New Pathfinder Release (Tasman)

1 June 2021

Release overview

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

You can now model fixed interest in Pathfinder (popular request!)

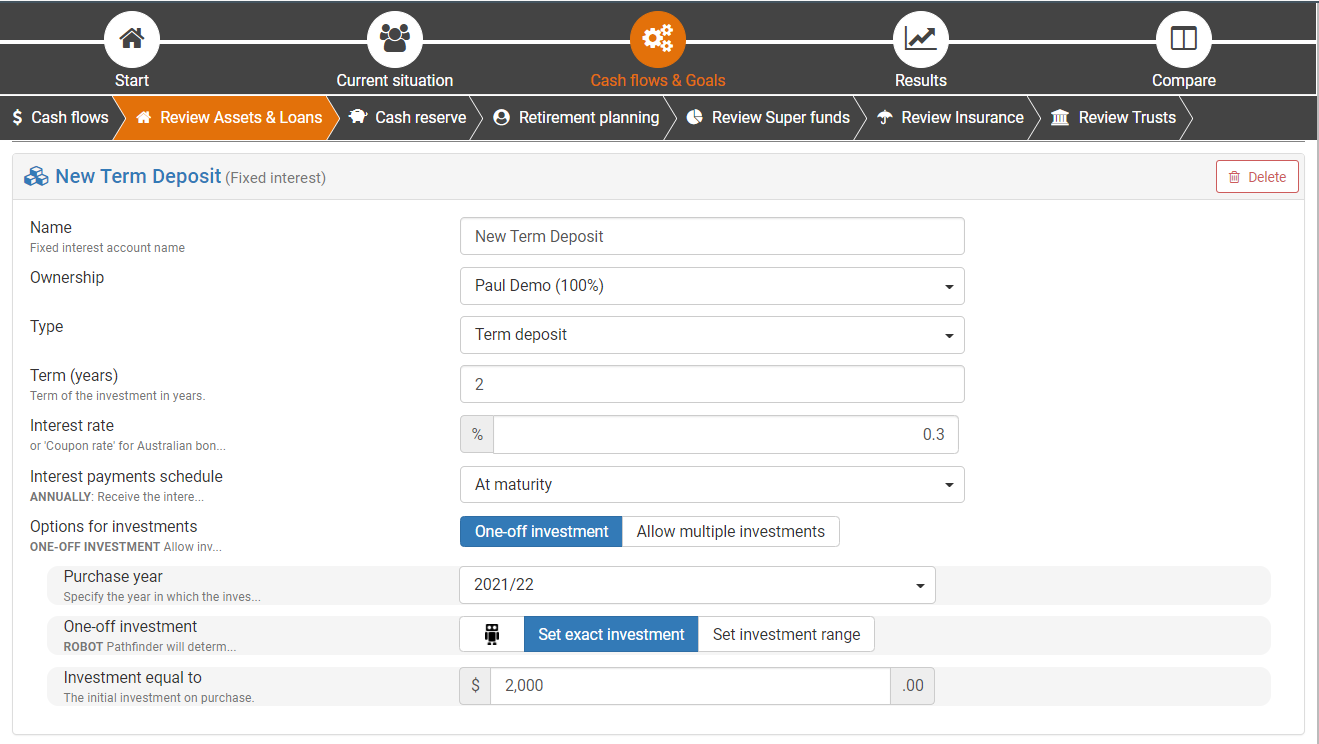

You can now model directly owned fixed interest assets in Pathfinder. Fixed interest covers term deposits and Australian bonds. For all fixed interest accounts, you can specify the interest rate and term, and for the 'Term deposit' type, you can also choose whether or not the interest is reinvested.

New fixed interest investment options

For new fixed interest accounts, you can choose the following options for the deposits:

One-off investment - make one deposit in the year you specify.

Allow multiple investments - allow Pathfinder to open new investments in more than one year. Each new investment will be kept for the term you specify. This option is useful if you would like to use Term deposits as a general ongoing investment.

For new fixed interest accounts, there are the following options to specify the investment amount:

Robot - let Pathfinder calculate the amount that will maximise the case's net wealth at the end of the analysis. Pathfinder will not deposit funds that are required before the investment matures.

Set exact investment - set the exact amount you would like to deposit.

Set investment range - set a minimum and maximum value and let Pathfinder calculate. This is particularly useful if you would like Pathfinder to calculate the investment amounts but would like more control than the ‘Robot’ option.

A few extra notes:

Cash kept in 'Fixed interest' does not count towards the cash reserve entered at the https://help.optimopathfinder.com.au/userdocs/web/cash-reserve-goal step.

You cannot model an early exit - you can reduce the 'Term remaining' field to the desired withdrawal time and, optionally, include the exit fee as an expense at the Cash flows step (under the Cash flows & Goals step on the top menu)

'Fixed interest accounts' operate on an annual basis with investments and payments assumed to be made mid-year. This means that:

In years where funds are invested and payments made, interest is only calculated for 6 months

Pathfinder cannot model fixed interest for terms less than 1 year (you can keep these funds in cash).

For more about modelling Fixed interest, see the Fixed interest (term deposits, government bonds) help page.

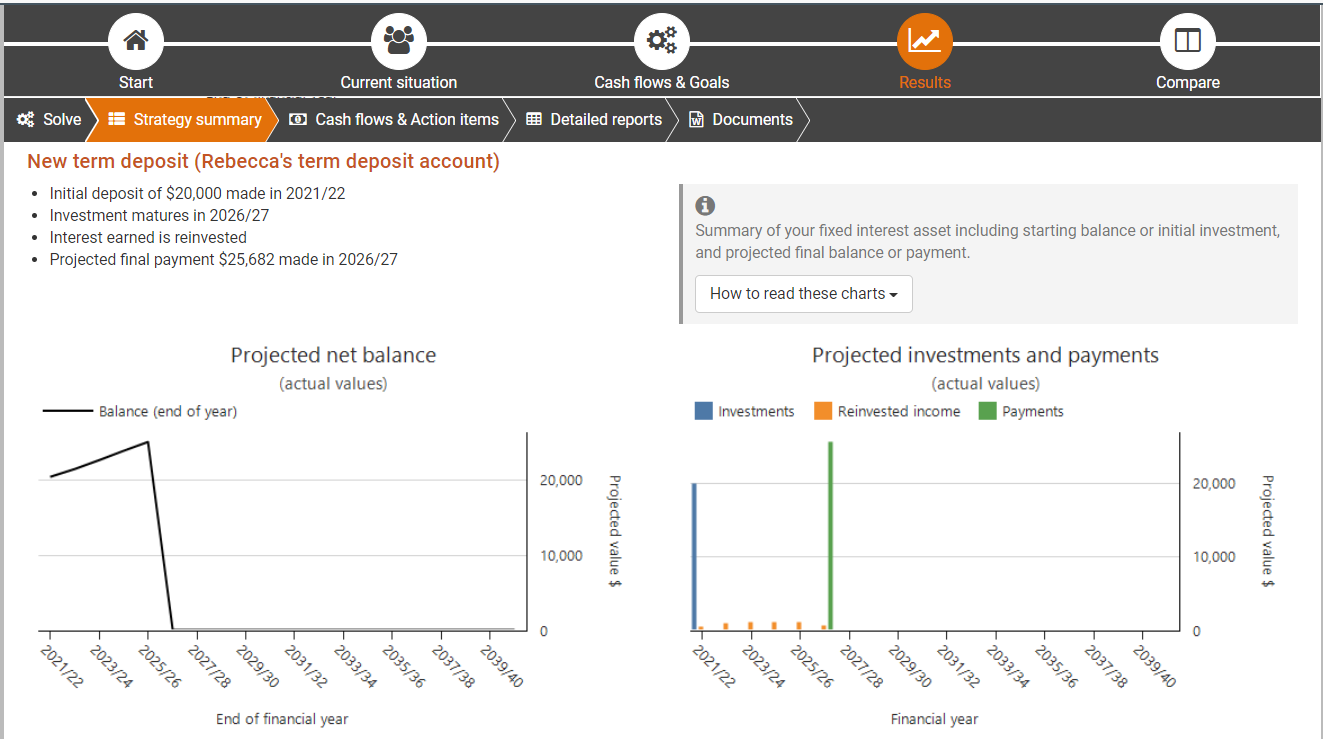

New results for fixed interest

At the results step, Fixed interest is now covered in the Strategy summary with new charts and dot points. The Action items have also been fully revised. For more details, see Fixed Interest results

Upcoming features for fixed interest

We wanted to release the above fixed interest features as soon as possible, but we're not finished yet. Over the next few releases, we'll also be:

Including fixed interest in SMSFs

Improving the detailed reports.

Notes for existing users

Fixed interest accounts in old cases will still work (just remember to click 'Solve' again and check the results)

If you have fixed interest accounts that were added before this release, then error messages will prompt you to fill in any new options and you will need to re-solve your case so you can see the new charts and action items. However, please check the results to make sure they are working as expected. If something looks awry, please contact us because we may need to remove some background adjustments or values that are no longer applicable because they are superseded by the new options.

International bonds are no longer available under Fixed interest

'International bonds' have been removed from the list of 'Types' on Fixed interest accounts because they were not a popular choice and Pathfinder does not support currency conversions. Furthermore, international bonds can be modelled with the 'Shares/managed fund' option. You can still choose 'Term deposit' and 'Australian bond' in fixed interest.

This change will not affect most cases, however please note:

If you had an old case with an International bond which you'd like to review, then you'll be prompted by an error message to choose a different type

If you have a custom assumptions database with values for 'International bonds', they will no longer be included.

.png)