Investigating an Age Pension payment

Pathfinder estimates the Age Pension for each individual based on the current legislation and the data in the case. If the estimate is not what you were expecting then this page lists some things you can investigate.

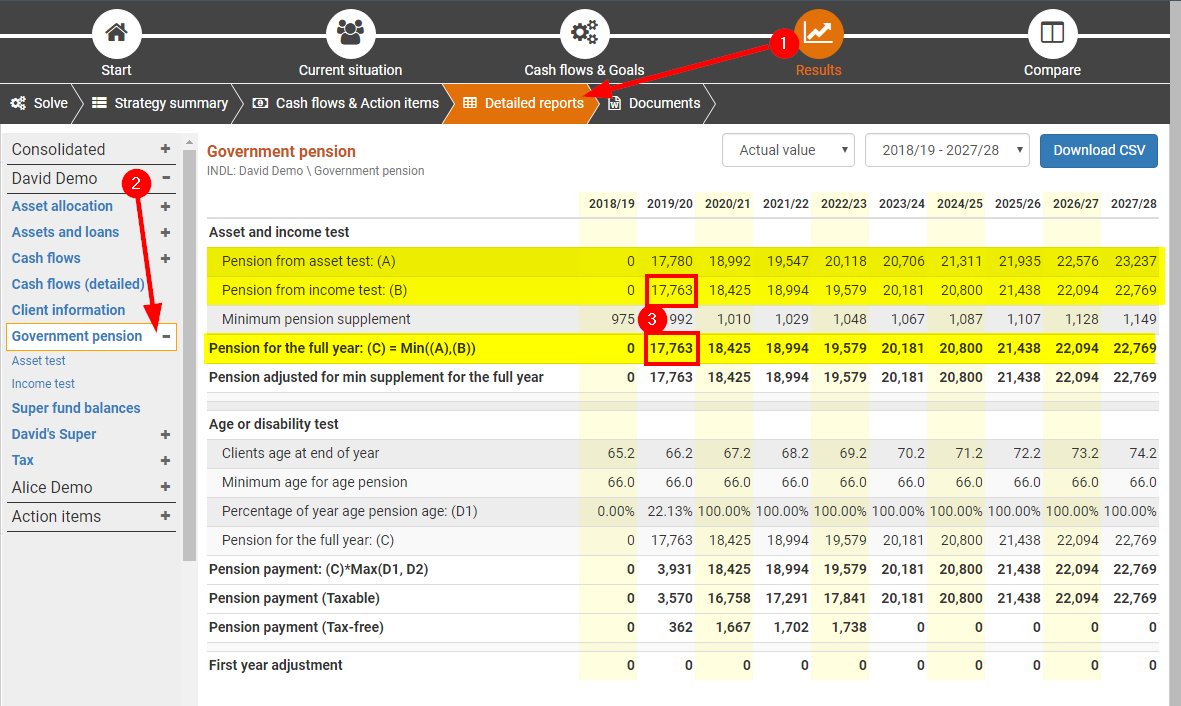

How to see if Income or Assets are restricting the Age Pension

If you were expecting an individual to earn a higher Age Pension, the first thing to check is whether their Pension is being more restricted by the Asset test or the Income test. To see which test is affecting an individual's Age Pension entitlement:

- Go to the Results > Detailed reports step

- On the left menu, click (Individual name) > Government pension

- On this report check the ’Pension for the full year’ line and check it against the values in the ‘Pension from asset test’ and ‘Pension from income test’ lines. The line it matches is the test that is limiting his Age Pension.

In the example below, in the second year, the individual's Age Pension entitlement is being restricted to by the income test:

Ensuring the the correct Age Pension rate is applied by setting the 'Marital status'

The Age Pension rates depend on whether the individual is part of a couple or is single. In Pathfinder, the 'Marital status' field (on the Current situation > Personal details step) is used to determine the whether to apply the single or couple rate.

.png)