Annuity results

For general tips about reading the results, see the Results step.

Strategy summary step

Go to the Results step on the top menu, and then choose the Strategy summary sub-step.

On this page, there is a section for each annuity, which will have:

Dot points explaining the initial balance or initial purchase amount, and the last payment or balance at the end of the analysis

Two charts: Projected investments and payments, Projected net balance

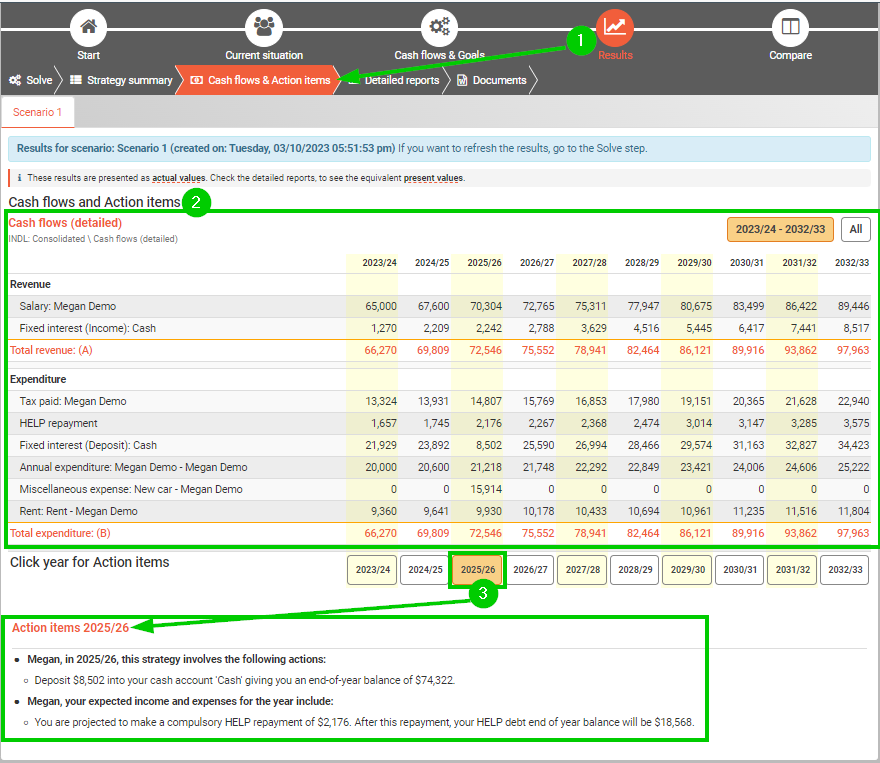

Cash flows & Action items step

Go to the Results step top menu, and then choose the Cash flows & action items sub-step.

In the cash flows report:

The Revenue section lists the following lines (if relevant)

Payments - if there are taxable and tax-free payments, they will be listed separately

Residual capital value

The Expenditure section will have a deposit line if an annuity is purchased with non-super money (if the source is super money, see the action items or detailed reports)

In the Action items (under the table):

An action item will be listed when an annuity is purchased - it will also mention if it is from super money or non-super money

Payments will be listed under the 'expected income and expenses for the year' sub-heading

Detailed reports step

Go to the Results step on the top menu, and then choose the Detailed reports sub-step.

The following reports may be useful (these reports list values for every year in the analysis):

Consolidated > Assets and Loans > (annuity name) - this report lists information about investments, payments, Residual capital value, tax rebates, and the balance used for Government Pension estimates

Consolidated > Assets and Loans > (annuity name) > (year) deposits details - under the main report for the annuity, there are sub–reports that give more details for how the values on the main report were calculated

The same reports as above are also listed under (Individual) > Assets & Loans

If an annuity is started with super money, you can see the rollovers out on the 'Transaction account (detailed)' report in the 'Transactions at start of year' section under the super fund or SMSF:

Super fund: (Individual) > (Super fund name) > (Super fund name) OR (Super fund name) Pension > Transaction account (detailed)

SMSF: (SMSF name) > Transaction account (detailed)

If you would like to review the Annuity’s affect on the Age Pension income test, then go to this report: (Individual) > Government pension > Asset test. The annuity will be listed at the top with the other assessable assets. Note that the annuity value listed will after be any discounts for innovative income stream annuities are applied.

If you would like to review the Annuity’s affect on the Age Pension assets test, then go to this report: (Individual) > Government pension > Income test. Income from the annuity will be listed in the ‘Assessable income’ section. Note that the income amount listed here will after be any discounts for innovative income stream annuities are applied.

Adjusting your results

If you would like to change something in the results or make another scenario for comparison, you need to change your input data and solve again. See Annuity for data entry tips.

.png)