How Optimisation works

On this page

What is Optimisation?

Overview

Mathematical optimisation is the selection of a strategy to achieve the best outcome based on a particular criterion, from a set of available alternatives. In simple cases, a specific optimisation problem involves minimizing or maximizing an 'objective function' systematically by choosing input values from an available set and finding the function’s value. Optimisation involves determining “best available” value of the objective function in a defined domain. A domain can be thought of as a (possibly very large) set of available options.

Optimisation in Pathfinder

In Pathfinder, the 'objective function' is to maximise net wealth at the end of the projection period. The 'domain' is defined by a set of constraints which are applied based on the input values and goals you set for your client, regulatory rules and the value and cost of investments and loans over time.

Any constraint is the quantity that must be true irrespective of the solution. A simple example is the constraint that your client has a minimum cash reserve of $5,000 in a particular financial year. The solution to the optimisation problem will ensure that this constraint holds true.

It is important to understand that Pathfinder contains no built-in strategies such as a super's transition-to-retirement or negative gearing. It will generate good (and indeed optimal) strategies in the process of maximising wealth while obeying all the constraints. You don’t have to input those strategies, although it pays to know about them so you can recognise them in the results.

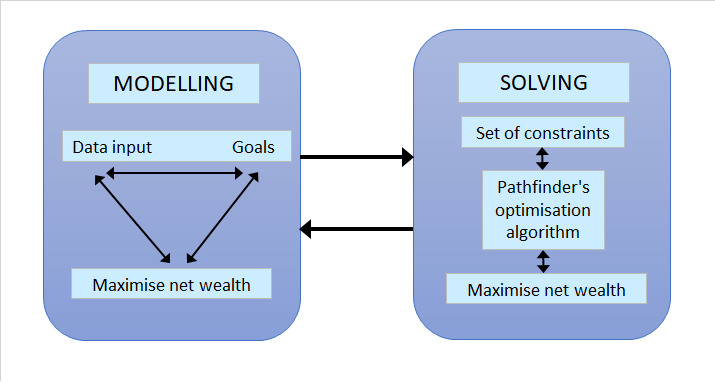

An overview of the interaction between data input, setting goals, and maximising your clients' net wealth through our optimisation algorithm can be illustrated as follows:

Why use Mathematical Optimisation

Optimisation is a mathematical approach that considers all the factors that influence decisions. Optimisation involves careful modelling of your clients' cases, a process which itself provides valuable information. In Pathfinder, the benefits of mathematical optimisations include understanding the effects of any variations made to input data and goals. So in Websolve, by creating various scenarios you can easily compare strategies based on financial risk versus the best expected outcome.

Important factors when optimising include:

- Decisions – these are the things that can vary, the things you need to choose between. An example is whether your client wants to retire earlier or later. You can set up scenarios to explore these decisions in Websolve

- Constraints – these are the limitations on or the rules governing our decisions. For example, a client may want to investigate a decision to retire sooner or later but is constrained by the age at which they can access their super funds.

Making best use of our optimiser

See Suggested approach for modelling a case in Pathfinder and Minimum data required for Pathfinder.

A simple optimisation example

To give you an idea of how a small optimisation problem might work, let's assume you've been asked to find material for your home renovations at the lowest cost. You decide on three possibilities described as follows:

- Option 1: Colours are red, purple, and orange and cost is $10/metre.

- Option 2: Colours are red, blue, and yellow and cost is $12/metre.

- Option 3: Colours are red, green, and yellow and cost is $14/metre.

With no constraints, the optimal solution to our problem is Option 1 costing $10/metre. However, your interior designer, who might be yourself, has specified that the material must have the colour yellow. With this additional constraint, your best option is now Option 2 at $12/metre.

We can see from this simple problem that there are other possibilities. For example, your interior designer may have said it must have the colour red as well, and, in this case, the optimal solution is also Option 2. An additional constraint may have no effect on the outcome. However, had we said it must have the colour green as well, then Option 3 would be the best option.

For Pathfinder's complex optimisation problems, it is difficult to ascertain whether an additional constraint will have an effect on its objective to maximise net wealth. The general rule is that every additional binding, or active, constraint will give a worse objective, or lower net wealth in Pathfinder. For that reason we prefer to limit the number of constraints and allow Pathfinder to optimise as much as possible.

Working with your set of constraints

Types of constraints

Further to our discussion on constraints and how they affect the outcome is the idea that for Pathfinder's optimisation problems we can split our set of constraints into three groups, that is:

- constraints imposed by Government rules and regulations, such as, Family Tax Benefit eligibility and payments, income tax thresholds, etc;

- constraints that describe the evolution over time of the value and cost of assets and loans; and

- constraints that describe the choices for your client such as a goal to invest a specific amount each year or purchase a family home in a particular year, etc.

If your scenario has a cash shortfall...

When you've decided on your strategies and setup your scenarios, you may see the solver message that you have a cash shortfall in particular year/s. Don't panic! It just means that one or more of your constraints has violated the rule that 'a constraint is a quantity that has to be true irrespective of the solution'. This typically happens when you define a set of constraints which cannot all be satisfied at the same time. For example, if you ask Pathfinder to make the client a millionaire on the pension, you are likely to end up with a cash shortfall and possibly other constraint violations as well. Pathfinder is very smart, but it cannot perform miracles!

This type of error can be readily solved by investigating which of your constraints has caused the shortfall and adjusting it or allowing its optimisation. For example, you may have a strategy to purchase a family home in a particular year. However, there's a cash shortfall in that year. We can then assume that there aren't enough funds and borrowing capacity to purchase the property. In your goals for the scenario, you can either purchase the property in a later year, or not specify a year so that Pathfinder makes the choice of when to buy for you. There are more tips on our help page How to investigate and fix cash shortfalls.

Let Pathfinder find the best path to maximising your client's net wealth while meeting all their lifestyle goals by allowing it to make the financial strategy choices for you.

Constraint violations

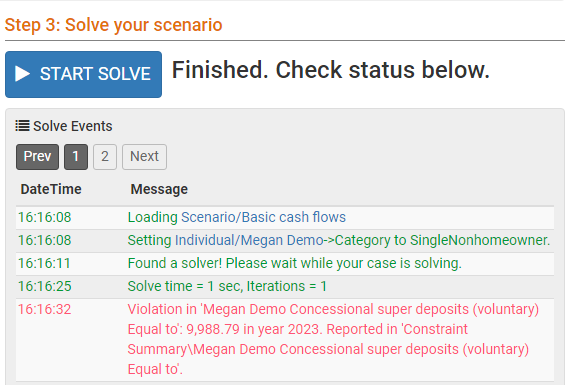

Sometimes, when you solve, in the 'Solve events' you may get a constraint violation message beginning with "Violation in...". An example is the message in red in the screenshot below:

Constraint violations occur because the case has constraint/s that Pathfinder cannot obey, and so Pathfinder has ignored the instruction. Usually, Pathfinder has a constraint violation because:

- If it followed the constraint, it would not keep within the legislation. For example, if you have set an exact concessional contribution which is more than the legislated concessional caps, Pathfinder will keep to the cap.

- It is clashing with another constraint entered in the case. For example, if you have set on-going exact deposits to a managed fund, a maximum balance and a minimum investment period that is the length of the analysis, then, once the maximum balance is reached it clashes with your instruction to continue to make deposits, and the minimum investment period prevents Pathfinder from making withdrawals to stay under the maximum. So Pathfinder will have to ignore one of the constraints.

When there are constraint violations, it is strongly recommended that you review the violation messages, adjust your inputs, and re-solve the scenario so that the violations no longer occur. If your case has constraint violations, Pathfinder may have taken unusual actions to minimise how many constraints it violates or to avoid violating other constraints, so it is best to correct them. The message should tell you which constraints were violated, by how much and in what year(s). Once again, the best way to avoid constraint violations, or work out a feasible value that does will not cause a constraint violation, is to use the Robot button on the item that has the constraint violation. If you are not sure of the cause of the violation, you can Contact Optimo Financial.

Related pages

- Tips for creating scenarios (Cashflows & Goals step)

- How to investigate and fix cash shortfalls

- Suggested approach for modelling a case in Pathfinder

- Minimum data required for Pathfinder

.png)