Income results

For general tips about reading the results, see the Results step.

You can see results about your income in the following places.

Cash flows & Goals step

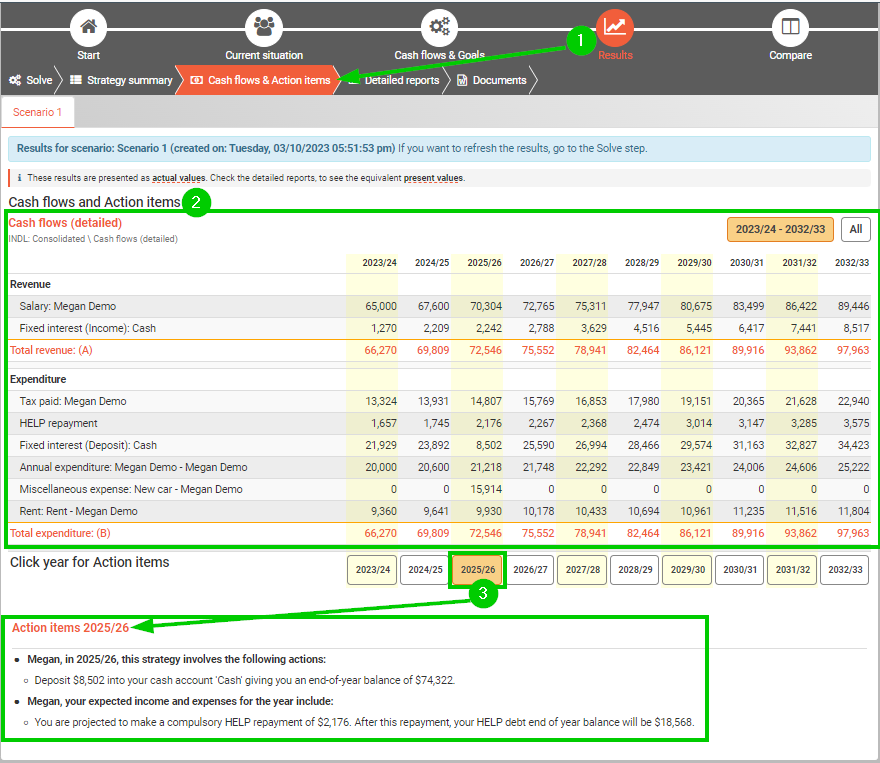

Go to the Results step top menu, and then choose the Cash flows & action items sub-step.

In the Cash flows report:

The Revenue section itemises annual income, with each source of income listed. For example, you may see income items for:

Wages, salary, business income

Withdrawals from assets such as cash accounts and share portfolios

Rental income for investment properties

Income from investments such as cash accounts (ie interest rate returns) and shares/managed funds (ie dividends)

Franking credits

Borrowings using secured and unsecured loans

Disposal of assets such as investment property and family home.

Detailed reports

Go to the Results step on the top menu, and then choose the Detailed reports sub-step.

At this step, the following reports may be useful (note, these reports list values for every year in the analysis):

Cash flows (under Consolidated) lists all direct income conflated into categories. For example, if each individual in the case has a salary, on this report, the salary will be conflated to a single line. This report is useful if your case has a lot of items and you just need a general overview.

Cash flows (detailed) reports (under Consolidated) lists all income itemised by item and individual. This report is useful when you are interested in specific details.

Reports under Consolidated > Assets & Loans give further details regarding sources of income

Cash flows and Cash flows (detailed) reports (under (Individual)) shows an individual's sources of income

Individuals ownership report (under Consolidated) lists an individual's percentage ownership for each asset

Reports under (Individual)> Assets & Loans give further details regarding an individual's sources of income for the assets owned by the individual, and borrowings using loans where the individual is the borrower.

Adjusting your results

If you would like to change something in the results or make another scenario for comparison, you need to change your input data and solve again. See Income for data entry tips, or these links for more tips:

- How to include or exclude the Government Age Pension

- How to include or exclude the super guarantee (SG)

- How to include the Family Tax Benefit (FTB-A and FTB-A)

- How to model a Disability Support Pension (DSP)

- Commonwealth Senior's Health Care Card (CSHC card) and Pensioner Concession Card

- How to maximise an individual's Age Pension entitlement by keeping their spouse's funds in the accumulation phase

- How to enter an initial Work Bonus balance

.png)