New Pathfinder Release (Norgay)

New features and improvements

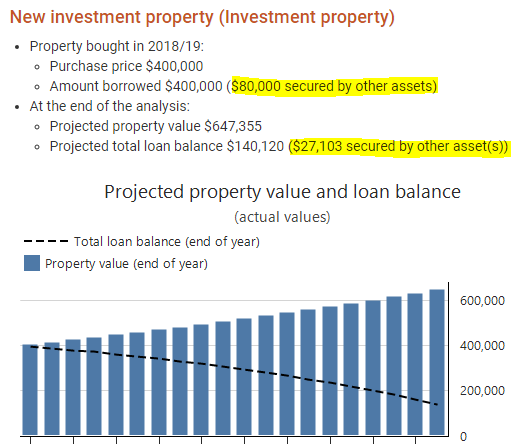

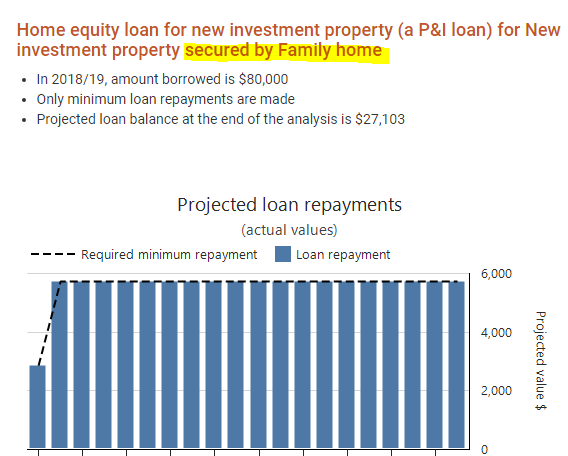

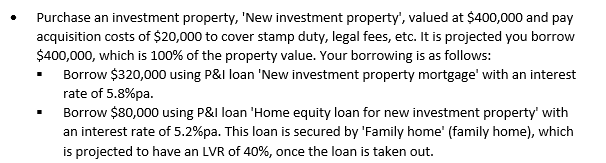

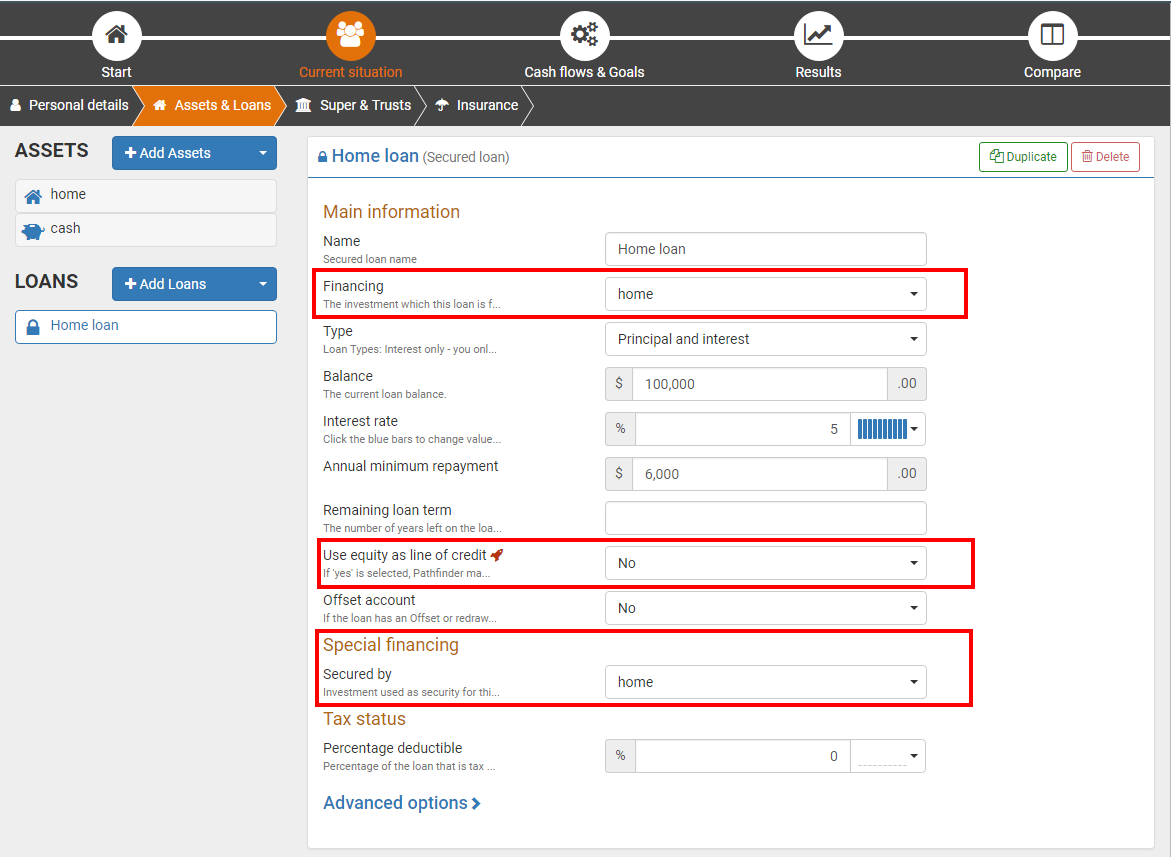

Easily model loans that are financing one asset and are secured by another asset (popular request)

You can now model loans that are financing one property/home and are secured by another property/home. Some examples where this is useful include:

An existing investment property has been purchased with two loans:

One that is secured by the property

One that is secured by the family home

You would like to buy an investment property:

20% of the purchase value should be funded using equity in the family home

80% of the purchase value should be funding with a loan secured by the investment property itself.

Buying a property and then using it as security to buy another property even later

Based on your inputs, you can control the total borrowing to finance the asset, the maximum borrowing for each loan and the LVR of the securing asset and in the results, Pathfinder will ensure that the borrowing keeps within all the restrictions. The results clearly explain the modelling throughout the results, including on the asset and loan summaries:

The action items list relevant information for the assets and loans when an property or home is purchased with multiple loans:

The detailed reports have more information on the LVR, and total loan balances secured by the asset.

For more see How to enter a loan that is secured by one asset and financing another asset (e.g. home equity loan). If you have a free trial, you can also choose the Cynthia and Tony sample data at the Start step.

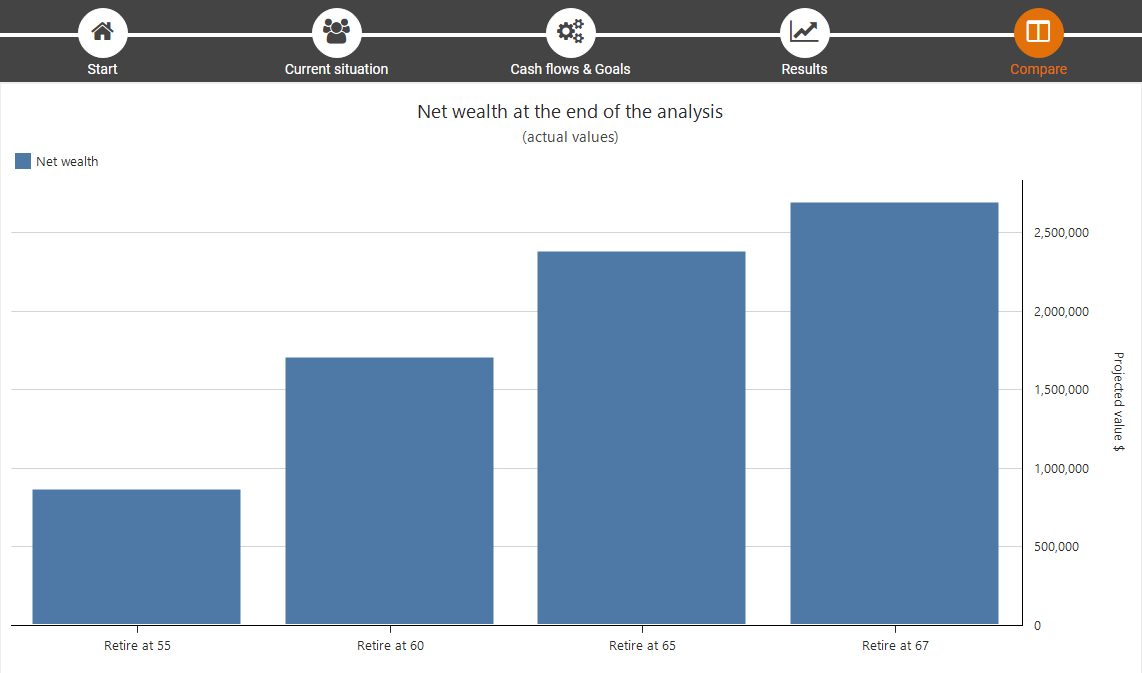

Improvements to the 'Compare' step

We've improved the code for the compare step to allow the following new features, and to lay a solid foundation more features for later releases (including putting them in documents!).

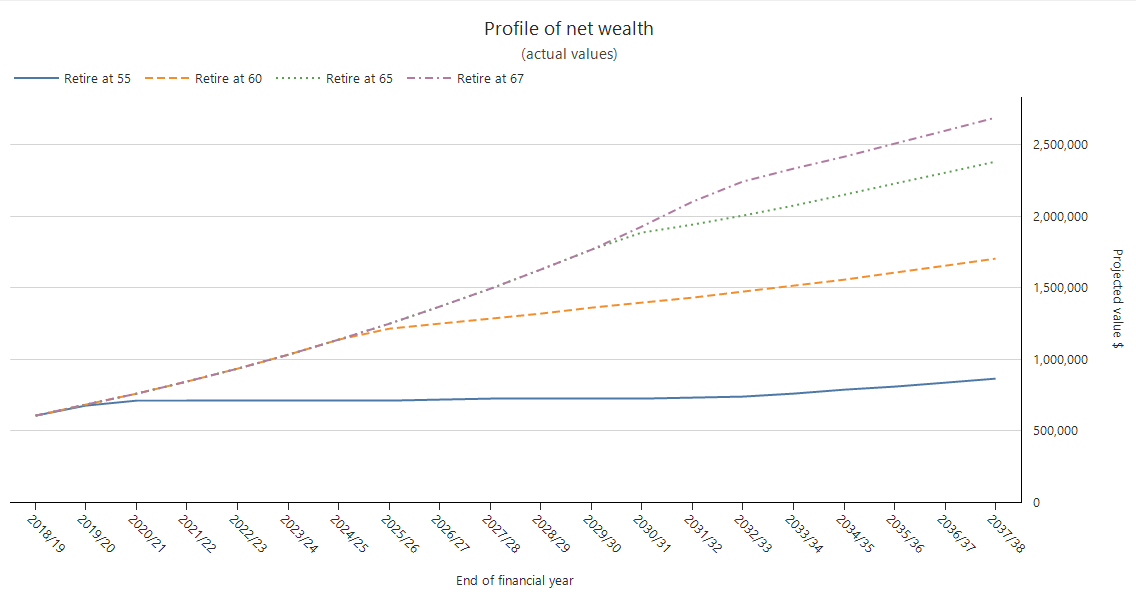

New 'Net wealth at end of analysis' chart at the 'Compare' step

This chart makes it easier to compare scenarios at a glance (instead of checking each strategy summary).

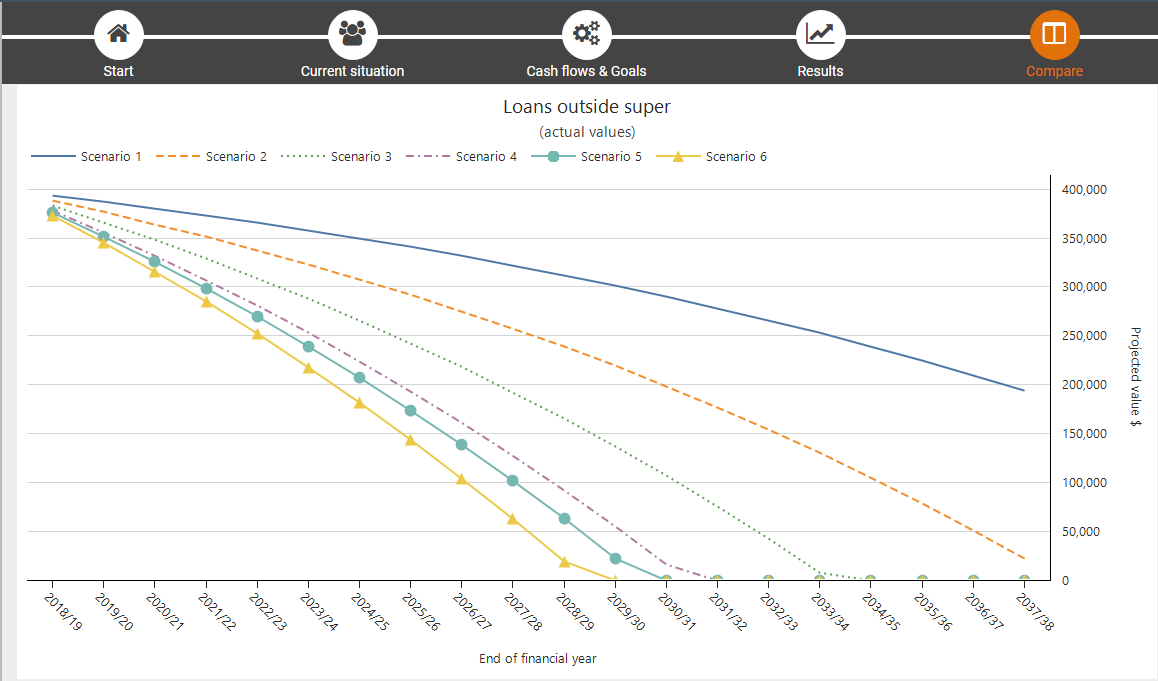

Line charts at the 'Compare' step are now in colour

For the line charts at the Compare step, each scenario line is now a distinct colour and line style for up to 6 scenarios on one chart, so it's easier to make comparisons.

(you also get bonus points if you can make a chart look like a rainbow)

New 'Loans outside super' compare chart

This new chart helps you easily see when loans outside super are paid off (or not) for each scenario.

'Assets outside super' compare chart is now 'Assets outside super (excluding family home)'

This change makes it easier to compare investments across scenarios, without the family home inflating the results.

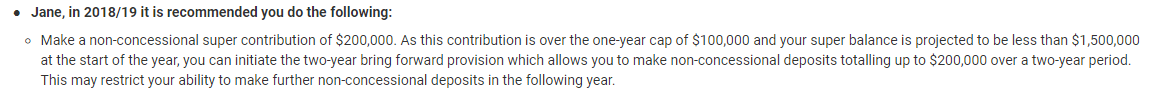

Improvements to action items for non-concessional super contributions

The action items for non-concessional super contributions got some special attention so that they now more pithily explain the rules that apply to the strategy, including the bring-forward rule and caps on super balances that restrict non-concessional super contributions.

For example, in this case, the bring-forward rule is triggered in 2018/19 and the individual's balance is between $1,400,000 and $1,500,000, so Pathfinder uses the two-year bring forward rule and explains what rules it's keeping to:

In the detailed reports, any asset that has a loan related to it (either financing or security) will have a detailed report showing

New help pages

We've added two new pages to the help documentation:

Investigating why voluntary super contributions are not being made

How to enter a loan that is secured by one asset and financing another asset (e.g. home equity loan)

We now accept AMEX

For your next case purchase, we now accept American Express cards along with Visa and Mastercard, for no extra fee.

Forward sizzle!

In addition to working on all the above features, but we've also been busy preparing for an exciting release due out later this year! Stay tuned!

Notes for existing users

If you were using Pathfinder before this release, you might find it useful to note that some things have changed.

Remember to re-solve any cases you're currently working on

If you have any cases in progress, we recommend click 'Start solve' on each of your scenarios so that your results reflect that latest Pathfidner model and so you can see the updated charts at the 'Compare' step.

New URL for logging into Pathfinder

Pathfinder now has a new URL: https://app.optimopathfinder.com.au

To register for Pathfinder (or share it with your friends!), the URL is now: http://app.optimopathfinder.com.au/account/register

You can continue to use older URLs, as this will automatically redirect to the new one.

Avoiding 'Oops' errors

Just a reminder from the Optimo testers (who saw more than their fair share) that keeping Pathfinder open in two separate browser tabs isn't supported and may cause errors. So if you get an 'Oops' error screen, don't panic! We save data after you edit each field, so your case hasn't disappeared. Just, check for and close any other browser windows that are open with Pathfinder, then try logging in again. If you would like to have two Pathfinder windows open, you can use Chrome's incognito mode, as described in How to have two different cases open at the same time.

Changes to fields on secured loans

Some fields on Secured loans have been changed to accommodate the new loan features. If you had an existing case with secured loans, you don't need to make any changes, but you may wish to note that previously, we only had one field called Secured by, whereas this release now has two fields:

Financing - This is located towards the top of the 'secured loan' form, where the old 'secured by' field used to be.

Secured by - This is located in a new 'Special financing' section

These fields will be present in the cases you created before this release, and will be filled in with the asset you entered in the old 'Secured by' field.

Also, the Home equity loan field has now been renamed to Use equity as a line of credit, since it is a more accurate description. This field continues to be an SDS field, so change it to 'Yes' with caution.

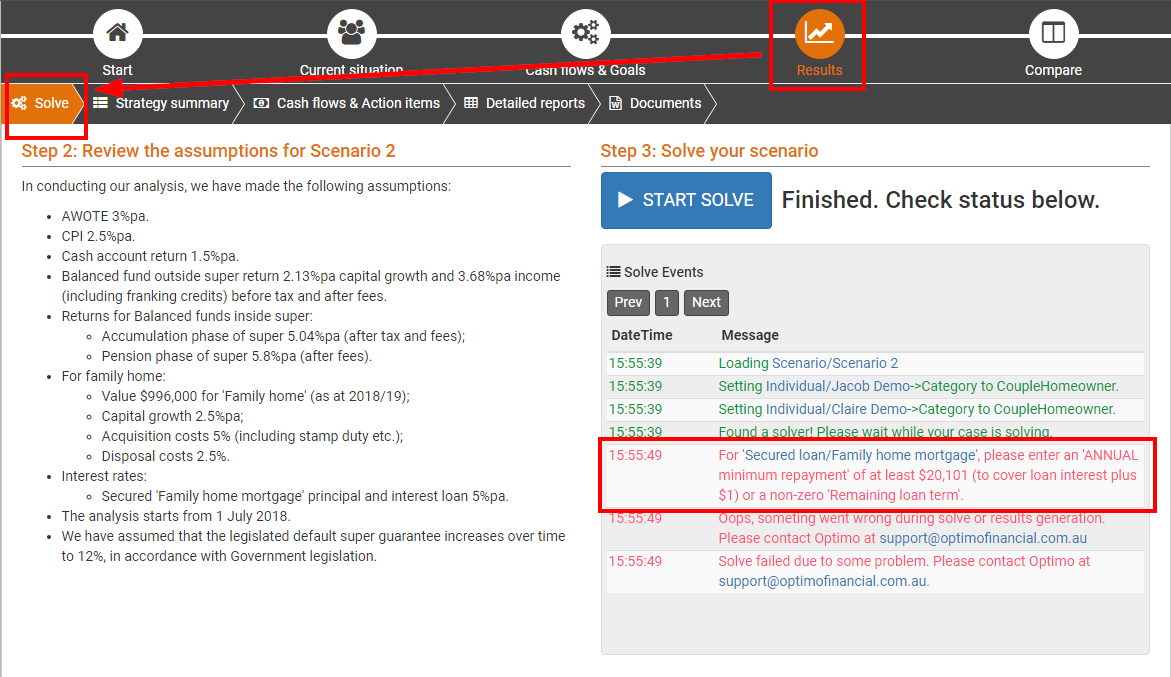

Improvements to error messages when loan data entry is inconsistent (popular request)

If you've encountered solver error messages that were caused by inconsistencies in the data entry between the loan balance, interest rate, minimum repayment and loan term, then you'll be happy to hear that we've improved the reporting so it you'll find it easier to know what you need to fix, so you can successfully solve.

Online strategy development service (SDS) results now just have documents and detailed reports

If you use our strategy development service, your online results will now only include downloading the documents and viewing the detailed reports for old and new cases. The results will no longer have the strategy summary online or in the 'Charts' tab, because these are both available in the documents and we understand the preference is to use the documents over the online presentation, anyway.

The reason for this change is to reduce the maintenance burden (since they are separate from the websolve results) and to reduce turnaround time on cases (since it was double the work to put the results in the documents and online). If future, we may expand the online presentation of SDS results to match the websolve. If you are interested in this, please let us know.

.png)