How to convert a family home to an investment property (or vice versa) - a workaround

In Pathfinder, if you follow the instructions, below, it is possible to:

- Convert an existing investment property to a family home (provided that they will not be eligible for the Age Pension when it is their home)

- Convert an existing family home to an investment property

You should note that:

- If the property will be sold in the analysis, then you also will need to calculate the percentage of the CGT exemption yourself

- Since these changes are made in the 'Current situation' step, instead of the 'Goals' step, if you would like to run multiple scenarios (e.g. no conversion vs conversion, conversion in 2 years vs conversion in 5 years), then you should get results for the first scenario, then make a copy and change the data (note that if you would like to re-run the first scenario, you will need to adjust the data again).

These options are only part of the Optimo Financial SDS:

- Convert an existing investment property to a family home and include property as a family home for the purposes of their Age Pension assets test estimate

- Purchase an investment property and then later convert it to a family home

- Purchase a family home and then later convert it to an investment property

Instructions

The general steps are:

- Decide which year the conversion will happen

- Add the property as an existing investment property (regardless of whether it starts as a home or investment property)

- In the year the conversion happens, adjust the the fields which control the tax status, expenses and income (see below)

- Be aware of how this is presented in the results (see below)

For specific instructions:

Convert an existing investment property into a family home

If you would like to turn an investment property into a family home then:

| Step | Instructions | |

|---|---|---|

| 1 | Decide in what financial year the conversion should happen | In the instructions below, Pathfinder will assume the property turns into the family home on 1 July of the specified financial year. |

| 2 | Enter and adjust their current living arrangements (i.e. another home or rent) |

|

| 3 | Add the property that will be converted to the family home as an Existing Investment property | For more, see Investment Property |

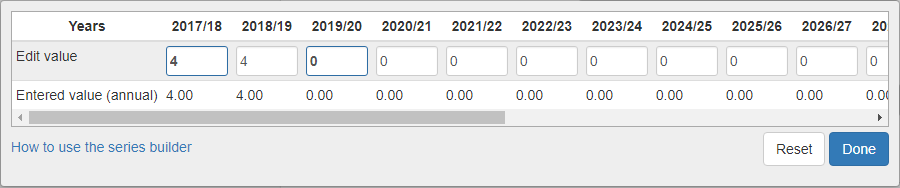

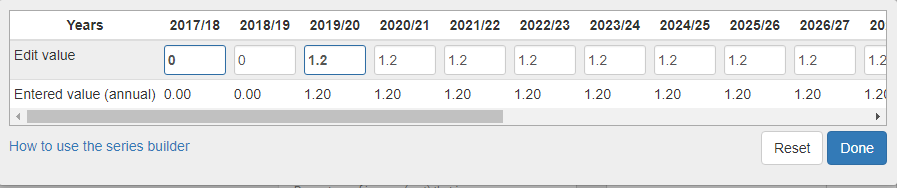

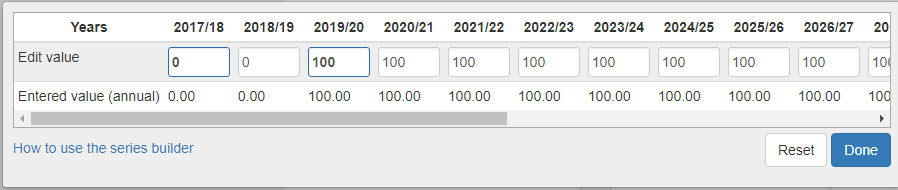

| 4 | On the property that will be converted to the home, stop the rental income (this will no longer be received when the property becomes a home). |

|

| 5 | On the property that will be converted, stop the running expenses (this will no longer be paid when the property becomes a home) | Examples of running expenses include council rates, strata fees, and property management fees (but not loan repayments):

|

| 6 | On the property that will be converted, stop the depreciation (this is no longer relevant when the property is a home) |

|

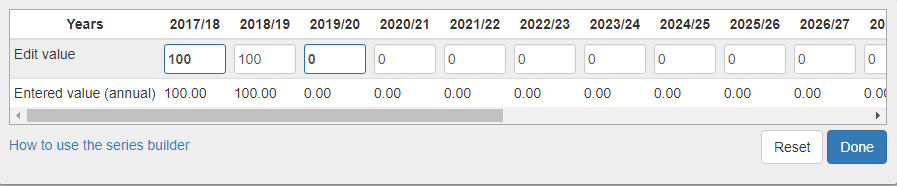

| 7 | On the property that will be converted, adjust the Capital gains exemption field (if the property will be sold) The property is not exempt when it is an investment property and is exempt when it becomes the family home. |

|

| 8 | If there is a mortgage on the on the property, adjust the Tax Status. The mortgage is tax deductible when the property is an investment and is not tax deductible when it's the family home. |

5. You may also wish to adjust the interest rate. |

| 9 | Understand how the conversion will be presented in the results | See How the conversion is represented in the results. |

Convert an existing family home into an investment property

| Step | Instructions | |

|---|---|---|

| 1 | Decide in what financial year the conversion should happen | In the instructions below, Pathfinder will assume the property turns into the family home on 1 July of the specified financial year. |

| 2 | At the current situation, add the home that will be converted into the investment property as an Investment property | For more, see Investment Property. Even though the property starts as a Family home, it is important to add it as an Investment property, as this allows the appropriate fields to be displayed when the conversion happens. |

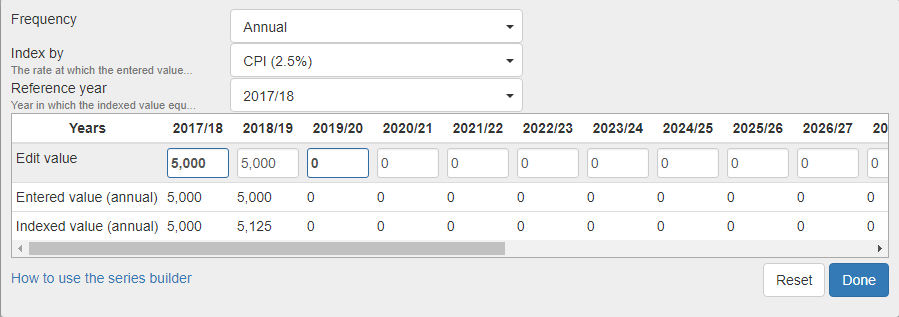

| 3 | On the property that will be converted, start the rental income (this will start being received when the property becomes an investment) |

|

| 4 | On the property that will be converted, start the running expenses (this expense will start when the home becomes an investment property). | Examples of running expenses include council rates, strata fees, and property management fees (but not loan repayments):

|

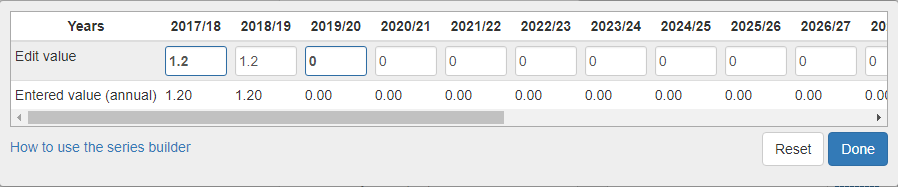

| 5 | On the property that will be converted, start the depreciation (this should start when the home becomes a property). |

|

| 6 | On the property that will be converted, adjust the Capital gains exemption if the property will be sold. The property's exemption from CGT will change when it becomes an investment. |

|

| 7 | On the property that will be converted, adjust the Costs deductible field. The running costs are deductible when it is an investment property and are not deductible when it is a family home. |

|

| 8 | On the property that will be converted, adjust the income assessable field. The income will start being assessable when the property becomes an investment |

|

| 9 | If there is a mortgage on the property that will be converted, adjust the Tax Status. The mortgage is tax deductible when the property is an investment and is not tax deductible when it's the family home. |

5. If the loan interest rate will be changing, you can use the series builder to adjust the Interest rate field for the relevant year |

| 10 | Enter their living arrangements after the property is no longer their home. |

|

| 11 | Understand how the conversion will be represented in the results | See How the conversion is represented in the results. |

How the conversion is represented in the results

In the results, although the calcualtions will be correct, the explanation of the conversion may not be as detailed as you require:

- Assumptions:

- The assumptions will be listed under the investment property only

- Strategy summary:

- The property will be listed as an investment property for the whole analysis

- Action items - Pathfinder will not create any action items for the conversion, so you may wish to add an action item such as:

Move out of your home, (property name), and rent it out as an investment property. This means that you will start receiving rent on the property and will pay running expenses. Furthermore, the loan repayments will be tax deductible.

Move in to (property) name and use it as your family home. This means that you will no longer receive rent on the property or pay running expenses. Furthermore, the loan repayments will no longer be tax deductible.

- Detailed reports:

- The property will be listed as an investment property in the detailed reports, even in the years it is a family home

.png)