New Pathfinder Release (Wanderwell)

29 August 2022

Release overview

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

Preparing for future integrations

In addition to the new features, listed below, we’ve been working on making it possible to integrate Pathfinder with other systems. We hope this will give you more options to reduce double data entry and help streamline your SOA generation. We're not quite finished, yet, so stay tuned for the announcement!

More keyboard shortcuts for entering data

You can now use more keyboard shortcuts when entering data at the Current situation and Cash flows & Goals steps. Keyboard shortcuts can be faster to use and reduce how much you need to use the mouse.

The keyboard shortcuts are:

Action | shortcut |

|---|---|

Go to next field | TAB |

Go to previous field | SHIFT + TAB |

Select item in a drop down menu |

|

Select a button |

|

You will still need to use your mouse to:

Set the 'Ownership' field

For the series builder

To add or delete items

For navigating between items and steps

If you're interested in more keyboard shortcuts let us know and it will help increase the priority for future development 🙂

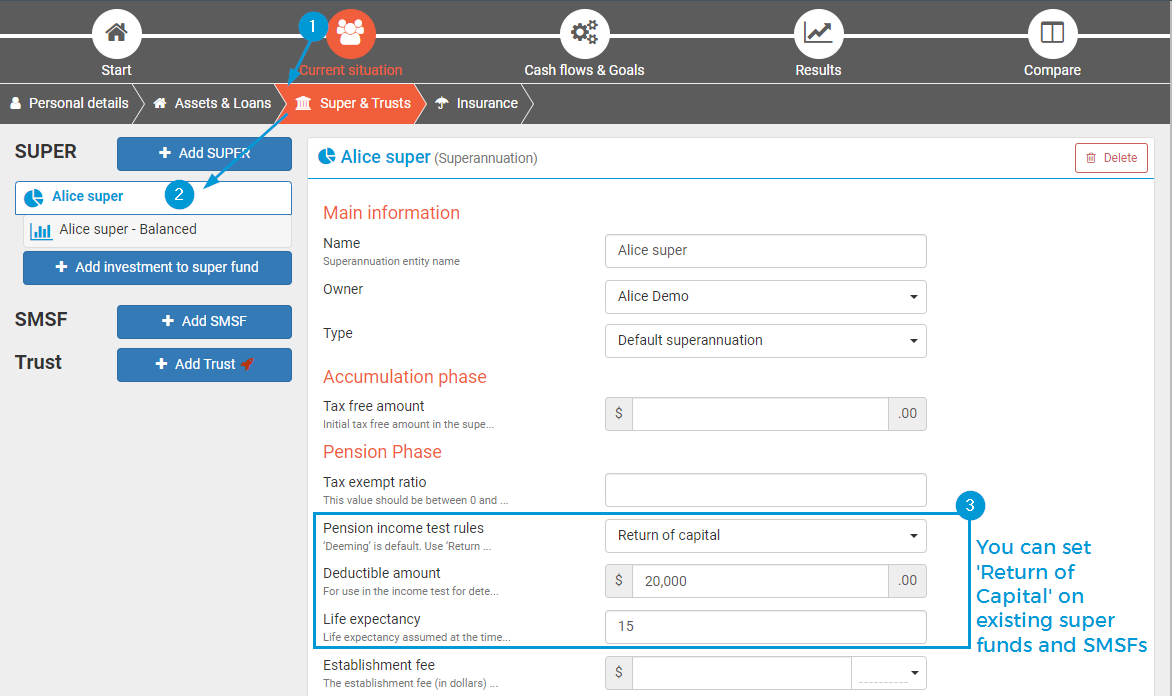

‘Return of capital’ account-based pensions are now part of the web solve

Account-based pensions that use the ‘Return of Capital’ Age Pension income test rule are now fully part of Pathfinder’s standard websolve modelling. 'Return of Capital' rules only apply to certain account-based pensions started before 1 July 2015, whereas ones started after this date use the default ‘Deeming’ rules.

The majority of this functionality, including the correct calculations for the Age Pension estimate, was already part of Pathfinder, but in this release we reviewed the validations and field help to ensure the modelling doesn’t require any further manual checks and that you will be prompted if there may be some nuance you need to be aware of. You can set an existing super fund to use the ‘Return of Capital’ rules using the 'Pension Income Test' rules field on the super entity at the Super & Trusts sub-step (under the Current situation step on the top menu). For more details, see see our help docs here How to add a 'Return of Capital' pension fund (super or SMSF).

Technical update

As part of this release, Pathfinder's CPI and AWOTE assumptions were also updated based on the latest Treasury and RBA forecasts. For more details, see Technical Update: CPI and AWOTE (Wanderwell v2).

New pages in our help documentation

We've added some new pages to the help documentation:

Notes for existing users

Please refresh your results for active cases

If you have any existing cases in progress, please refresh your results by clicking the Start solve button for any scenarios where you created results on or before the release date of 29 August 2022. This will ensure that all your scenarios are consistent. Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

Bug fixes

Errors from orphaned loans have been fixed

We have fix an issue where you would get a an error for a loan you can't see because you deleted the item it was financing. So, you can now delete things with abandon!

Display issue with the 'Total assessable income' report has been fixed

On the 'Total assessable income' report there was a minor issue if the case had a 'Bonuses' income, which has now been fixed. This report showed an error, but it was just a display issue, that didn't actually affect the calculations and was not in the other major tax reports.

.png)