Dependants results

For general tips about reading the results, see the Results step.

You can see results about dependents in the following places.

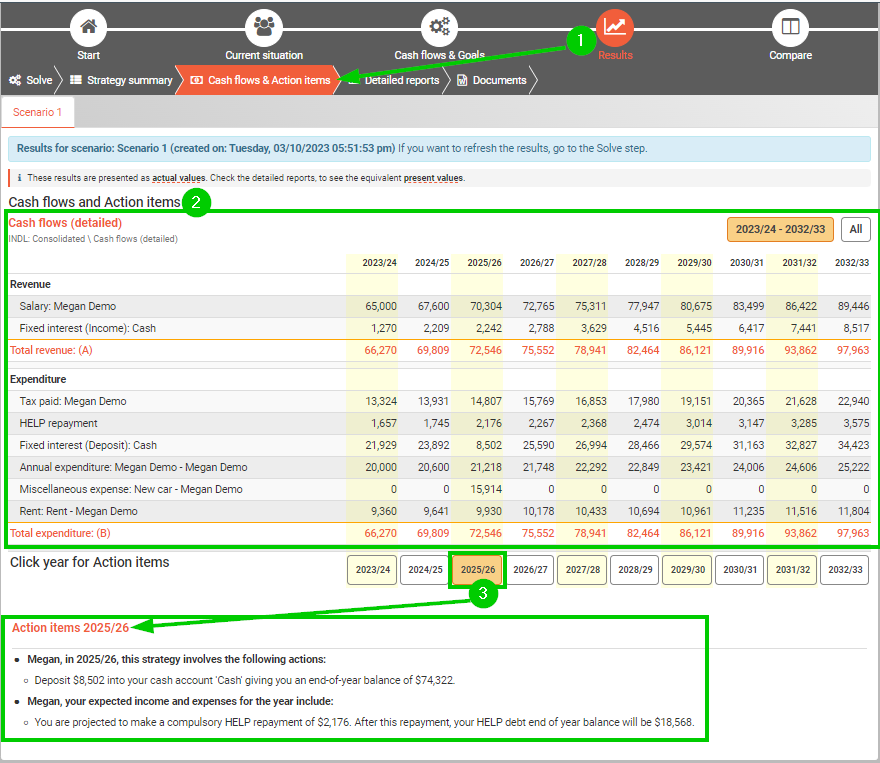

Cash flows & Action items step

Go to the Results step top menu, and then choose the Cash flows & action items sub-step.

In the Cash flows report:

The Revenue section lists the following lines:

Family tax benefit part A (if none is received, this line won't be present)

Family tax benefit part B (if none is received, this line won't be present)

The Expenditure section lists the following items (if in the strategy):

Any expenditure for a dependent, eg education expenses

Detailed reports step

Go to the Results step on the top menu, and then choose the Detailed reports sub-step.

The following reports may be useful (note, these reports list values for every year in the analysis):

Cash flows and Cash flows (detailed) reports (under Consolidated) - in Revenue section, lines for Family tax benefit part A and Family tax benefit part B if payments are received.

Family tax benefit part A report (under (Individual) > Tax where the individual is the parent for benefits set at the 'Current situation' step) shows, how the FTB A was calculated and the payment, if any

Family tax benefit part B report (under (Individual) > Tax where the individual is the parent for benefits set at the 'Current situation' step) shows, how the FTB B was calculated and the payment, if any

Adjusting your results

If you would like to change something in the results or make another scenario for comparison, you need to change your input data and solve again. See Dependants for data entry tips, or these links for more tips:

.png)