New Pathfinder Release (Peron)

Monday 9th March 2020

This release is named after François Péron, who was a French explorer and zoologist on Nicolas Baudin's expedition to Australian waters.

New features and improvements

One hundred more modelling combinations for super funds

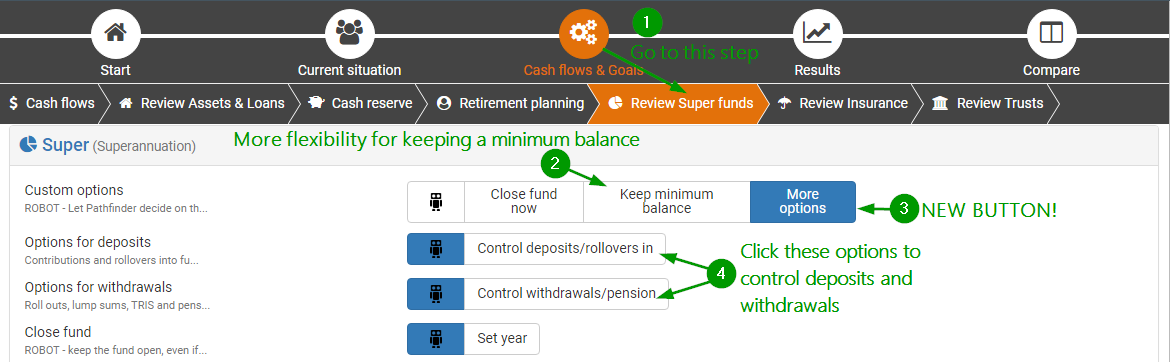

The main focus of this release is to give you more options to control super funds. We reviewed your feedback and found that there was so much variety in what you wanted to model that we've made separate fields, so you can use the combination that suits your case. We counted more than one hundred different combinations (Pathfinder used to have only three!), so we've listed some of the more useful recipes, below. These new options are most useful when an individual in your case has multiple super funds, but as a rule of thumb start with the robot option:

![]()

and if the results aren't what you're looking for, come back and set more precise options. Also note that we didn't want to hold up releasing these new fields, so more options for the pension phase and for SMSFs will be in a later release.

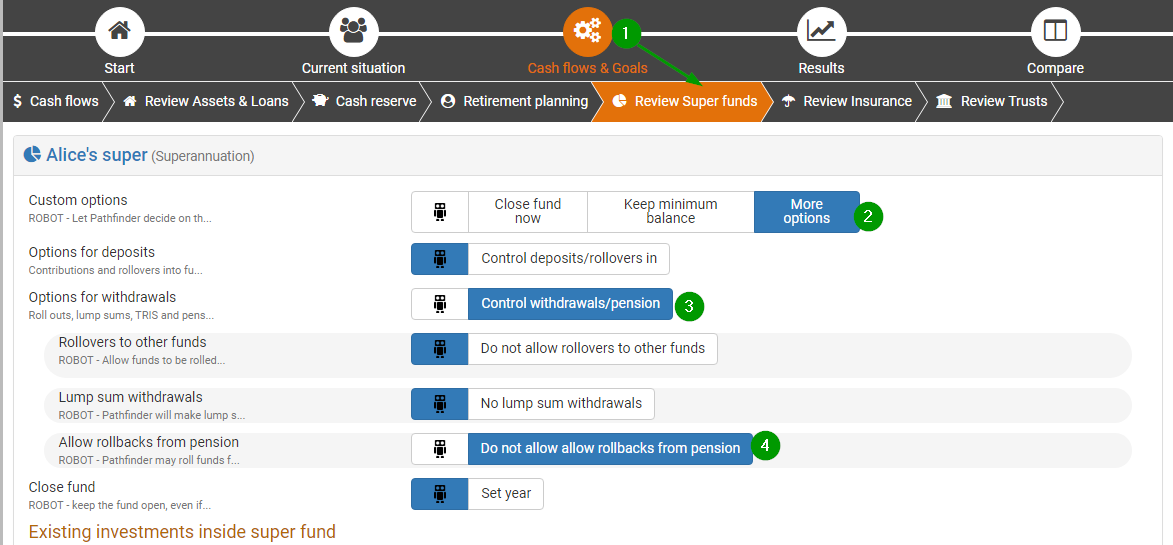

In summary, on a super fund, at the Cash flows & goals > Review super funds step, using the Custom options field, you can now control:

Deposits:

Receive contributions; and/or

Receive rollovers from other funds; and/or

Withdrawals:

Roll funds out to other funds; and/or

Make lump sum withdrawals; and/or

Allow funds to be rolled back from the pension to the accumulation phase

Plus, we've improved the options for maintaining a minimum balance, so you can now choose whether to:

Maintain the balance by topping up from contributions and/or rollovers in; or

Deposit the super guarantee and then roll excess funds out

And then you can set options for withdrawals:

Allow lump sum withdrawals; and/or

Allow roll backs; and/or

Set a 'Close year' for the fund

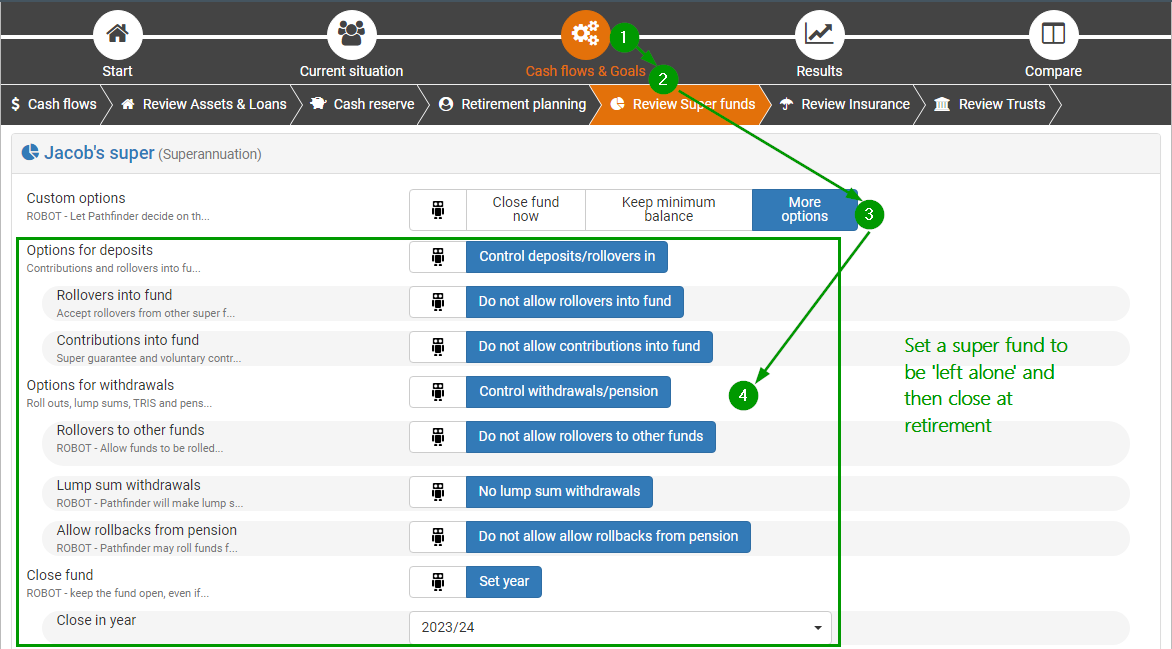

Super options recipe 1: 'Leave alone' a super fund (popular request!)

If a super fund needs to be kept open without having any deposits or withdrawals, then:

Go the Cash flows & goals

Then got to the Review super funds sub-step and find the super fund

For the Custom options field, choose 'More options'

For the rest of the fields, choose the non-robot option for the deposits and withdrawals.

If required, you can choose a year to close the fund, and Pathfinder will choose whether to roll funds out or withdraw them

You should also include a primary super fund that can receive contributions, since this fund won't accept them

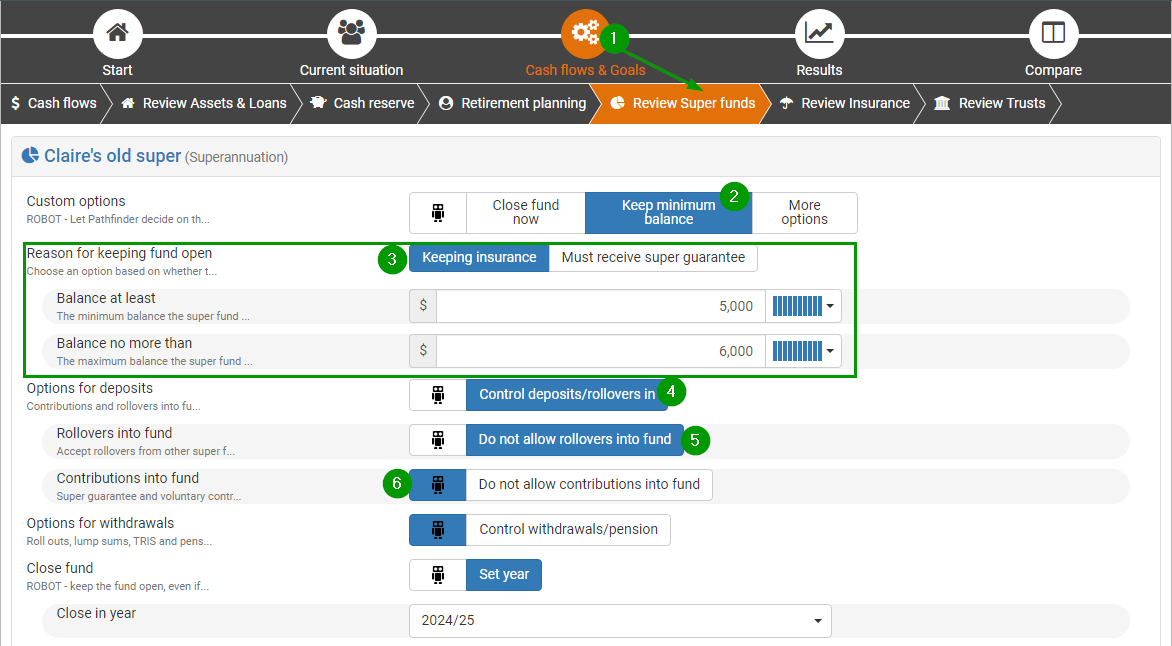

Super options recipe 2: Keep a super fund open for insurance and top it up with contributions

In this example, the super fund needs to be kept open for insurance, and when the premiums deplete the balance, it should be topped up with contributions only (not roll overs in). Note that in this example, you should also include a primary super fund that can receive the rest of their contributions:

Go to the Cash flows & Goals step, then the Review super funds sub-step

For the Custom options field, choose 'Keeping minimum balance'

For the Reason for keeping fund open field, choose 'Keeping insurance' and fill in the minimum and maximum balance fields

For the Options for deposits field, choose 'Control deposits/rollovers in'

For the Rollovers into fund field, choose 'Do not allow rollovers into fund'

For the Contributions into fund field, leave it as the default Robot:

![]()

In the results, if the super balance is above the specified maximum, Pathfinder will roll funds out, and if the premiums will put the balance below the minimum, it will top up the balance with contributions.

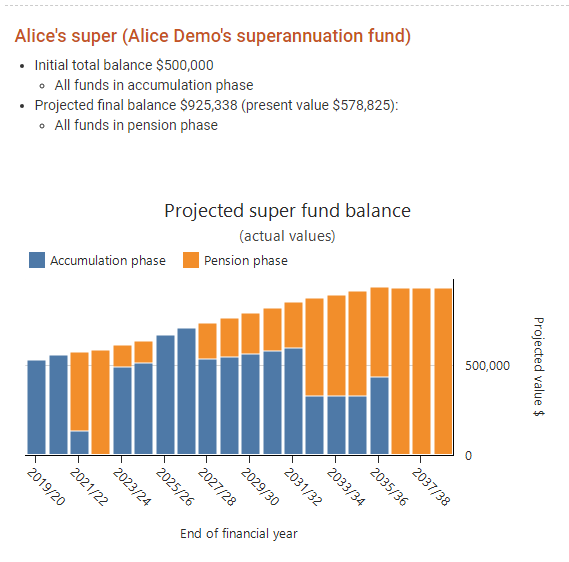

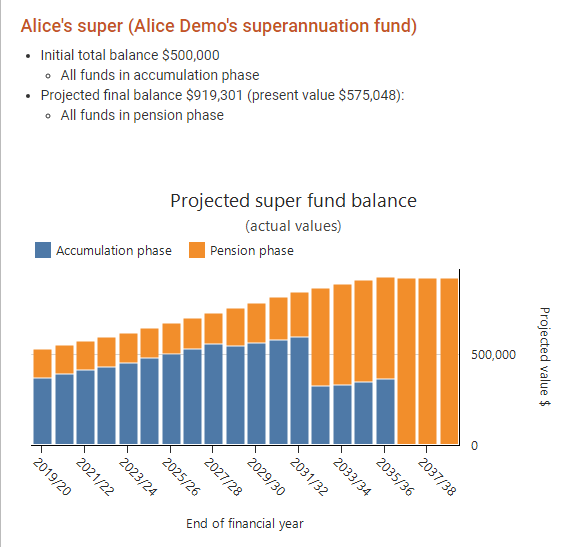

Super options recipe 3: Tidy up the pension phase by preventing rollbacks

Preventing rollbacks may be useful if, in your initial results, Pathfinder has projected a lot of back and forth between the pension and accumulation phases and the summary chart for the super fund looks like a toddler has upended a box of cuisenaire rods:

If you take the previous example and prevent roll backs, the new results have a much smoother transition from accumulation phase to pension phase. However, you should compare the two scenarios to see how much if affects the projected outcome:

Sometimes, roll backs will significantly improve the projected outcome, and sometimes preventing them will only make a small difference while making the strategy easier to implement. So, the new Allow rollbacks from pension field (at the Review super funds step) will help you figure out which approach is appropriate:

Run the scenario allowing roll backs (this is the default) and then make a copy of the scenario. In the new scenario, go to the Cash flows & goals > Review super funds step, and find the super fund

For the Custom options field, choose 'More options'

For the Options for deposits field, choose 'Control deposits/rollovers in'

For the Allow rollbacks from pension field, choose 'Do not allow rollbacks from pension'

Compare the scenarios with and without roll backs - this will show you the projected benefit of allowing roll backs and help you decide whether it's an appropriate strategy. For more, see Understanding why funds are kept in in the accumulation phase of super instead of the pension phase and How to prevent rollbacks from pension phase to accumulation phase in a superannuation fund.

Super options recipe 4: Prevent lump sum withdrawals from a super fund

By default, Pathfinder will calculate when it is beneficial to make lump sum withdrawals from the accumulation and pension phases of super. With this release, it's now possible to prevent lump sum withdrawals from a super fund:

Go to the Cash flow & Goals > Review super funds step

Find the super fund you want to change

For the Custom options field, choose 'More options'

For the Options for withdrawals field, choose 'Control withdrawals/pension'

For the Lump sum withdrawals field, choose 'No lump sum withdrawals'

Note that:

If you prevent lump sums, Pathfinder may still withdraw the same amount as a pension

It's a good idea to compare scenarios with and without lump sums to ensure that preventing the lump sums does not significantly reduce the projected outcome

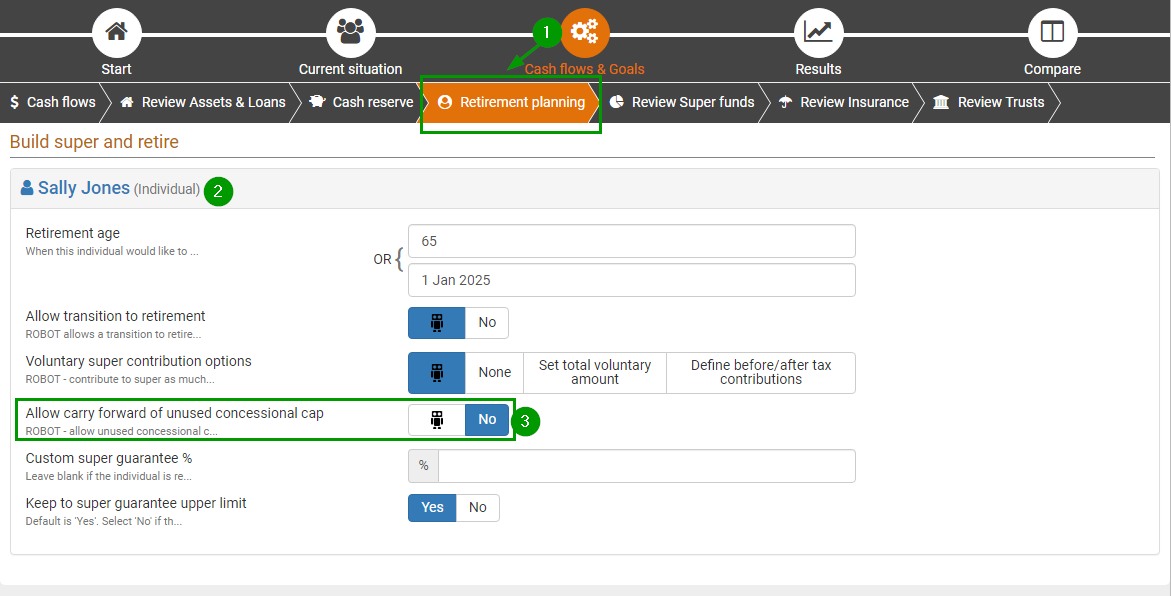

Switch off carry-forward of unused concessional cap

By default, Pathfinder includes the carry-forward of the unused concessional cap, and now there's a handy button to switch it off if you just want to keep to the annual cap. This will be particularly useful in rare cases where Pathfinder's optimisation may cheekily carry-forward the unused concessional cap to take advantage of future changes to tax thresholds, which was 'Optimal but not practical'. This button will now make it easier to get the results you expect:

Go to Cash flows & Goals, then go to the Retirement planning sub-step

Scroll down to find the individual who doesn't need to use the carry-forward cap

For the Allow carry forward of unused concessional cap field, choose 'No' (Robot is selected by default)

Notes for existing users

Remember to refresh your results for existing cases

If you have any existing cases in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before 3 March 2020. This will ensure that all your scenarios are consistent. Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

In your old cases, the new super options will also be available, however if you have asked the Optimo support team to apply background constraints to super funds (check the 'Scenario notes') then it's best to just leave the super funds options as 'robot' since the constraints will still apply. If you'd like the background constraints removed so you can use the buttons please Contact Optimo Financial.

Small fixes

These are changes that you may notice if you are working in a case you started in a previous version of Pathfinder.

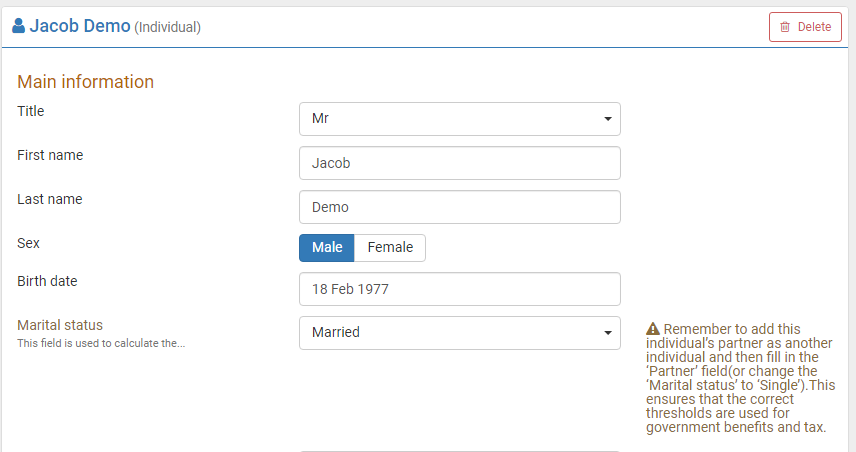

Behaviour of 'Marital status' and 'Partner' fields on Individuals has been adjusted so it's easier to keep them consistent

On Individuals, you are required to fill in the 'Marital status' and 'Partner' fields. These fields are used to calculate tax and government benefits correctly, and it's important that they are consistent with each other. So, we've made some adjustments to when the fields are shown and how they are validated, so you'll be prompted to correct any inconsistencies. For example, if you have a case with only one person, and you enter their status 'Married', then you'll get a reminder that you need to either add their partner or change their status to a 'single' status.

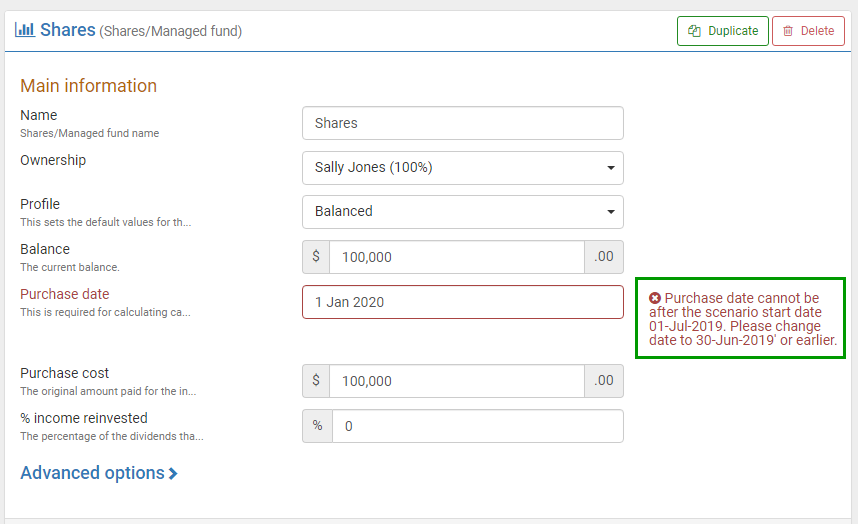

Adjustment to validation message on the Shares/Managed fund 'Purchase date' field

If your old cases had an existing 'Shares/Managed fund', you may notice a error on the 'Purchase date' that wasn't there before. If you see, it, just adjust to the date suggested in the error message. It's caused by us adjusting the validation so that the date must be before the start date of analysis. This change was made in preparing for the future SMSF release.

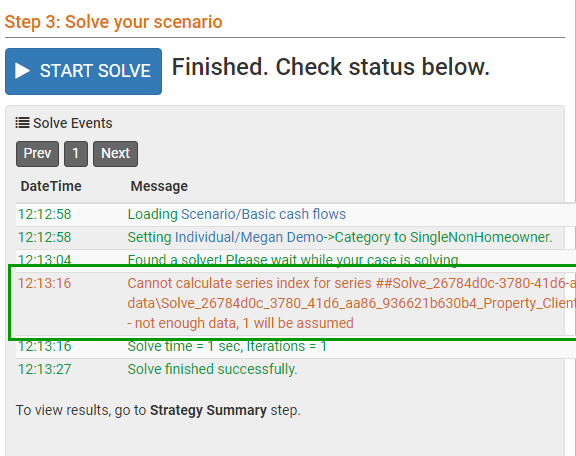

'NRAS' message in solve log has been fixed

If your case had an investment property, you may have noticed an warning message in the Solve events log pop up. In this release we've fixed the reporting issue that caused it, so you won't see it any more. Since this was just a reporting issue, and didn't affect the calculations, it was safe to ignore it when you did see it.

New pages in our help documentation

We've added some new pages to our help documentation:

How to copy data for a case you have completed before (e.g. for a client review)

Recovering from an 'Oops: Sorry! Something went wrong!' error message

Commonwealth Senior's Health Care Card (CSHC card) and Pensioner Concession Card

How to prevent rollbacks from pension phase to accumulation phase in a superannuation fund

.png)