Insurance Bond results

For general tips about reading the results, see the Results step.

You can see results about an insurance bond in the following places.

Strategy summary step

Go to the Results step on the top menu, and then choose the Strategy summary sub-step.

On this page, each insurance bond will have a section with an overview of the deposits, withdrawals and balance.

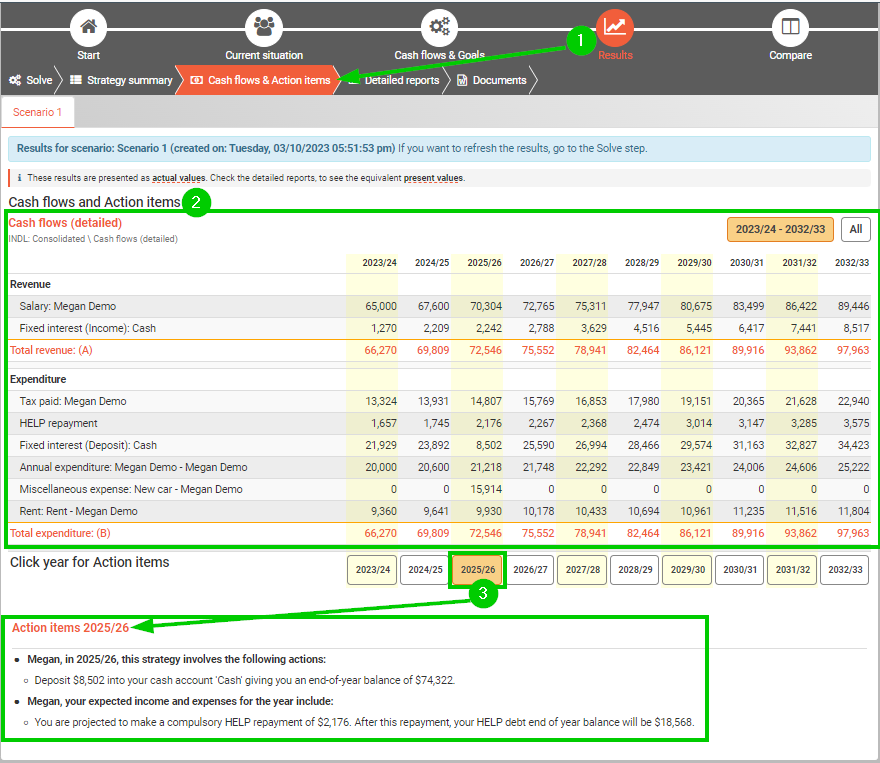

Cash flows & action items step

Go to the Results step top menu, and then choose the Cash flows & action items sub-step.

In the Cash flows report:

- The Revenue section lists the following lines (if in the strategy):

- Withdrawals from the insurance bond

- If a tax rebate applies to a withdrawal, there will be a 'Insurance bond franking credit' line

- The Expenditure section lists the following items (if in the strategy):

- Deposits to the insurance bond

In the Action items, there will be an action item for each deposit and withdrawal. The action item will also state the balance, and the tax status of withdrawals that are made.

Detailed reports step

Go to the Results step on the top menu, and then choose the Detailed reports sub-step.

On this page, the following reports may be useful:

- (Insurance bond) report (under Consolidated > Assets & Loans) gives an overview of the asset, and year-by-year, deposits, withdrawals, fees paid, and start and end-of-year balances

- Under the (Insurance bond) report are sub-reports for:

- Entry fee - calculates the annual entry fee, if any, for deposits

- Investment return - calculates, for each year, the return on the invested funds

- Reinvested income - shows the proportion of the investment return which is reinvested.

- For each owner, under (Individual) > Assets & Loans, there are similiar reports for the asset, however, only the owner's withdrawals, deposits, and balances are reported.

Adjusting your results

If you would like to change something in the results or make another scenario for comparison, you need to change your input data and solve again. See Insurance bond for data entry tips.

.png)