Tips for making the most of Pathfinder’s optimisation capability

On this page

What is Optimisation?

Overview

Mathematical optimisation is the selection of the best outcome based on a particular criterion from a set of available alternatives. In simple cases, a specific optimisation problem involves minimizing or maximizing an 'objective function' systematically by choosing input values within an allotted set and finding the function’s value. Optimisation involves determining “best available” values of the particular objective function in a defined domain.

Optimisation in Pathfinder

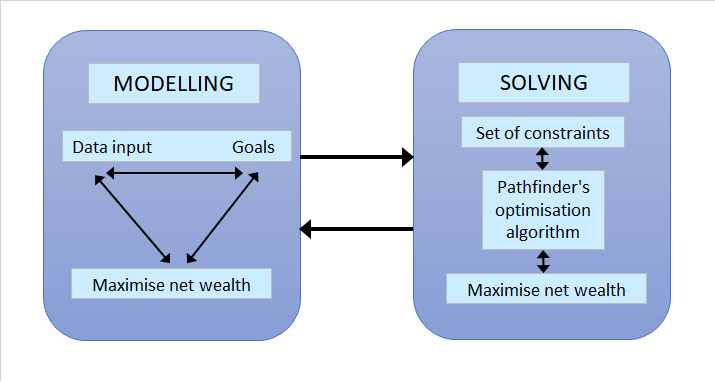

In Pathfinder, the 'objective function' is to maximise net wealth at the end of the projection period. The 'domain' is defined by a set of constraints which are applied based on the input values and goals you set for your client.

Any constraint is the quantity that has to be true irrespective of the solution. A simple example is the constraint that your client has a minimum cash reserve of $5,000 in a particular financial year. The solution to the optimisation problem will ensure that this constraint holds true.

An overview of the interaction between data input, setting goals, and maximising your clients' net wealth through our optimisation algorithm can be seen as follows:

Why use Mathematical Optimisation

Optimisation is a mathematical approach that considers all the factors that influence decisions. Optimisation means careful modeling of the your clients' cases, a process which itself provides valuable information. In Pathfinder, the benefits of mathematical optimisations include understanding the effects of any variations made to input data and goals. This means, in Websolve, by creating various scenarios you can easily compare strategies based on the financial risk versus the best outcome.

Important factors when optimising include:

- Decisions - these are the things that can vary, the things you need to choose upon. For example, whether your client decides to retire earlier or later. You can set up scenarios to explore these decisions in Websolve.

- Constraints - this is the limitations of our decisions. For example, a client may want to investigate a decision to retire sooner or later, but is constrained by the age at which they can access their super funds.

Making best use of our optimiser

A general guideline to building a case

For Pathfinder and our optimisation algorithm to work at its best, try to limit the number of constraints. Remember, that for any solution to the optimisation problem each constraint must hold true. If your strategy is too prescriptive, such as imposing exact amounts for deposits/withdrawals to and from an asset, maximising your clients' net wealth will also be limited by these types of constraints.

A general guideline to building your clients' cases and strategies is:

- Initially, let Pathfinder optimise as much as possible using our 'Robot' and then go from there.

- Then, you should only add restrictions to adjust for personal preference, for example, paying off a loan earlier than the optimal solution in order to reduce risk. Remember, with less decisions allowed to optimise, the less your clients' net wealth will be at the end of the projection period.

Make finding the best strategy for your client an iterative process. Once you have a general idea of what the optimal solution is, you can then create any number of scenarios with varying goals so as to compare strategies.

- By optimising as much as possible you allow Pathfinder to do the calculations for you. Our detailed reports and action items will tell you the cash flows needed to implement your strategy - you don't need to work them out.

- Trust the optimiser! It will work out the numbers for you to maximise your clients' net wealth.

Our optimiser likes data

Our optimiser is a powerful mathematical tool and it likes data! It will use your data, decisions, and goals to construct and rapidly solve your optimisation problems. Giving the optimiser as much information as possible, and allowing it to optimise as much as possible, lets it show off its capabilities.

Some tips for giving Pathfinder what it likes and finding the best strategy for your clients:

- If your client has a partner, enter the partner’s details as well.

- Enter the projected income and living expenses as annual figures.

- Enter proposed assets and let Pathfinder decide if and when to purchase a property, or deposit and withdraw funds to and from a share portfolio or managed fund.

- Let Pathfinder find the best way of using excess funds, such as allowing it to choose between contributing to super or investing outside of super,

Let Pathfinder determine the best time to start a pension fund in super, whether it's a Transition to Retirement Income Stream (TRIS) or an account based pension.

A simple optimisation example

To give you an idea of how a small optimisation problem might work let's assume you've been asked to find material for your home renovations at the lowest cost. You decide on three possibilities described as follows:

Option 1: Colours are red, purple, and orange and cost is $10/metre

Option 2: Colours are red, blue, and yellow and cost is $12/metre

Option 3: Colours are red, green, and yellow and cost is $14/metre.

With no constraints, the optimal solution to our problem is Option 1 costing $10/metre. However, your interior designer, who might be yourself, has specified that the material must have the colour yellow. With this additional constraint, your best option is now Option 2 at $12/metre.

We can see from this simple problem that there are other possibilities. For example, your interior designer may have said it must have the colour red as well, and, in this case, the optimal solution is also Option 2. This can happen, that is, an additional constraint has no effect on the outcome. However, had we said it must have the colour green as well, then Option 3 would be the best option.

For Pathfinder's complex optimisation problems it is difficult to ascertain whether an additional constraint will have a negative effect on its objective to maximise net wealth, but, in general, we like to assume that it will and allow Pathfinder to optimise as much as possible.

Working with your set of constraints

Types of constraints

Further to our discussion on constraints and how they affect the outcome is the idea that for Pathfinder's optimisation problems we can split our set of constraints into two groups, that is:

- constraints imposed by Government rules and regulations, such as, Family Tax Benefit eligibility and payments, income tax thresholds, etc, and

- constraints that are your choices for your client, such as, a goal to invest a specific amount each year, purchasing a family home in a particular year, etc.

Your scenario has a cash shortfall

When you've decided on your strategies and setup your scenarios, you may see the solver message that you have a cash shortfall in particular year/s. Don't panic! It just means that one, or more, of your constraints has violated the rule that 'any constraint is the quantity that has to be true irrespective of the solution'. That is the solution has a quantity which is not true for one, or more, constraints.

This type of error can be readily solved by investigating which of your constraints has caused the shortfall and adjusting it, or allowing its optimisation. For example, you have a strategy to purchase a family home in a particular year, however, there's a cash shortfall in that year. We can then assume that there isn't enough funds and borrowing capacity to purchase the property. In your goals for the scenario, you can either purchase the property in a later year, or not specify a year so that Pathfinder makes the choice for you of when to buy. There are more tips on our help page How to investigate and fix cash shortfalls.

Let Pathfinder find the best path to maximising your client's net wealth by allowing it to make the choices for you.

.png)