summary step, we've always covered the most common ways for opening and closing a super fund, and now, after reviewing your feedback we’ve made some improvements to more elegantly cover some rarer edge cases. So, if you start an SMSF with contributions and no rollovers, or your super fund closes because the fees ate it up, the reports will look neat.

New pages in our help documentation

We’ve added the following pages to our help documentation:

Workaround for using unused concessional cap in first year of analysis

Edit (17/08/2023): ‘Workaround for using unused concessional cap in first year of analysis’ replaced with How to include or exclude the unused concessional cap carry forward rule.

Notes for existing users

Remember to refresh your results for active cases

If you have any existing cases already in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before this release (Monday 6 July 2020). This will ensure that all your scenarios are consistent and that all the charts work. Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

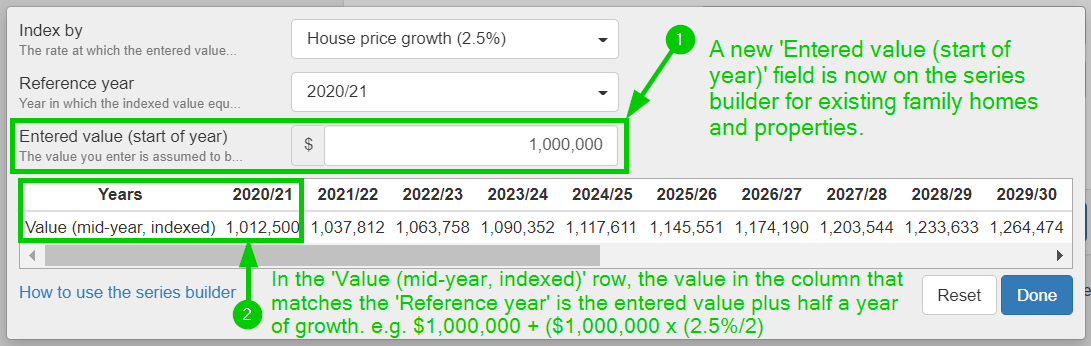

Existing family homes and investment properties are now modelled with the start of year value

The property value you enter for existing family homes and investment properties will now be taken as the start of year value (rather than the mid-year value). We have made this change so it is consistent with the rest of the asset data entry and initial SMSF member balances, which are assumed to be the start of year value.

This change means that:

It is important to re-solve any active cases that were started before this release so the assumed values for properties are consistent across all scenarios

Compared to previously, Pathfinder will model an additional 6 months of growth for the property/home, so the final projected value will be a little higher than previously.

If you have an existing property that is sold in the first year and you’d like the sale price to match the value you entered, simply set the ‘Index by’ value to ‘None’

Note that proposed properties entered at the Cash flows & goals step are the same as before. So, the value you enter will be assumed to be the mid-year value. This is more intuitive because properties are also assumed to be bought mid-year so the value you enter will correspond to the purchase price.

The main change you will see in the data entry is on the series builder on the Property value $ field. When you enter a property value on the main form, if you open the series builder, it will appear in the new 'Entered value (start of year) field in field series builder:

Some improvements to solve times

Reducing solve times is tricky, but we’ve made some adjustments to help improve the solve times of those tricky edge cases. We’re hoping it will reduce how many very slow cases you get.

However, cases with an SMSF may take a little longer than before, because the solver is working harder with the new implementation.

While you are solving, you can see how hard the solver is working by checking the Events log . The more iterations Pathfinder needs to do, the trickier your case is for Pathfinder, and the longer it will take to solve (but hopefully, the wait between iterations isn’t too long). You can see how many iterations it is taking to solve your case by watching the 'Solve events'. You can also check Tips for reducing solve times.

Small improvements by popular request

Thanks to your feedback, we've made some minor improvements to Pathfinder:

New action item to report Gifting in Trusts - If you have an SDS case with a Trust (or Trusts), or you're doing cheeky Trusts in the websolve, then there is now an automated action item when gifting occurs, so our analysts (or you) don't have to add this manually. So, if you see a 'Gift to Trusts' line in the cash flows report, there will now be a corresponding action item.

We’ve improved the validations on the Family home ‘sale options’ field so that it’s easier to see if you’ve chosen an option that isn’t compatible with buying a new family home, which is an improvement on getting an opaque error at the solve step.

As part of our background adjustments, we can now increase future property or family home values as a result of renovations.

If you are trying to buy a case and your payment is declined, you’ll now get a more helpful message (e.g. insufficient funds, try your card again, try another card. contact Optimo)

Bug fixes and small adjustments

Occasionally, cases that had a blank ‘Cash reserve’ reserve field were being truncated at the ‘Strategy summary’ step. Previously, the workaround to fix this was to fill in a small value for the ‘Cash reserve’, but now it’s okay to leave the ‘Cash reserve’ field blank and the 'Strategy summary won't be truncated.

At the ‘Solve’ step, you might have seen errors some about investments in a super fund which you couldn’t see and correct when you clicked the link. (e.g. 'Future % split' is required). This has now been fixed so the errors won't show unless they're visible, so if you see these errors and click the link the relevant fields will always be visible for you to fix. This was a bug introduced in the previous release and was triggered by choosing the ‘Close now’ option.

We’ve done some tidying up and removed some obscure, online detailed reports that didn’t spark joy. We doubt you’ll miss them, but for the record, the here’s list (if you do miss them, please let us know what you were using them for and we’ll bring them back!):

Inside super (under Consolidated > Asset allocation > Asset allocation)

Outside super (under Consolidated > Asset allocation > Asset allocation

Ownership report (under Consolidated)

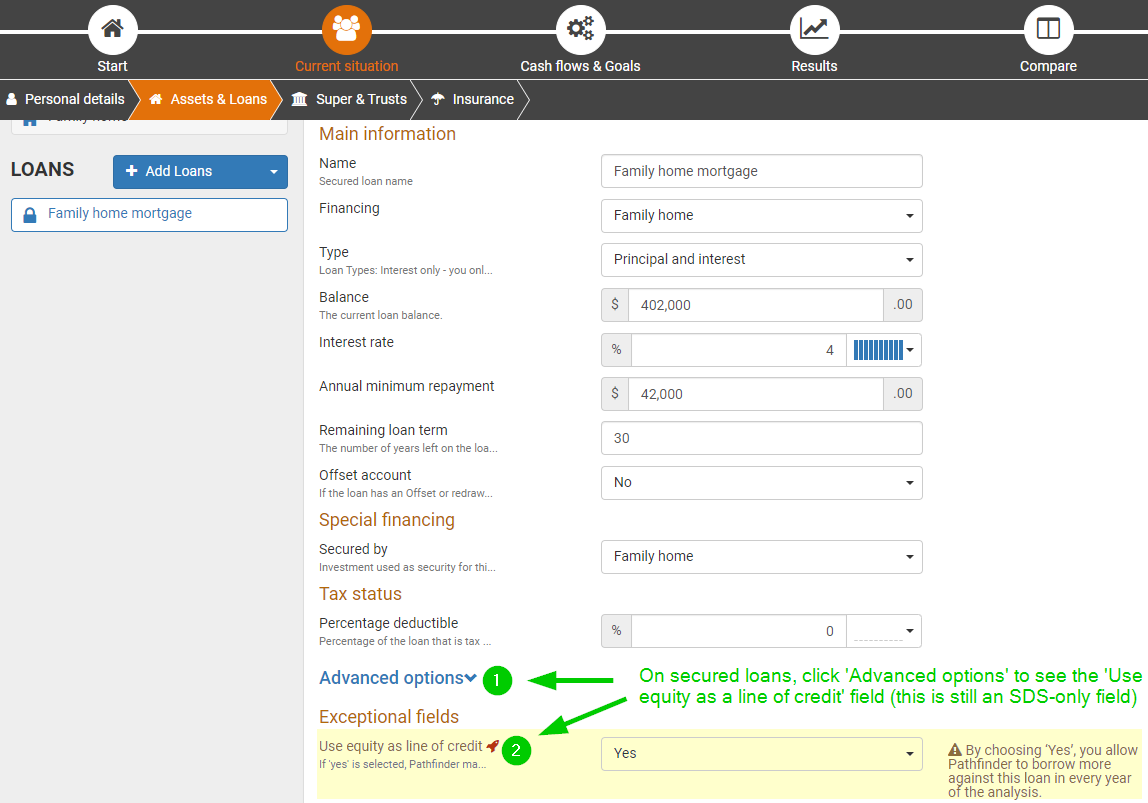

On existing Secured loans, we’ve moved the ‘Use equity as a line credit field’ into the ‘advanced options’ section. We did this because new users were accidentally changing it to ‘Yes’, so we thought we’d make it less tempting. We’ve also added a validation to remind you that this field may not do what you think it does. In most cases, this field is left as the default ‘No’, so this change shouldn’t really affect many cases.

.png)