Insurance bond

What should be entered as an Insurance Bond

The following should be added as an Insurance bond:

Insurance Bonds

Investment Bonds

How to add an insurance bond

To add an existing Insurance Bond, go to the Current situation step (top menu), then the Assets & Loans sub-step. And then click the +Add Assets button (on the left menu). Then choose Insurance bond.

To add a new Insurance Bond, go to the Current situation step (top menu), then the Assets & Loans sub-step. And then click the +Add Assets button (on the left menu). Then choose Insurance bond. Then choose Invest in an Insurance bond.

NOTE: Make sure you enter the after tax rate in the 'Investment return' field.

NOTE: Make sure you enter the after tax rate in the 'Investment return' field.

Modelling options for Insurance bonds

By default, Pathfinder will:

Keep within the 125% rule for deposits (i.e. Pathfinder will never deposit more than 125% of the previous year's deposit). If you specify deposits that violate this rule, you will get an error.

Apply the correct tax rates depending on whether withdrawals are made before or after the bond has been held for 10 years.

Pathfinder lets you control deposits and withdrawals separately, however some common approaches are:

Saving for a specific expense | If you are using the insurance bond to save for a specific expense, you can specify the withdrawals, and then let Pathfinder work out the schedule of deposits. To do this:

|

|---|---|

Regular savings plan | Make regular deposits and let Pathfinder calculate the withdrawals:

|

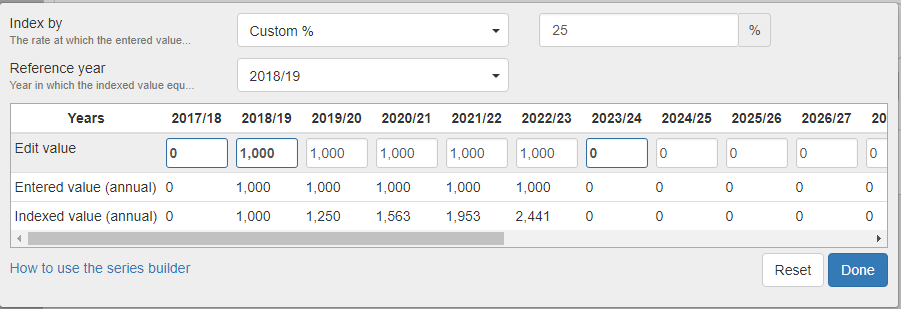

Tip for entering deposits that keep to the 125% rule | If you would like to enter a series of deposits where each deposit is 125% of the previous year's value, you can enter the first deposit, and then use the series builder to calculate the subsequent deposits:

In this example, $1,000 is deposited in the second year of analysis, then deposits that are 125% of the previous year are made for the following 4 years. The data entry is as follows:

|

Specifying deposits | You can specify deposits if: 1. It is a new insurance bond 2. It is an existing insurance bond where the 'previous year deposit' field (at the 'Current situation > Assets & Loans' step) is not zero. (If the previous year's deposit is zero, then the 125% rule means that no more deposits can be made, so Pathfinder will not let you set further deposits). |

Results for Insurance bonds

For an overview, see Insurance Bond results.

Related items

Strategy Development Service (SDS) and Background adjustment options

If the case includes complex analysis that you are not able to do in Pathfinder yourself, Optimo Support may be able to do some background adjustments to help you get the results you need. Depending on the complexity, this may be included as part of the standard support or additional charges may apply. For more details, please see Modelling outside the scope of Pathfinders' standard modelling.

Some examples of things that are outside the scope of Pathfinder's modelling and how Optimo support can help, are listed below:

Adjustment | Details | Information required by Optimo Support | Examples where additional charges may apply |

|---|---|---|---|

Making a partial withdrawal from an insurance bond before it has been held for 10 years. | Before 10 years, Pathfinder can make a full withdrawal; and, after 10 years, Pathfinder can do both partial or full withdrawals. | Please send us specific details, and we can see what we can do. | Depending on the case complexity, you may need to submit the case to the Optimo Financial SDS |

.png)