How to investigate and fix cash shortfalls

How to tell if your results have a cash shortfall

If a scenario does not have enough funds to meet all expenses and goals, then the results will have a cash shortfall, and the strategy is not yet complete. You should review the results to understand when the shortfall occurs and how much it is, and then change and re-run the scenario (or a copy of it) until the shortfall is resolved.

| Step | Details | |

|---|---|---|

| 1 | Solve your case | For more see How to solve a scenario to get results |

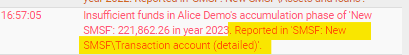

| 2 | While Pathfinder is solving, if a shortfall occurs, the Solve event log will display red messages that say either 'Cash shortfall' or 'Insufficient funds'. | |

| 3 | Check the solve events to find out which report to check (either individual, SMSF, etc) | The solver errors will tell you the amount of the shortfall, what year it occurs in, and which report to check. If the shortfall occurs in many years, then you'll get a message for each year, but you just need to check the first one. The message will tell you which report to check (the reports are at the 'Results > Detailed reports' step):

|

| 4 | Check the reports for more details |

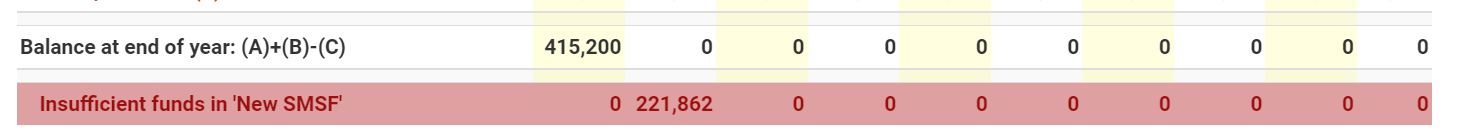

If you are checking an SMSF transaction account, the shortfall information will be at the end of the report:

|

| 5 | To download the results, you can use the 'Cash shortfall strategy paper' which just has reports to help resolve the shortfall | For more, see How to download results into a document (Strategy Paper, SOA (Statement of Advice) Foundation document, Strategy Comparison) |

Tips for investigating shortfalls

Check input data for errors

The source of the issue may be in the input data, rather than an actual shortfall.

| Thing to check | How to check it |

|---|---|

| Check the 'Solve events' to see if the shortfall belongs to an individual or an entity |

|

| Check errors and warnings |

|

| Check the income and expenses in the results | Go to the Results > Cash flows & Action items step, and in the cash flows report, read across each row and check that it is what you expect. In particular, check:

|

| If you need to make corrections, make the corrections, solve the case again and check the results. | For more see Entering Data in Pathfinder and How to solve a scenario to get results |

Understand the nature of the shortfall

If your input data are correct, then work out if the shortfall is a one-off or happens in multiple years.

| Thing to check | How to check it | |

|---|---|---|

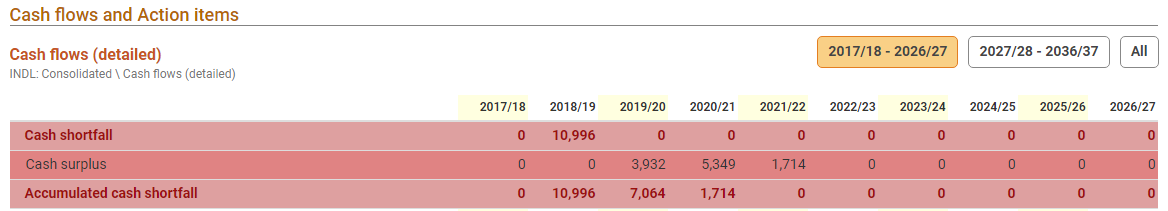

| 1 | Check if the shortfall is one-off or ongoing |

|

| 2 | Check if the shortfall is caused by a particular expense or event | In the first year the shortfall occurs, read down the column for that year to see what else is happening in that year (or check the action items):

|

| 3 | Check if the surplus cash resolves the shortfall in the future |

|

Suggestions for resolving shortfalls

General suggestions for resolving shortfalls

Regardless of the nature of your cash shortfall, the following general tips are good to keep in mind.

| Check your input data are correct | See above. |

Make notes when you copy scenarios and do re-runs |

|

| Prioritise goals | If you need to adjust goals, you may prefer to adjust the lower priority ones first, before considering adjusting more important goals. |

| Make the instructions for Assets & loans scenarios less restrictive | The more freedom Pathfinder has to optimise, the more likely it is to find a feasible solution. To remove restrictions, go to the Cash flows & Goals > Review assets & loans step step and review the options you've chosen:

|

| Make instructions at the Retirement planning step less restrictive | At the retirement planning step, for voluntary super contributions choose |

| Make the instructions for the SMSF less restrictive | Some common causes of cash shortfalls in SMSFs include:

|

Specific suggestions for resolving one-off shortfalls

| See the general tips, above. | |

| Reduce the value of the goal | You should reduce the value by a bit more than the amount of the cash shortfall. For example, if the shortfall is caused by a $10,000 holiday, and the shortfall is $1,500, then you should reduce the holiday by about $2,000, so the holiday is now $8,000. |

| Delay the goal | In the cash flows reports, the year the Accumulated cash shortfall returns to zero is good guidance for the earliest affordable year the expense can occur. For example, if the shortfall is caused by an expense in the third year, and the accumulated cash shortfall returns to zero in the fourth, year, then you can shift the holiday to occur in the fourth year. Note that the year the shortfall returns to zero is a starting place and you may need to run the scenario several times to find the best year. If you try the year the shortfall returns to zero and there is a shortfall, you may need to delay the expense further. If the year the shortfall returns to zero is okay, perhaps make a copy of the scenario and try moving the expense one year earlier to see if that is feasible. |

| Dip into the cash reserve | In the year the shortfall occurs, reduce the cash reserve (if any) by a little more than the shortfall (for more information see Cash reserve goal) |

| Combination of the above | e.g. reduce the value and dip into the cash reserve. |

| Specific tips for resolving a shortfall caused by a property purchase | |

| These tips are in addition to the above tips. | |

| Check you've included a loan | At the Solve step, there will be a warning if a loan has not been added for a property. You can add the loan at the Cash flows & Goals > Review assets & loans step. For more, see Secured loan. |

| Change the reference year for the property value | Consider whether the property purchase price should be indexed from the first year of analysis or indexed from the purchase year. For example, if the property value is $100,000 in the first year of analysis, and the indexation is 2.5%pa. If the property is purchased in the second year, then the purchase price will be $102,500 (i.e. $100,000 x 2.5%pa growth). If you would like the purchase price to be the value you entered, then in the series builder, change the 'Reference year' to the purchase year (for more, see How to use the series builder) |

| Consider borrowing more | This can be risky because it may not be realistic to borrow more, plus, it may not resolve the shortfall because the mortgage repayments will be higher. If it is suitable to borrow more, in Pathfinder you can increase the LVR of the property so a smaller deposit is required. |

| Review the acquisition costs (stamp duty) of the property | In the results, you can see the acquisition costs used in the action items the year the property is purchased. If you used Pathfinder's default value for acquisition costs, it may be higher than reality because the actual acquisition costs (especially stamp duty) vary from state to state. If the case has first home buyers, they may also be able to take advantage of additional concessions. Typically, each state government has online calculators you can use to more accurately estimate stamp duty. The acquisition costs for new family homes and investment properties can be edited at the Cash flows & Goals > Review assets & loans step. |

Specific suggestions for resolving on-going shortfalls

If a case has shortfalls in many years, it has an ongoing shortfall where the on-going expenses in the case exceed the income and disposable assets. This can happen for many reasons, but some common cases are:

- In retirement, spending exceeds income from super, age pension and other assets

- A property is purchased and the subsequent mortgage repayments are too high

| See the general tips, above. | |

| Reduce annual living expenses or calculate maximum feasible living expenses | You can reduce expenses at many stages of the analysis. For example:

For more see How to increase or decrease a value in the series builder. To calculate maximum feasible living expenses, see How to run a 'surplus cash' scenario. |

| Allow direct assets to be sold | Check the assets and loans report to see if it's feasible to sell any assets. This report is under Detailed reports > Consolidated > Assets & Loans. |

| Reduce number of years for analysis | This does not solve the cash shortfall, but in some cases, it may be appropriate if you are able to explain the shortfall in another way. For example, if the shortfall happens in the 20th year of the analysis and is in retirement. It may be simpler to only do the analysis for 19 years and then show that the asset balances at the end of 19 years are low. For more, see How to set the number of years for analysis. |

| Specific tips for resolving an on-going shortfall in retirement | |

| Delay retirement | For more, see Retirement planning goal (super contributions and pensions) |

| Allow more voluntary super deposits | Allow more voluntary super deposits. For more, see Retirement planning goal (super contributions and pensions) |

| Switch on the Age Pension (if it was previously switched off) | If you have not allowed the Age Pension, you could try allowing it to see if it helps . For more, see How to include or exclude the Government Age Pension. |

If you set a minimum balance in Superannuation, adjust the goal so that super funds can go to zero. | If you have put restrictions on a super fund to keep a minimum balance, and in later years, this minimum balance isn't required, you can adjust it:

|

| For an SMSF asset, if you set a minimum balance or chose 'leave alone', adjust the goal so that the asset can be solve down | If you have given instructions for an SMSF's assets that don't allow them to be sold (e.g. Leave alone, Keep minimum balance), choose a more flexible options, such as |

| Change investment profile in super | If this is appropriate for the individual's risk profile, try changing the investment profile in super to one with a projected higher return. For more see Superannuation (a.k.a Super). |

.png)