New Pathfinder Release (Ui-te-Rangiora) - Annuities, Fixed interest in SMSFs

8 November 2021

Release overview

This release is named after Ui-teRangiora, a 7th-century navigator from the island of Rarotonga in Polynesia.

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

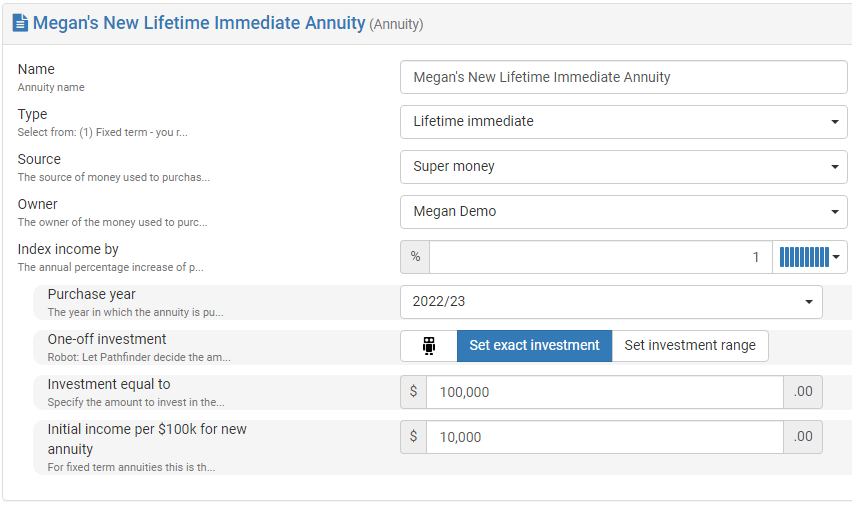

You can now model annuities in Pathfinder (popular request!)

You can now model the following types of annuities in Pathfinder:

Fixed term

Lifetime deferred

Lifetime immediate

You also have the option to:

Choose a ‘Source’ of super or non-super money for annuity purchase

‘Allow multiple investments’: To easily model multiple proposed fixed term annuity purchases with the same details over different years

‘Set exact investment’, ‘Set investment range’, or let Pathfinder optimize how much to invest in a proposed annuity.

The following have been added for efficient data entry:

Dynamic fields that display only if required for the chosen annuity type

Improved help text to explain each field

Validation messages to indicate whether a field is required to be filled

As well, these fields have been removed to streamline data entry:

‘Advanced options > Payments per $100k’ section: This previously contained ‘initial income per $100k’ figures for males/females of different ages. However, it is now simpler and more accurate for the user to supply their own figure for their annuity in the ‘Initial income per $100k’ field.

‘Life expectancy’ type option and ‘Term remaining’ field: The user now has more control to enter a fixed term annuity with a fixed term set to the desired remaining life expectancy.

‘Guaranteed term (years)’ and ‘Reversionary’ fields, related to the death of the owner.

For more, see the Annuity page of the help documentation.

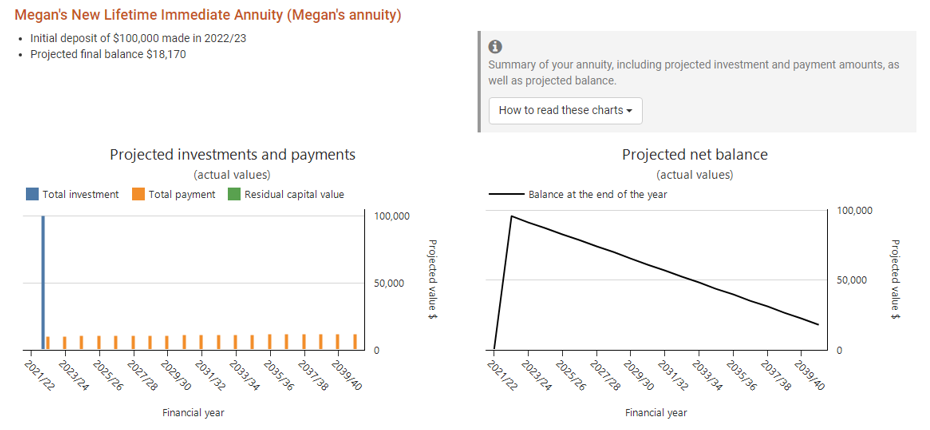

Pathfinder will provide comprehensive results:

Strategy summary charts display the projected investment amount and payments, as well as projected net balance

Actions items outline the annuity's purchase and receival of payments

Detailed reports provide data on the deposits, balances (including those used in government pension tests), payment, and other totals.

All legislative rules will be automatically considered by Pathfinder: For example, the tax status of payments will be calculated based on the individual's preservation age, source of money used, and other relevant factors.

For more see the Annuity results page of the help documentation.

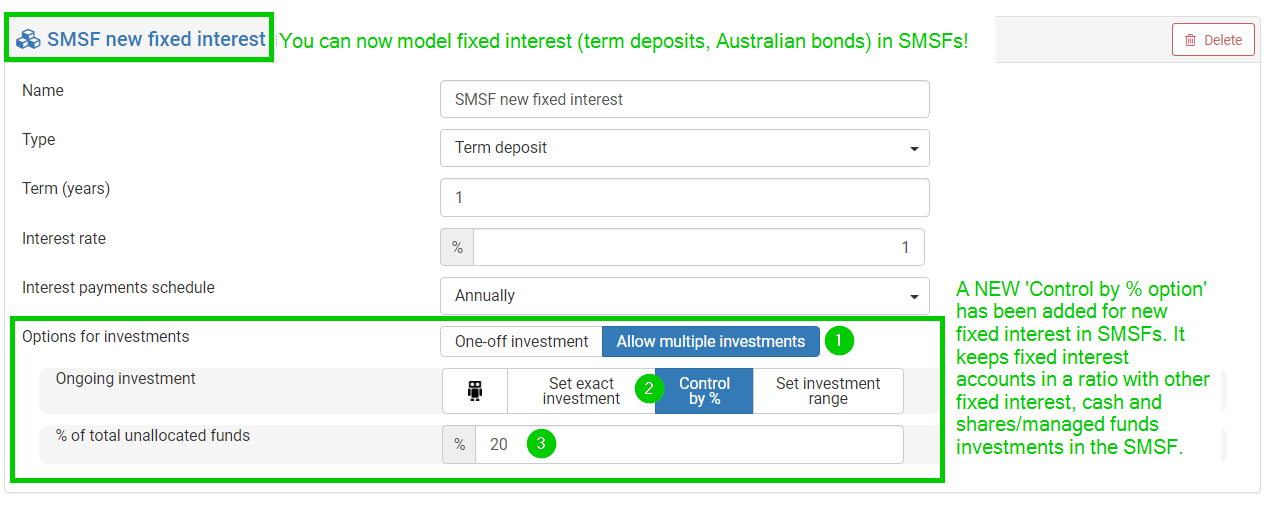

Fixed interest now included in SMSFs

You can now add fixed interest accounts (term deposits and Australian bonds) to SMSFs, and keep new fixed interest accounts in a ratio with other assets in the SMSF with the new Control by % option.

Data entry for Fixed Interest in SMSF

The options for directly owned fixed interest, are now also available for fixed interest accounts in SMSFs:

If you have an existing fixed interest account in an SMSF, then Pathfinder will withdraw the funds based on the term you entered.

If you would like to add a proposed fixed interest account to an SMSF, then you can set the investment to be one-off or on-going, and set the deposit amount by choosing from the same options that are available for directly owned fixed interest:

Robot Icon - let Pathfinder calculate the investment amount that will maximise the case's net wealth at the end of the analysis. Pathfinder will not deposit funds that are required before the investment matures.

Set exact deposit amount - set the exact amount you would like to deposit.

Set range for deposit amount - set a minimum and maximum value and let Pathfinder calculate. This is particularly useful if you would like Pathfinder to calculate the investment amounts but would like more control than the Robot option

New 'Control by %' option

In addition to the above options, fixed interest accounts in an SMSF that are proposed (i.e. entered at the 'Review super funds' step, rather than in the 'Current situation' step) also have a NEW, additional option called Control by % that allows you to keep fixed interest balances in a ratio with other assets in the SMSF (e.g keep cash, fixed interest and shares in a ratio of 10-20-70), and let Pathfinder calculate the deposits so that the ratio can be maintained. If you choose this option, it is recommended that you also set the 'Term (years)' field to one year so Pathfinder can re-balance every year, if required. If you choose a term of more than one year, then please pay close attention to any messages in the 'Solve events' - if there are errors or warnings, the underlying cause may be that setting a term of 2 or more years is too restrictive.

For more, see Fixed interest (term deposits, government bonds).

Results for for Fixed Interest in SMSF

In the results, if your case has a fixed interest account in an SMSF, you will see:

At the Strategy summary, the SMSF fixed interest will be listed after the SMSF reports (with the other SMSF assets)

In the Action items:

If the SMSF is closed, and a withdrawal is made from a fixed interest account, there will be an action item for the withdrawal

In any other year, there will be a general action item saying to review the SMSF assets.

- there will be a general action item reminding you to review your SMSF assets, and an action item if a withdrawal is made when the SMSF is closed. Note deposits to fixed interest happen in the SMSF in the middle of the year, which ensures that the interest calculations are consistent. So, if an SMSF has rollovers into the account at the start of the year, you may see funds being held in the transaction account or in another investment, until the deposit can be made to the fixed interest account mid-year.

In the Detailed reports:

The Transaction account and Transaction account (detailed) will list investments and withdrawals in the 'Revenue' and 'Expenditure' sections

An overview of the asset with deposits, withdrawals, interest calculations and balances is: Go to Consolidated > (SMSF name) > Assets & Loans > (Fixed interest name)

For more, see Fixed Interest results

New pages in our help documentation

We've added some new pages to our help documentation:

v1 Tips for modelling foreign income, investments and residency

How to make contributions over the concessional cap (a workaround)

We've also improved the Legislative updates and Optimo Pathfinder page and Release notes pages so it's easier to see the most recent updates.

Notes for existing users

Please refresh your results for active cases

If you have any existing cases in progress, please refresh your results by clicking the Start solve button (at the Results > Solve step) for any scenarios where you created results on or before the release date of 8 November 2021. This will ensure that all your scenarios are consistent and will also include the new charts for Annuities and Fixed interest. Note that the numbers in your results may change when you re-solve, but it is better to be consistent across scenarios. If you are unsure when your results were created, see How to check when your results were created.

Improved detailed reports for Tax

Various Tax reports at the 'Detailed reports' step have been updated so that they are more consistent and clearer. These changes are also helping us prepare for a new feature in a future release.

New reports have been added:

Losses (under: Individual > Tax) - shows tax losses claimed and tax losses carried forward from previous years.

Net rent (under: Assets and Loans > (investment property name)) - shows assessable rental income, deductible interest on loans, deductible running expenses, depreciation and capital works, and net rent.

Some lines on the the 'Tax' report (under each individual) have been adjusted:

The 'Assessable salary' line now has any voluntary pre-tax super contributions deducted. e.g. if the Individual earns $100,000, and they salary sacrifice $10,000, then the 'assessable salary' on this line will be listed as $90,000

The 'Assessable part of properties income' line has been renamed to 'Assessable net rental income', and you can see how this value was calculated in the new 'Net rent' report under the property

The 'Deductible interest on loans' line will exclude the property loans because it will be covered on the 'Assessable net rental income' line

Lastly, the 'Pre-tax income' report (Under: (Individual) > Tax), has been renamed to the 'Assessable income' report.

Changes to annuities

If you had an old case with an annuity, then there have been many changes with this release, including change the available 'Types', changes to fields. If you have a current case with an annuity that you added before this release, the best approach would be to replace the annuity you entered previously with a newly entered annuity:

Add another annuity

Copy the details of your original annuity over to the one you just added - you may have to fill in additional information, or there may be information that you filled in previously that is no longer required

Remove your original annuity

Click 'Start solve' again

.png)