New Pathfinder Release (Riedle) - SMSF modelling now in production

11 August 2020

Release overview

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

You can now model SMSFs (Popular request!)

You can now model SMSFs in Pathfinder! We've completely re-written the SMSF model and extensively tested it during out Beta phase. It's taken us a lot of time and a lot of work, and now we think Pathfinder gives you the best SMSF modelling on the market!

Pathfinder's SMSF modelling now covers:

One or two members and accurate modelling of asset allocations and fees between members and accumulation and pension phases

Cash and shares/managed funds - you can freely choose options to control these assets by dollar value, balance or by keeping in a ratio

Properties and their mortgages:

Property ownership is automatically calculated based on the proportions of the SMSF member balances

You can buy, sell or keep properties (although if you have a lot of properties, we recommend avoiding the ‘Sell if optimal’ and ‘Keep for X years’ options to keep the solve times reasonable)

You can choose how you’d like to approach paying off a property's loan, including only making minimum repayments, setting a specific repayment year, or letting Pathfinder calculate an affordable schedule of repayments

No limit on how many properties or loans you include

Rollovers to and from other super funds

Pathfinder will calculate transition to retirement income streams (TRIS), account-based pensions, lump sum withdrawals based on the member's expenditure needs and other income.

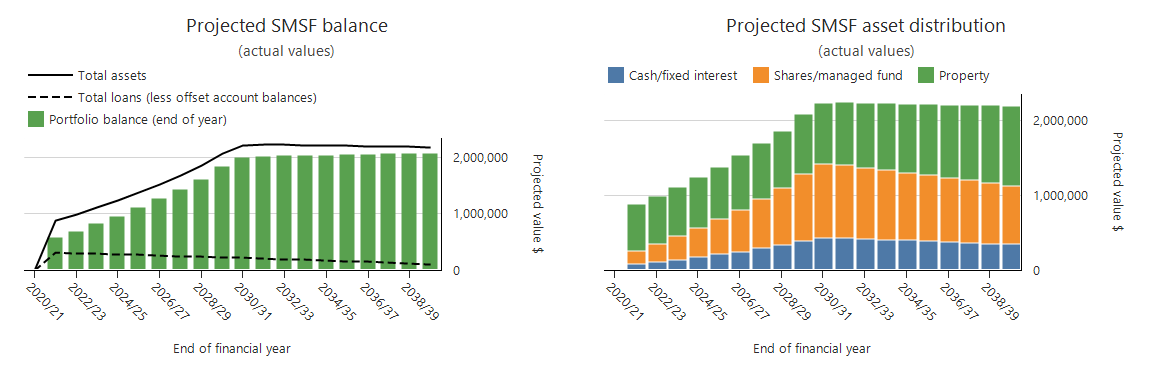

The results for SMSFs include:

Strategy summaries and charts for each SMSF member, the total SMSF, and each asset and loan in the SMSF

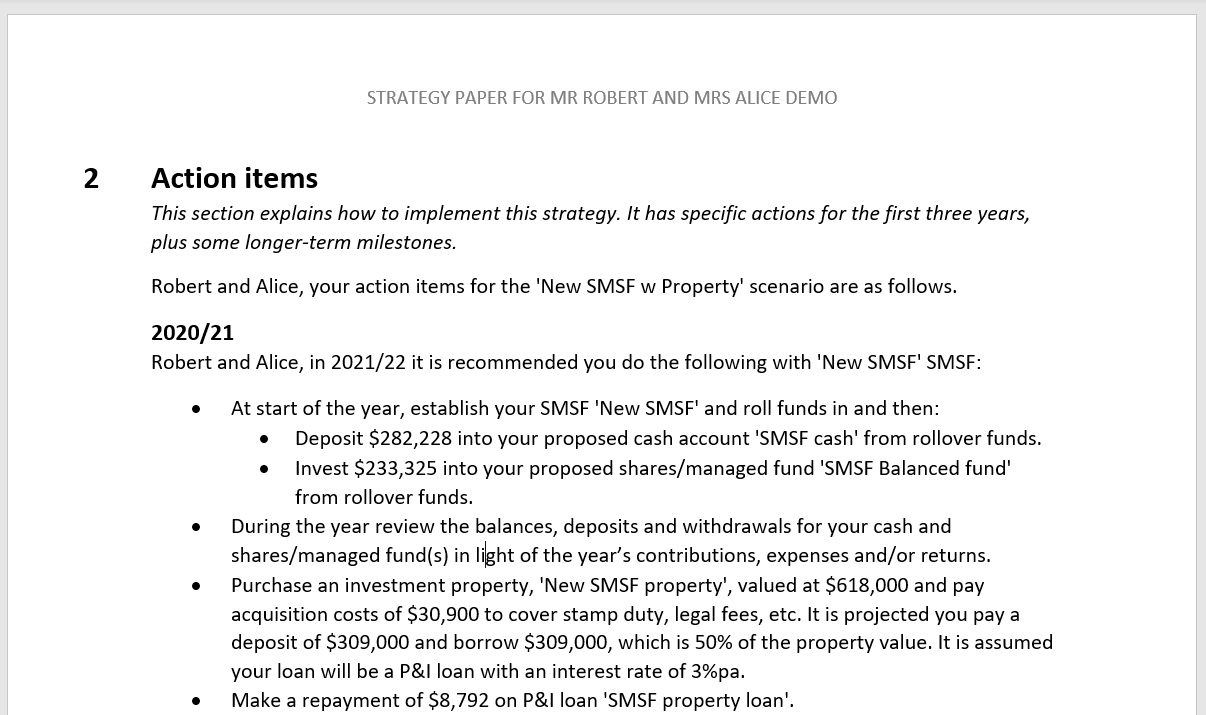

Action items for assets within the SMSF (new!)

Action items for each member's roll overs, pensions and withdrawals

Detailed reports including transactions, tax, asset/loan reports, pension payments and more.

For more, see the SMSF (Self-Managed Super Fund) in our help docs.

We hope that the above is enough to cover the most common SMSF modelling needs, however in later releases, we'll be adding options to more precisely control each member's deposits and withdrawals.

If you were using Pathfinder before this release, make sure you also read the 'Notes for existing users' section, below.

New action items for SMSFs

As part of this release, Pathfinder now includes some new action items for SMSFs, including:

Action items for setting up an SMSF and making initial deposits

Action items for assets inside the SMSF: property purchase/sale, property loan repayments, reminder to re-balance cash and shares/managed funds

Action items for closing an SMSF and final withdrawals.

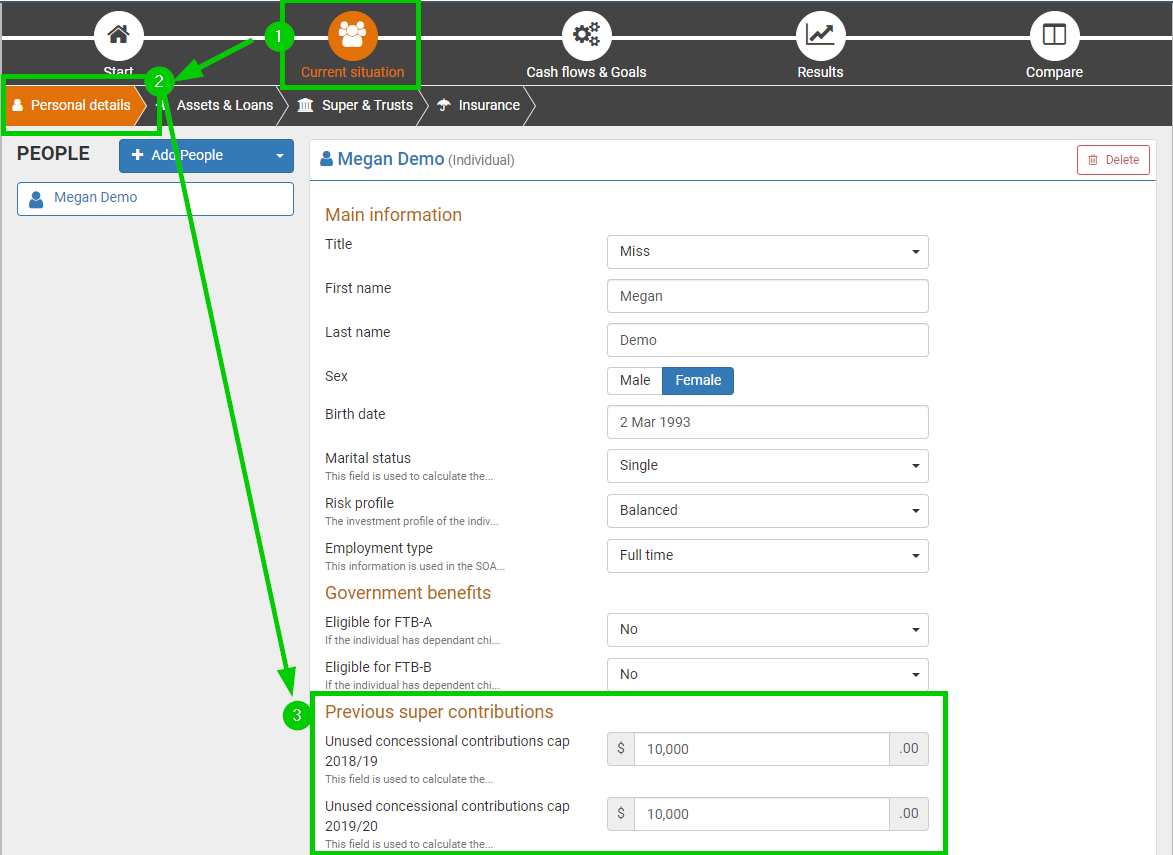

Carry forward the unused concessional cap from contributions made before the first year of analysis

You can now include the unused concessional contributions cap from years before the first year of analysis, so that the carry forward unused concessional cap rule can be accurately modelled from the first year and will be reported in the results as well (previously, we only calculated the unused concessional cap in the years in the modelling and you had to use a workaround for the first year).

To enter an individual's previous years' concessional contributions:

Go to the the Individual (at the Current situation > Personal details step)

Find the "Previous super contributions" section

Fields for each year you can enter the 'Unused concessional contributions cap' will be shown . The number of years depends on the rules and the start date for your case.

For example, if your first year of analysis is 2020/21, then you can enter the unused concessional cap for 2018/19 and 2019/20:

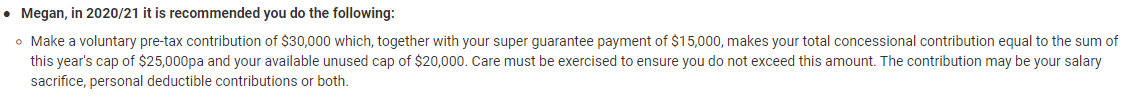

In the results, Pathfinder takes into account the previous years' unused concessional contributions cap. For example, if a voluntary concessional contribution is made in the first year, the cap will be mentioned in the action items:

If you leave the 'Unused concessional contributions cap' fields blank, then Pathfinder will take the more conservative approach and assume that there is no unused cap to carry forward. For full details, see our help docs How to include or exclude the unused concessional cap carry forward rule.

Additional tax on concessional contributions (Division 293) now calculated automatically for liable individuals

If an individual's income is over the Division 293 threshold ($250,000 in 2020/21) and they are making pre-tax super contributions, then Pathfinder will now automatically calculate the additional tax on their pre-tax super contributions. For 2020/21, this means that if an individual's income is over $250,000, then they will pay an additional 15% tax on pre-tax super contributions. (Previously, this tax had to be calculated manually and added as an expense adjustment in the super fund).

If Div 293 is applied for an individual, you will see it in the following detailed reports:

Individual > Tax > Division 293 assessment - this shows how their assessment is calculated, including their assumed income

Individual > Cash flows > Super deposits summary - there will be a line called "less Division 293 tax" in the "Concessional deposits (after tax)" section.

Technical update: default values for CPI and AWOTE have been reduced (need to check if RBA update also included)

Due to a change in expectations following the COVID-19 pandemic, we are modifying projections for CPI and AWOTE based partly on information from the Reserve Bank in its Statement on Monetary Policy, August 2020, “Baseline Scenario”. Note that the values are for the December quarter compared to the previous December quarter. The updated values are:

2019/20 | 2020/21 | 2021/22 | 2022/23 | 2023/24 onwards | |

|---|---|---|---|---|---|

CPI | 1.25 | 1 | 1.5 | 1.5 | 2.5 |

AWOTE | 1.25 | 1.25 | 1.75 | 1.75 | 3 |

These values are used in series builder fields when, for the 'Index by' field, you choose 'CPI' or 'AWOTE". They are reported in the Assumptions section (in the Results > Solve and Results > Strategy summary sub-steps). For more, see How to use the series builder.

Notes for existing users

Please refresh your results for active cases

Since we have done a technical update, if you have any existing cases with SMSFs in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before 11 August 2020. This will ensure that all your scenarios are consistent and that all the charts work.

Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

.png)