How to enter salary packaging in Pathfinder

On this page

Salary packaging is when an individual negotiates with their employer to have some of their pre-tax income pay for a specific expense. e.g. a car lease, meals and entertainment, a laptop.

Although there are many different types of salary packaging agreements, these general guidelines should let you work out a reasonable workaround specific to what you need to do.

Note, if you would like to enter a salary sacrifice amount into super, please see Retirement planning goal (super contributions and pensions).

Overview of steps

- The individual's gross income is entered in two parts:

- Salary packaged amount

- Non-salary packaged part

- The expense the salary packaging is spent on is entered as an expense

- Adjustments for any FTB on super guarantee paid on the salary packaged amount are also required

Detailed instructions

| Step | Details |

|---|---|

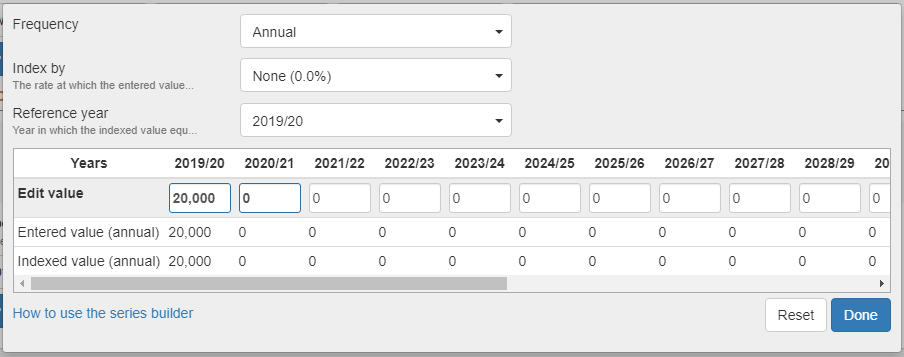

| Work out the salary packaged amount and enter it in Pathfinder as non-taxable income | In Pathfinder, go to the Cash flows & Goals > Cash flows step and add an Income with the following details:

Amount = Click the Customise button and fill in the values for the relevant years. You can enter a one-off amount or an amount that stops after a certain amount of years (for more, see How to increase or decrease a value in the series builder) |

Check if the super guarantee is paid on the individual's gross salary rather than net of the salary packaged amount | If the individual is paying the super guarantee on their salary packaged amount (i.e. super guarantee is paid on their gross salary rather than net of the salary packaged amount), please Contact Optimo Financial so that the super guarantee is modelled correctly. The above instructions assume that no super guarantee is paid on the salary packaged amount. |

| Add the salary packaged amount as an expense | At the Cash flows & Goals > Cash flows step and add an Expense with the following details:

|

| Check any other annual living expenses that have been entered do not include the salary packaged amount | For example, if the individual has annual living expenses of $50,000. And they are salary packaging $5,000 for meals and entertainment, should their annual living expenses be adjusted to $45,000? (i.e their total annual living expenses minus their meals and entertainment) |

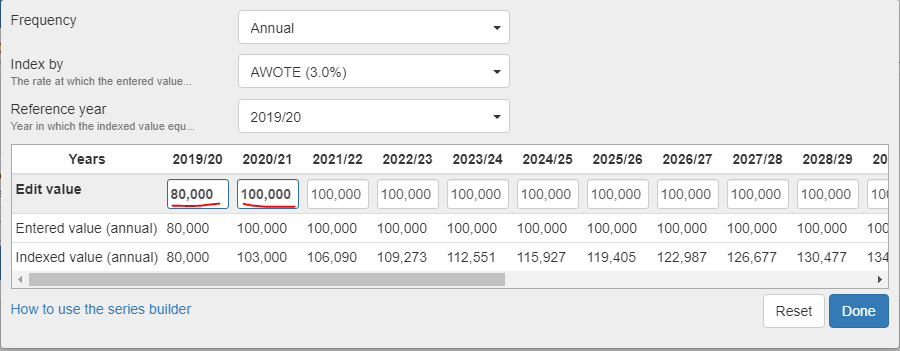

| Enter the individual's taxable income (i.e. the gross income minus the salary packaged amount) as Wages/Salary. | At the Cash flows & Goals > Cash flows step, add an Income with the following details:

|

| Add any Fringe Benefits Tax (FBT) implications that the individual must pay | You will need to calculate this amount yourself and enter it as an expense. If the individual's employer will be paying the FBT, it does not need to be entered in Pathfinder. |

Salary packaging example

Sally's gross income is $100,000 and she is salary packaging her new car purchase of $20,000. Her employer is only paying the super guarantee on her taxable income, and not the salary packaged amount, This is happening in the first year of analysis only.

Before entering any values in Pathfinder you need to work out what her taxable income is:

| Income | Year 1 | Year 2 onwards | How this is entered in pathfinder |

|---|---|---|---|

| Gross income (not entered in Pathfinder) | $100,000 | $100,000 | When an individual is salary packaging, gross income is not entered in Pathfinder. |

| Salary packaged amount | $20,000 | $0 | This is entered in two places:

Note that since it is a one-off income and expense, the value is $20,000 in the first year and then $0 for subsequent years.

|

| Taxable income (gross income - salary packaging) | $80,000 | $100,000 | This is entered as an income with Type=Wages/Salary. This value is calculated by subtracting the salary packaged amount from the gross income. Note that the value changes between year one and year two because the salary packaging is only applied for the first year.

Also note that the super guarantee will only be paid on this income. |

.png)