New Pathfinder Release (Shackleton) and Technical updates

2 December 2020

Release overview

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

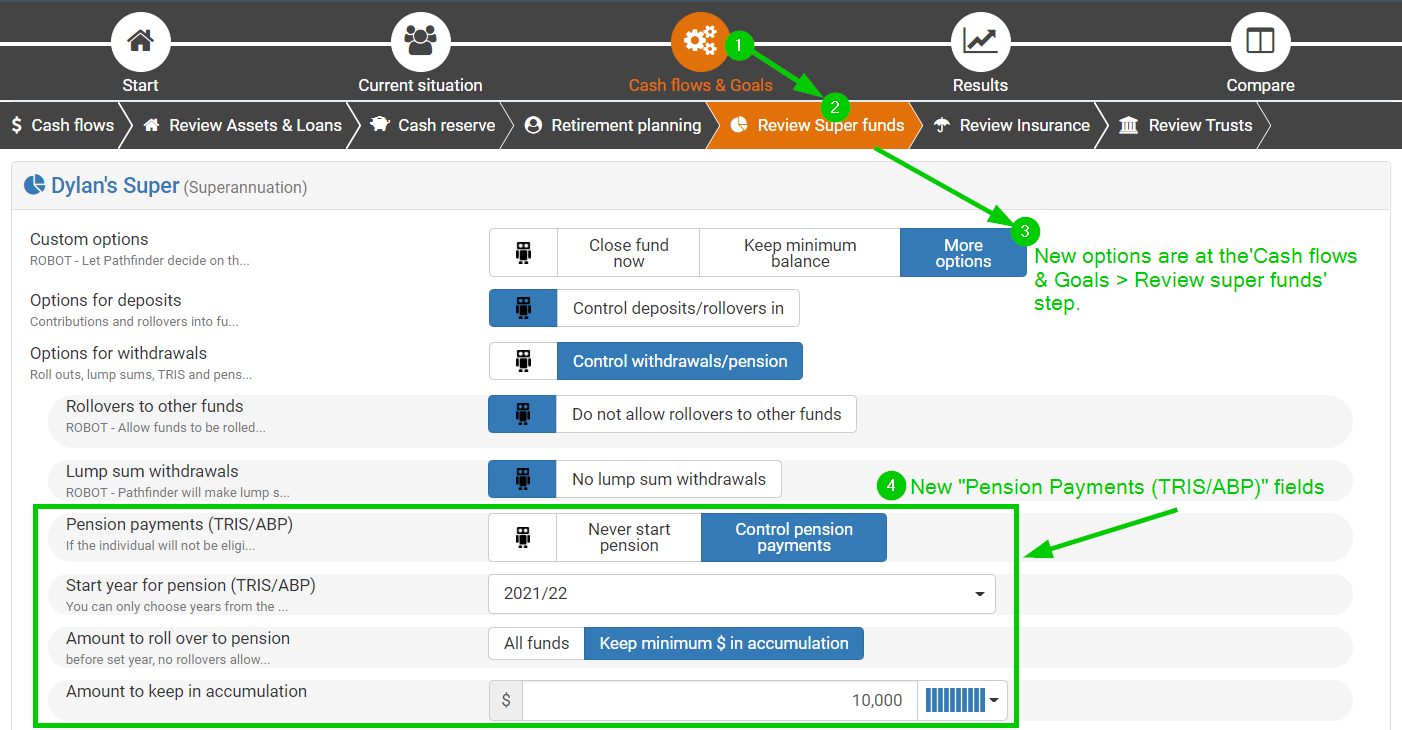

More options for modelling account-based pensions (ABP) and transition-to-retirement income streams (TRIS) in superannuation funds (popular request!)

On superannuation funds (at the Cash flows & Goals > Review super funds step), there are now the following new options to let you control account-based pensions and TRIS (in addition to the default 'Robot' option):

Never start a pension

Control pension payments:

Choose what year to start the pension

Choose whether to rollover all funds, or keep a minimum balance in the accumulation phase

These options are available on existing and new superannuation funds, however, they are not available on SMSFs, yet (we will add them in a later release). You can also use these options in combination with the other options on superannuation funds, such as lump sum withdrawals and controlling contributions.

These options are useful if it is necessary to set more specific instructions, for example to make the strategy more practical to implement or to mitigate risk.

Some rules of thumb for choosing options for super funds are:

Start at the top of the options and work your way through the fields one-by-one - the fields change based on previous fields.

If you’re not sure which option to choose, the help text under the field gives more details. You can always start with 'Robot' and, adjust if the results aren't what you expect.

Pathfinder will not take actions that are not applicable to the individual or case, so if an option does not apply to an individual (e.g. they are too young to start a pension, the individual only has one super fund so can't do rollovers), then just choose the Robot icon

If you would like to choose specific options for Pension payments, it is recommended you compare the results with a scenario where you have set ‘Pension payments (TRIS/ABP)' to 'Robot’, so you can see how big the projected difference is. For more, see How to make another scenario for comparison

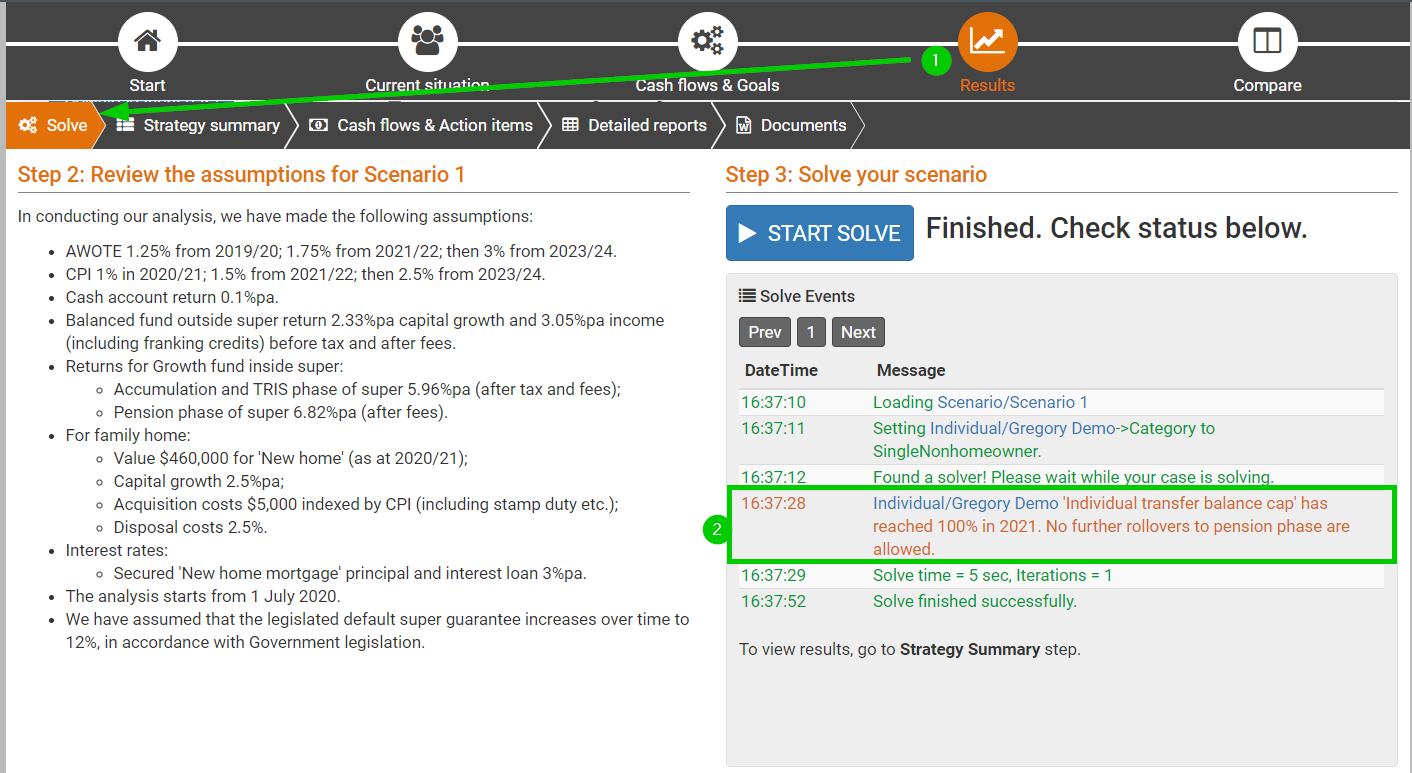

Avoid choosing options that will force Pathfinder to exceed the transfer balance cap when rolling funds over to the Pension phase. If the transfer balance cap is reached in your case, it will be reported in the ‘Solve events' box, and then you can check the Detailed reports. Pathfinder may make commutations or violate constraints, so carefully review the results, and adjust if necessary. If an individual reaches their transfer balance cap, it is strongly recommended you set 'Pension payments (TRIS/ABP)' to 'Robot’ since Pathfinder's optimiser works best when it's unrestricted.

When reviewing your results, some tips are:

When you are solving, watch the 'Solve events' for messages about the transfer balance being reached and/or other errors which may indicate you should correct your inputs.

For information about useful reports to review, see Superannuation and SMSF Results

There can be benefits to not rolling over all funds to the tax-free pension phase. For more, see Understanding why funds are kept in in the accumulation phase of super instead of the pension phase.

Technical updates

Technical updates

Technical updates are applied to all cases, so it is strongly recommended you resolve all scenarios in any active cases to refresh the results, and make sure all scenarios are using the same technical details.

The following updates have been applied in Pathfinder and are based on 'A guide to Australian Government payments' (20 September 2020):

Maximum government age pension payment and supplement for couple and single person increased

Rent assistance updated

Assumptions updates

The new assumptions will be applied on cases created after the release. Cases created before the release, will continue to use their original assumptions.

Changes to CPI and transfer balance cap increase

In accordance with the RBA Statement of Monetary Policy November 2020, the default value for CPI in 2020 has been lowered from 1.25%pa to 0.5%pa. Please note that this also affects the indexation of the transfer balance cap, so, in Pathfinder, the cap is now projected to increase from $1.6m to $1.7m in 2022/23, whereas under the old assumptions when the CPI was assumed to be higher, it was projected to happen in 2021/22.

Changes to assumed interest rates

Due to the RBA's decision to lower interest rates, Optimo Financial's default cash interest rate has been lowered to 0.1%pa (down from 0.25%pa), so assumptions have been updated for the following items in Pathfinder:

Cash interest rates

Fixed interest interest rates

Australian and International bonds returns

Secured loan interest rates

Unsecured loan interest rate

Shares/Managed funds and Superannuation investment options that include a cash allocation. e.g. Balanced funds.

For the full list of the latest assumptions, see Optimo Financial Default Assumptions.

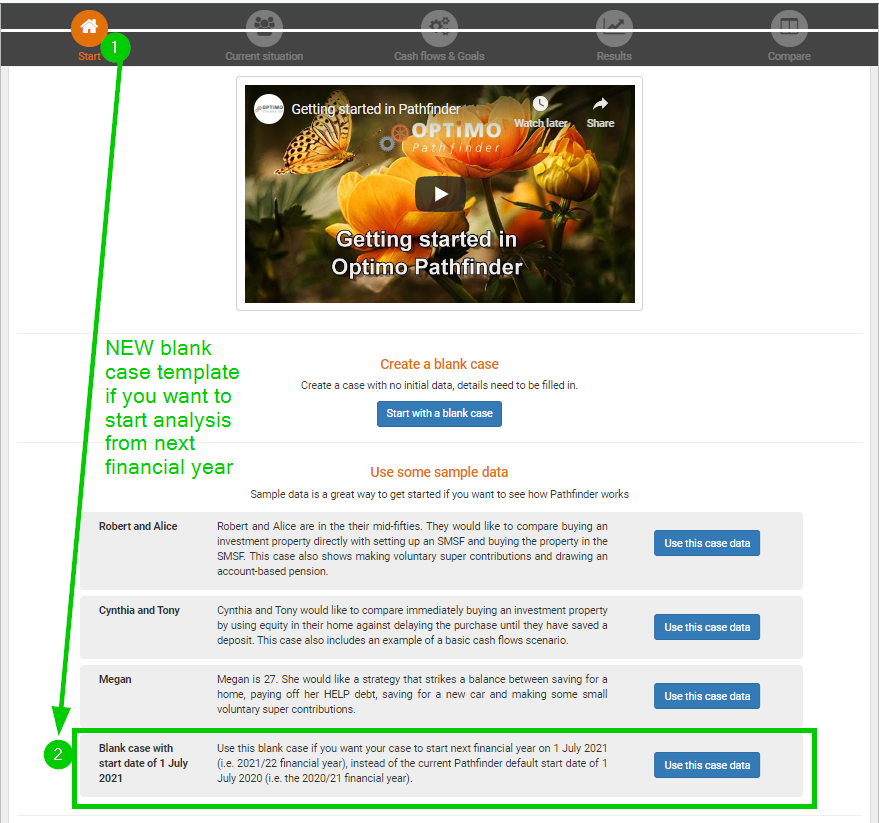

Blank case starting 1 July 2021 now available

The default start date for cases is currently 1 July 2020 (2020/21 financial year). However, if you would prefer to start you case from the next financial year, (1 July 2021, 2021/22), then:

Add your case

Before you start your data entry, go to the Start step

At the Start step, choose the 'Blank case with start date of 1 July 2021' button, then enter you data as usual

NOTE: If you have already started your data entry with a 1 July 2020 start date and you want to change it to 1 July 2021, then you will need to Contact Optimo Financial. By default, Optimo Financial will change the default case start date to 1 July 2021, on 1 April 2020.

Handy message in 'Solve events' when transfer balance cap is reached

If an individual is projected to use 100% of their individual transfer balance cap, then this will be reported in the 'Solve events'. This is particularly useful if you used the new pension options to force rolling over funds to start a pension, because Pathfinder may make commutations or violate constraints, so carefully review the results, and adjust if necessary. The best place to check the transfer balance cap is in the detailed reports: (Individual name) > Cash flows > Superannuation transfer balance account.

Improvements to detailed reports

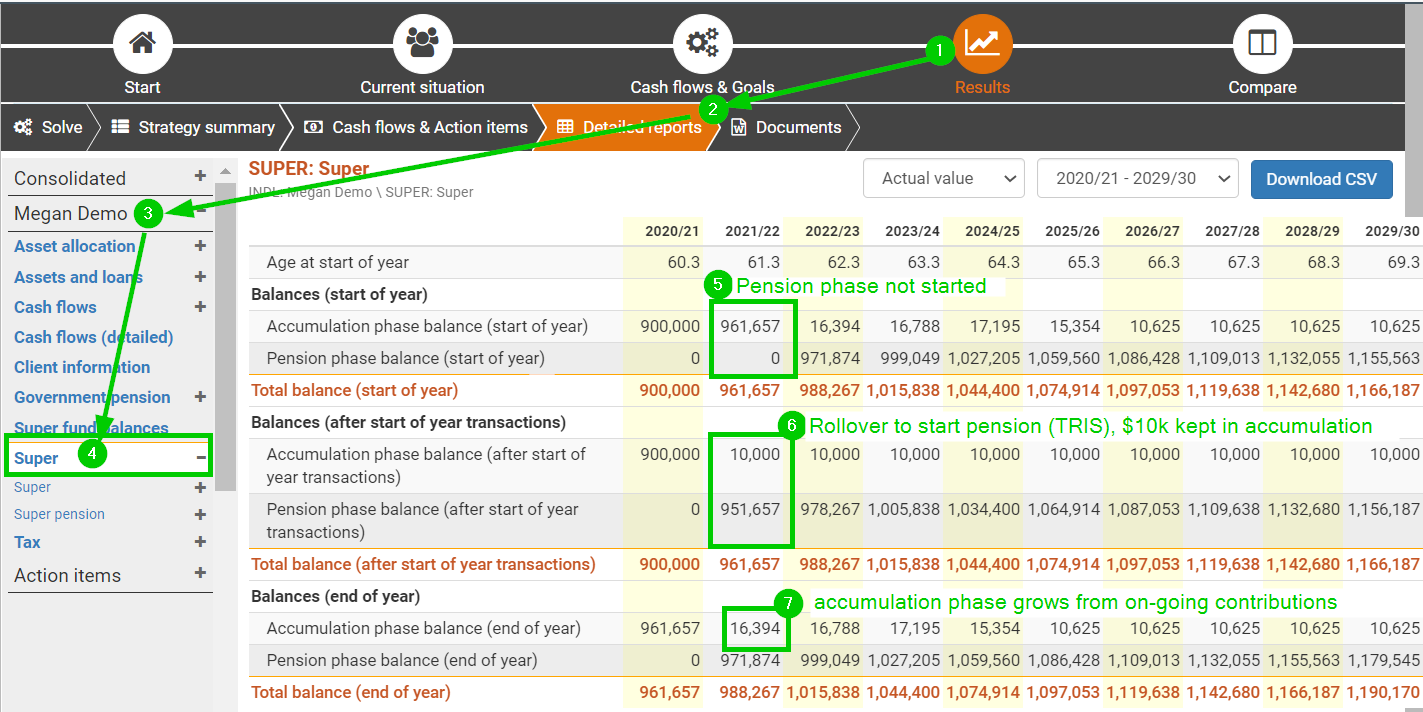

More details on the detailed report for superannuation and SMSFs

More information has been added to the following SMSF and superannuation detailed reports:

Superannuation top report: (Individual - on left menu) > (Superannuation fund name)

SMSF top report: (SMSF name - on left menu)

SMSF top report for each individual: (Individual - on left menu) > (SMSF name)

In each of the above reports, there are now sections for 'start of year balance' and 'start of year (after transactions) balance'. Previously these reports just had the 'end of year' balances. This additional information makes it easier to see what happens in the super fund throughout the year. In particular, it helps you see the balance after rollovers, which is particularly useful if you've set a minimum balance. If, after looking at this report, you want to see how the balance is calculated, check the 'Transaction report (detailed)', which will be a child report under the report you are looking at.

In the example below, the fund has used the new superannuation pension options to start a TRIS in 2021/22, while keeping $10,000 in accumulation phase (after rollovers) and continuing to receive contributions:

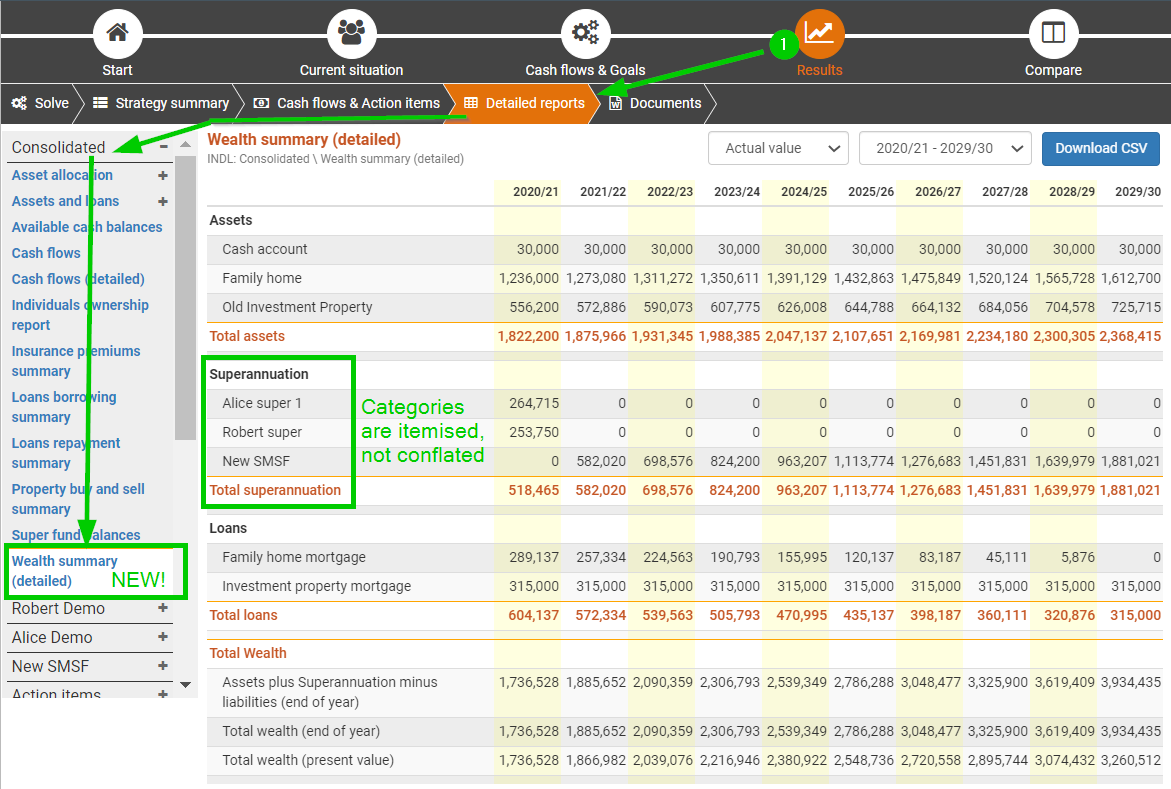

New 'Wealth summary (detailed)' report

In the Detailed reports, under Consolidated, there is a new report called 'Wealth summary (detailed)', which is an itemised version of the top 'Consolidated' report (which conflates into categories). This report has been added to the 'Strategy Overview' template, to accompany the cash flows report.

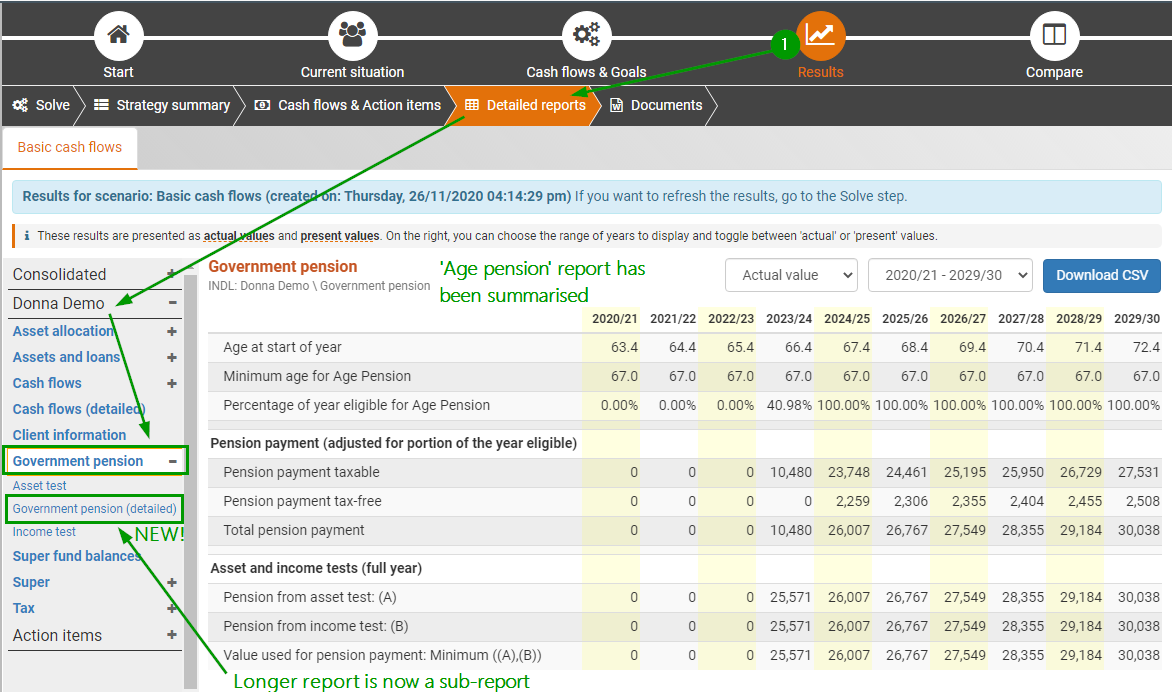

New 'Age Pension' reports

The 'Government Pension' reports for each Individual, which show the Age Pension payments and calculations, have been changed to help you find the right information at the right time:

The top 'Government pension' report is now more succinct, so it's easier to find the basic information about actual payments, and the asset and income test.

There is a new sub-report called 'Government pension (detailed)', which has more details (this was previously all on the top report)

New help pages and instructional videos

There are some new help pages with general tips about making the best use of Pathfinder's optimiser. They are good for new users, or existing users who would like a refresher:

Some instructions videos have also been updated:

Video - Getting started in Optimo Pathfinder

Video - How to run a sample case

Video - How to run a case from scratch

Video - Using the comparison charts

Video - How to add an individual

Edit (17 August 2023): The above video links have been removed and are replaced with our https://help.optimopathfinder.com.au/userdocs/web/getting-started-guide.

Notes for existing users

Please refresh your results for active cases

Since we have done a technical update, if you have any existing cases in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before the release on 2 December 2020. This will ensure that all your scenarios are consistent. Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

For the updated assumptions, any cases you started before the release date will continue with the previous assumptions. Any cases you create after the release date will have the old assumptions.

Bug fixes

Thanks for reporting these issues and for your patience while we fixed them!

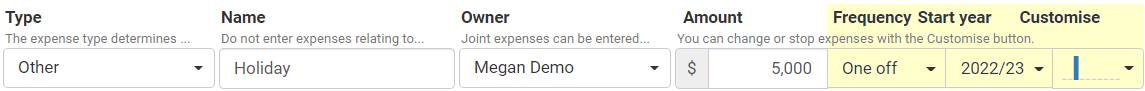

'One-off' frequency in series builder is working again

You can now choose the 'One off' frequency in any series builder, and it will stick, instead of reverting to 'Annual'. If you entered a workaround with the 'Annual' expense and then zeros in other years, then you can keep it as it is in that case, but enjoy using one-off next time you need to enter a holiday.

Intermittent ‘Solve failed issue' fixed

In September/October, you may have been getting ‘Solve failed’ errors, where we told you to simply try again, without making any changes. This issue has been fixed, so if you see ‘Solve failed’ trying again probably won’t work, so either check the error messages, your input data or Contact Optimo Financial. Thanks for your patience with this one.

Better reporting of insurance premiums on the SMSF transaction account (detailed)' report

On the SMSF 'Transaction account (detailed)' report, insurance premiums are now itemised instead of being conflated under a single name.

TRIS and account-based pensions for over 65s bug fixed

There was an introduced bug where Pathfinder would not start a TRIS or account-based based pension if they wanted to start over 65. This has now been fixed.

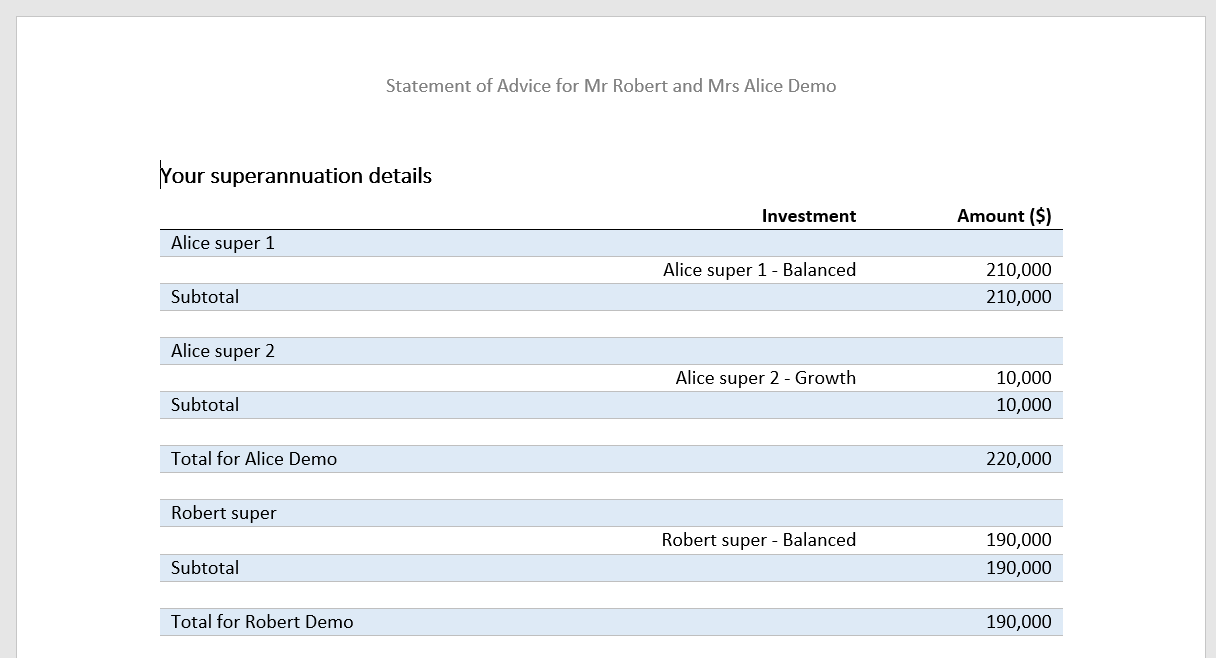

‘Your superannuation’ table in 'SOA foundation document template' no longer needs to be manually edited

In the SOA foundation template, the ‘Your superannuation’ table would incorrectly list funds twice if the case had a couple, and so it had a comment to check this table manually. This has been fixed, so you no longer have to manually correct it.

.png)