How to prevent rollbacks from pension phase to accumulation phase in a superannuation fund

Background

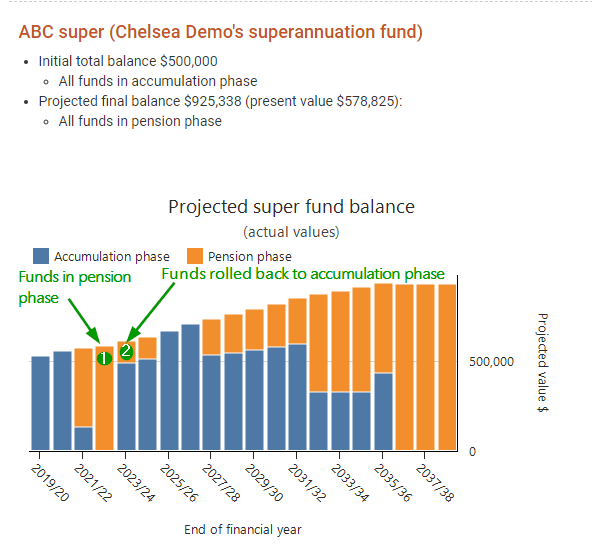

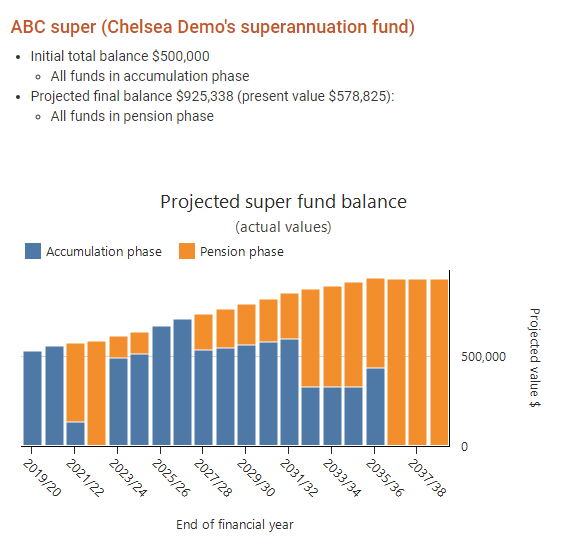

By default, for super funds, Pathfinder will choose whether to keep funds in the accumulation phase or pension phase of super. It makes decisions based on the individual's eligibility, expenses and whether or not it will maximise their projected net wealth at the end of the analysis. Sometimes, this means that Pathfinder will move funds from the pension phase of a super fund back to the accumulation phase. You may have to make a decision as to whether or not these roll backs should be part of your strategy.

Some reasons why Pathfinder may roll funds back in order to maximise the individual's net wealth are listed in Understanding why funds are kept in in the accumulation phase of super instead of the pension phase.

However, turning off roll backs can be useful for 'tidying up' the charts, particularly if:

- The rollbacks are happening in the distant future and so it's likely that the clients will come back for a review before needing to think about rolling back

- It's not practical or possible to do the rollbacks

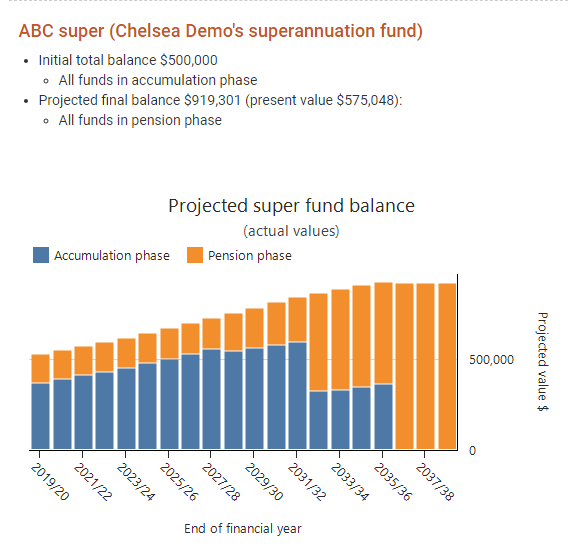

- The benefit of doing the rollbacks is small (you can check this by running a scenario for comparison)

Steps to prevent rollbacks

Please note that these steps only apply to superannuation funds, not SMSFs. If you would like to prevent rollbacks in an SMSF, please Contact Optimo Financial.

| Step | Details |

|---|---|

| If you already have results, check if roll backs from the pension phase to the accumulation phase are happening in the super fund | 1. At the Strategy summary sub-step (under the Results step on the top menu), find the box for the super fund. If the chart shows has a year where funds are in the pension phase, and then in the next year more funds are in the accumulation phase (and the change in the total balance hasn't changed much), this usually indicates a roll back is happening. 2. In the action items, there will be a an action item saying something like "Rollover $462,602 from the Pension phase into the accumulation phase of your 'ABC super'." |

(optional) Make a copy of the scenario so you can see the projected effect of preventing rollbacks. |

|

| Set options to prevent rollbacks from happening in the super fund | This option is currently only avaialble for retail/industry super funds, not SMSFs (if you would like to do this in an SMSF, please Contact Optimo Financial's support team).

|

| Check the results | In the results:

|

.png)