New Pathfinder Release (Eagle)

25 March 2023

New features

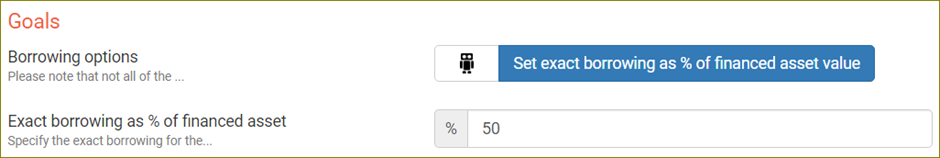

Set exact borrowings for new property loans (popular request!)

Figure 1: New borrowing options allow you to set exact borrowings.

You now have the option to specify how much you want to be borrowed as an exact percentage of the property value, when using a loan to fund the purchase of property or family home. Previously, the amount borrowed for secured loans was always optimised by Pathfinder.

This is useful for strategies not requiring the mathematically optimal borrowed amount, such as when:

The optimal figure isn’t practical: E.g. If Pathfinder initially determines you can buy a property outright with cash, but you need to borrow exactly 50% due to a prior contract.

You want neater results: E.g. If Pathfinder initially determines 48.75% borrowings is optimal, you can set exact borrowings to be 50%.

For further information on how to do this, and other modelling options for Secured loans, see https://help.optimopathfinder.com.au/userdocs/web/secured-loan

New sample case showcasing property modelling

Figure 2: New sample case at Start step.

We added a new sample case focusing on property, due to popularity with this topic, and to showcase our new ‘exact borrowings’ feature. You can use this case by selecting it at the Start step of your case.

As well, you can read the accompanying case study on our website here.

It can be a guide for setting up a property-related case for your clients, as it illustrates how to:

Set up a ‘Basic cash flows’ scenario

Model buying and selling property, with and without loans

Model a basic debt-recycling strategy

Interpret results

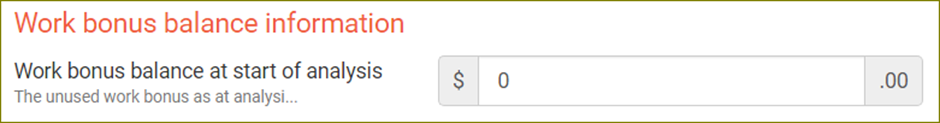

Work bonus rules updated

Figure 3: New field for improved Work bonus functionality.

To be consistent with the Work bonus rules, recently changed from 1 January 2024 (Social Security and Other Legislation Amendment (Supporting the Transition to Work) Bill 2023), Pathfinder’s Work bonus functionality was updated, and now includes the following:

New age pensioners begin with a work bonus balance of $4,000 (previously $0)

The maximum work bonus balance accruable is permanently $11,800 (was to previously revert to $7,800).

A new field ‘Work bonus balance at start of analysis’ was added (in the Current situation > Personal details step) for users to include an individual’s balance prior to start of analysis.

Usage and accrual of the work bonus is paused, while the unused balance is carried forward, when the individual is not eligible for the age pension.

For further details, see How to enter an initial Work Bonus balance .

Notes for existing users

What to do if you have existing cases with background constraints set to exact borrowing

With this new release, it’s now possible to set exact borrowing in the Pathfinder interface. However, if you have a previous case where Optimo Support had set a background constraint because you had requested to set exact borrowing, then those background constraints are still in those cases.

So please note:

If your case has a background constraint, it will still be applied, so it’s best to leave the ‘Borrowing options’ field set to ‘Robot’, and avoid using the ‘Exact borrowing’ options in the case, because they might clash with the background constraints

You can contact us and ask us to remove the background constraints. Once they’re removed, you can use the new fields to set the exact borrowing yourself.

If you’re unsure if there’s a background constraint applied, check your ‘Scenario notes’ for a note from Optimo (we would have added one when we did the support request). Or if you are unsure, please contact us and we can check if there are any back constraints being applied, this is particularly worth doing if you set exact borrowing yourself, and you’re getting solve errors that don’t match your inputs.

If we copy or unlock a case with background constraints relating to exact borrowing, Optimo support will remove the constraints in the new version of the case, so you can apply them yourself.

Improvements to the Dash integration

This Pathfinder release was co-ordinated with a Dash release, and there are now the following improvements when you are in Dash and save a contact to Pathfinder:

In Dash, if an a family home or lifestyle asset (e.g. motor vehicle) is specified with owners, in Pathfinder it will appear with 50% ownership allocated to each individual (instead of 100% to the first person)

In Dash, if an investment property has two owners with a specified ownership split (e.g. 50-50, 60-40), then this will appear the same in Pathfinder

If you enter an income with Type='Tax free' it will now appear in Pathfinder as 'Non taxable' (instead of being left blank)

If a contact in Dash has a ‘Title’ field that is blank or set to the ‘Professor’ option, then you can now successfully save the case in Pathfinder without getting any errors when you export.

For the full set of tips for what to check in a case you have saved from Dash, please see https://help.optimopathfinder.com.au/userdocs/web/how-to-check-data-imported-from-dash

Previous update

Last month, we updated Pathfinder’s assumptions based on the latest CPI and AWOTE figures released by the ABS, and projections by the Treasury and RBA. Accordingly, various rates that are indexed by CPI and AWOTE were updated too.

See the release notes https://help.optimopathfinder.com.au/news/technical-update-cpi-awote-tax-cuts-and-more-dolph ) for details.

.png)