How to review the results for a transition to retirement income stream (TRIS)

For information about how to enter data for a TRIS, see How to include or exclude a Transition to retirement income stream (TRIS, formerly known as TTR).

Reviewing a TRIS in the results

For general tips about reading the results, see the Results step.

In the results, you can see the TRIS in the following places.

Strategy summary step

Go to the Results step on the top menu, and then choose the Strategy summary sub-step.

On this page, find the Retire section for the individual, there will be a bullet point if the individual starts a TRIS.

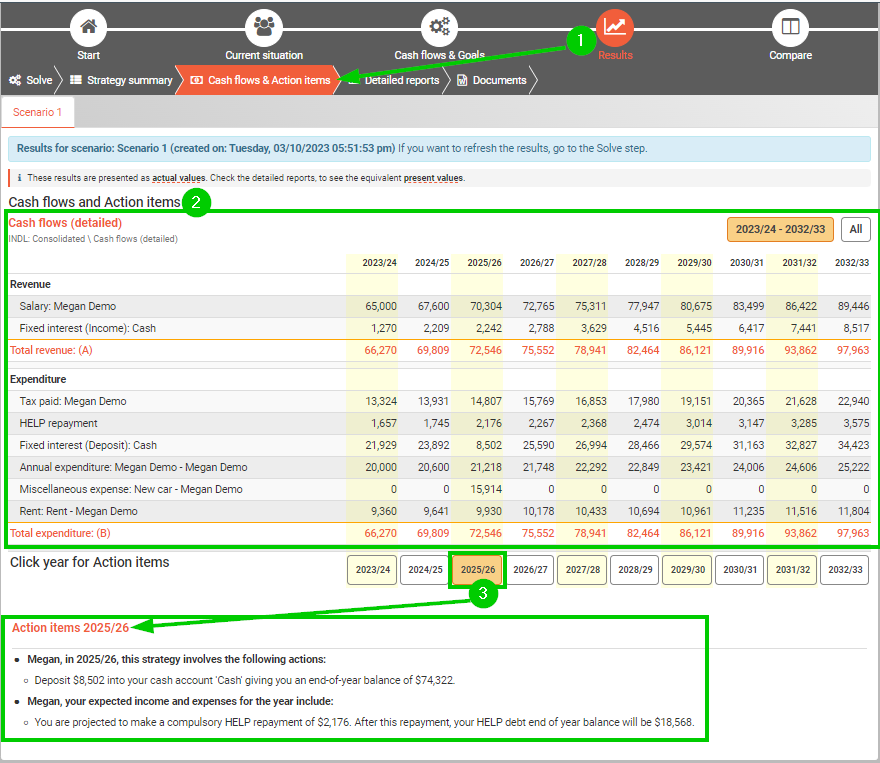

Cash flows & Goals step

Go to the Results step top menu, and then choose the Cash flows & action items sub-step.

In the Cash flows report, the TRIS will be listed in the Revenue section with a row called 'TRIS payment'

In the Action items, this is an action item for the TRIS in years where:

The TRIS is started or refreshed

A TRIS payment is made

When a TRIS is converted to an account-based pension (ABP)

Detailed reports step

Go to the Results step on the top menu, and then choose the Detailed reports sub-step.

Tou can see a TRIS in the following detailed reports:

Consolidated > Cash flows: There's a line for 'TRIS payment' (note that this will be the total TRIS payments if it is a couple)

Consolidated > Cash flows (detailed): There's a line for 'TRIS payment' for each individual

If the TRIS is drawn from a retail or industry super fund (note that the TRIS is drawn from the pension phase), then it is under this report:

"Individual name" > "Super fund name" > "Super fund name" Pension > Pension payments

If the TRIS is drawn from an SMSF: SMSF name > SMSF name > TRIS Balances

Troubleshooting a TRIS that is not started as you expected

If you were expecting to see a TRIS started in your results, but it is not matching what you were expecting, then some things to check are in the following table.

Note that if you would like to force the TRIS to start from a superannuation fund, you can see the instructions in the 'How to include a TRIS for an individual' section , above.

Thing to check | How to check it |

|---|---|

Check your data input allows a TRIS | Check the TRIS settings on the Retirement planning sub-step (under the Cash flows & Goals step on the top menu) and the Review super funds sub-step (under the Cash flows & Goals step on the top menu). For more details, see How to include or exclude a Transition to retirement income stream (TRIS, formerly known as TTR). |

Check the individual is eligible to start a TRIS | Pathfinder will not start a TRIS if they are not eligible to do so according to the current legislation. So you may wish to double check the individual's eligibility. e.g. you can check when they reach their preservation age on the Age Lookup table |

Does the individual have enough income to cover their expenses without a TRIS | Typically, Pathfinder will only start a TRIS in order to meet expenses. So, if an individual has sufficient income from other sources to meet their expenses, then Pathfinder may not start the TRIS. To see if this is the case, you can review their income at the Cash flows & action items sub-step (under the Results step on the top menu). Note that if you want to start the TRIS from a superannuation fund, then you can control the start date at the Review super funds sub-step (under the Cash flows & Goals step on the top menu). |

Are there other advantages to keeping funds in the accumulation fund rather than starting a TRIS. | Sometimes, there are benefits to keeping funds int he accumulation phase of super, rather than starting a TRIS. For more, see Understanding why funds are kept in in the accumulation phase of super instead of the pension phase. |

How to find out what return is being modelled for the TRIS

For an SMSF, the returns that are being used can be found by checking the assumptions report. For more, see How to see and edit the assumptions.

For a retail or industry super fund, the return, in the assumptions report will give you the returns, however, if you have entered fees, you will need to check the detailed reports for the final value:

Check the returns that have been entered for the super investment option at the assumptions.

In your results, go the to 'Investment return' detailed report for the super investment in the pension phase. To find the report, go to the Detailed reports sub-menu (on the Results step on the top menu), and then on the left menu, follow this path: (individual) > (Super fund name) > (Super fund name) Pension > Assets and loans > Investment – (investment name) > Investment return

On the ‘Investment return’ report, there is a line called 'Rate of return' which shows values with the following logic:

When the investment is in pension phase for the whole year, the rate of return will match the pension phase in the assumptions, minus any fees. For example, if the pension phase return is 6.6% and you've entered a 'Platform admin fee %' of 1%, then the 'rate of return will be 5.6%

When the investment is in TRIS phase for the whole year, the rate of return will match the accumulation phase in the assumptions. However, if you also entered fees on the investment, then fees will be deducted from the pre-tax amount, and then the tax will be deducted. For example, if the TRIS phase return (before fees) is 5.75% and you've entered a platform admin fee of 1%, the rate of return will be 4.9%, with the calculations as follows:

Return after tax = 5.75

Return before tax = 5.75 / 0.85 = 6.7647

Subtract fees = 6.7647 – 1 = 5.7647

Return after tax (and fees) = 5.7647 x 0.85 = 4.9

In transitional years (e.g.the year a TRIS is converted to an ABP, the year a TRIS or ABP starts), the return will be scaled for the portion of the year the return should be applied.

.png)