New Pathfinder Release (Leichhardt)

4 April 2018

Release summary

Useful links

Ready to check out this update?

Log in to Optimo PathfinderDo you have feedback or questions?

Contact usNeed further information?

Visit our website

New features in this release

SMSFs are now in BETA phase in the websolve (popular request!)

In Pathfinder, you can now model SMSFs with the following features:

One or two members

Include an existing SMSF or start a new SMSF

Include existing investments in an SMSF and add new investments. In this release investments are restricted to cash and shares/managed funds and we recommend keeping these assets in a ratio (properties and fixed interest can be modelled only with the Optimo Financial SDS)

There are some limitations in this BETA release, so please see our SMSF help docs for more details.

What is a BETA release?

A BETA release is a software development term for a software version that is fairly close to the finished product that is made available to users to try under real conditions. It is an opportunity for you to try a new feature sooner than if it were 100% complete, and is a chance for Optimo to gather more feedback and so we can incorporate it into the final version.

For the SMSF BETA release, this specifically means that:

If your case has an SMSF, the results should be fairly robust, but you should be aware of the limitations listed here.

We appreciate your patience and welcome feedback

The Optimo Team is continuing to work on an improved methodology which will be in the production release (date to be announced)

If you are an existing user of Pathfinder, please also see the Notes for existing users section, below.

Model a simple SMSF with our sample data

You can use our sample data to model a simple SMSF case:

Log in to Pathfinder or sign up (your first case is free)

Add a case (or select a case where you don't mind clearing the data) and at the Start step, choose the Jacob and Claire case (for more see How to use the sample data in Pathfinder)

To review the SMSF data entry, go to the Cash flows & Goals > Review Super step, choose the 'Start SMSF' scenario tab (top left, under the sub-menu). This step has instructions to:

Close their existing super funds

Open a new SMSF with cash, Australian shares and International shares kept in a 30:35:35 ratio

Go to the Solve step, and click the Start solve button (for more see How to solve a scenario to get results)

Review your results

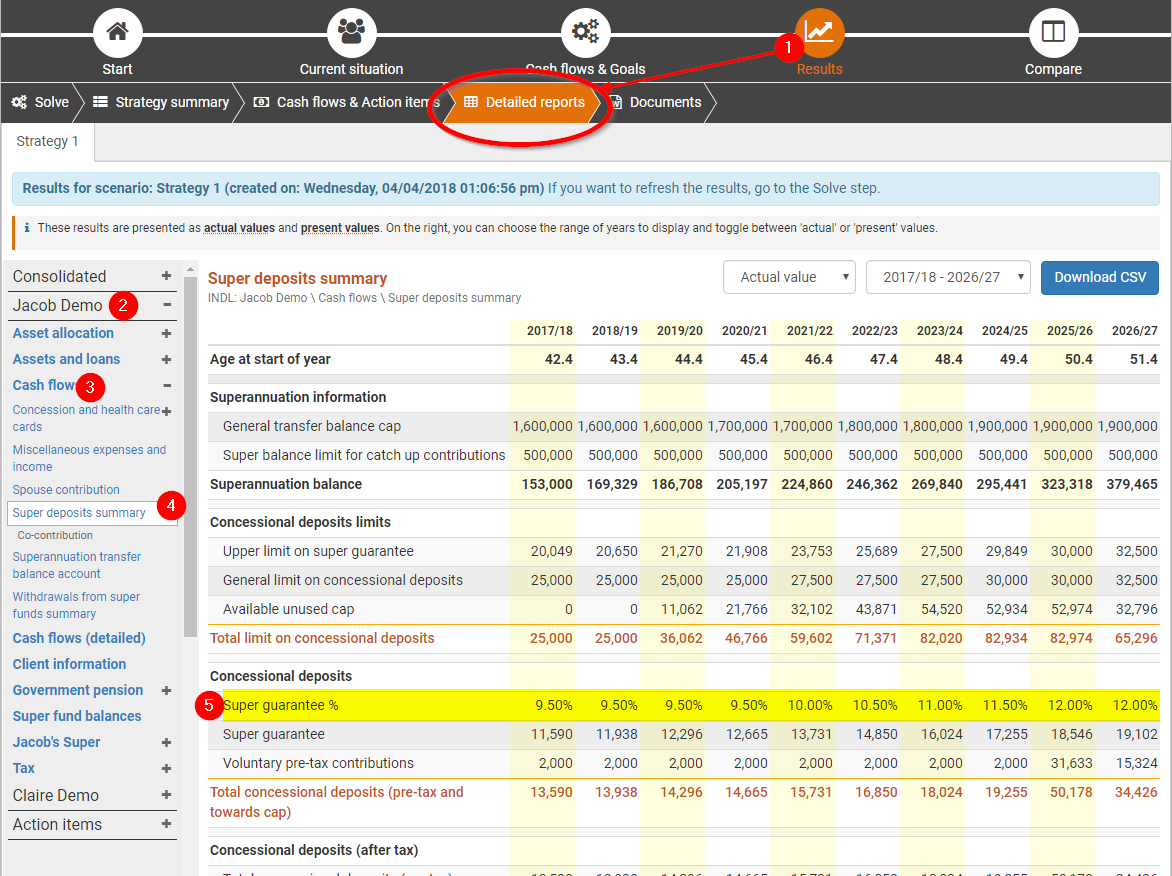

The 'super guarantee' percentage is now listed on the super deposits summary report

In the results, you can now see what percentage is used for the super guarantee in the Super deposits summary report. This is useful to see:

When the default super guarantee is legislated to increase. Pathfinder applies the current legislation of 9.5% in 2017/18 and then increasing to 10% in 2021/22 with further increases in later years (for more see the ATO's Super guarantee percentage)

If an individual has a non-default super-guarantee, you can see it is being applied.

To see this report (steps are labelled in the screenshot below):

Go to the Results > Detailed reports step

On the left menu, click the individual's name

Under the individual, click the Cash flows report

Under the Cash flows report, click the Super deposits summary report

In the report, there is a Super guarantee % line in the 'Concessional deposits' section

(robot) now an option for Shares/Managed funds

For shares/managed funds, the robot button:

is now available as an option at the Cash flows & Goals > Review Assets & Loans step, this is a more convenient alternative than leaving fields blank. This option lets Pathfinder calculate all deposits and withdrawals and depending on your case it could do anything from making the balance zero to directing all excess funds there, so double check the results to see check if they are appropriate. It is a good option to use in your initial modelling if you'd like to see what is feasible, and once you've got some numbers, you can make adjustments using the more restrictive options.

'Transfer balance cap % used' field required for cases starting from 2018/19

This field, listed under each Individual, is required as part of the new rules in the Fair and Sustainable Superannuation Bill (2016). It will be required under the following circumstances (Pathfinder will prompt you with validation if the field is left blank):

The analysis starts on or after 1 July 2018

If the individual has already started an account-based pension

This field is required to project the individual’s available transfer balance cap space, since it changes according to indexation. Also note that this field is not required for cases starting in the 2017/18 financial year, because in the first year of the Fair and Sustainable Superannuation Bill, Pathfinder calculates the value for you.

Links to release notes

We know these release notes are great bedtime reading, so you can now find them more easily with links in the following places:

In the footer of the login page the release name is a link

In the Pathfinder help menu, click 'Release notes'

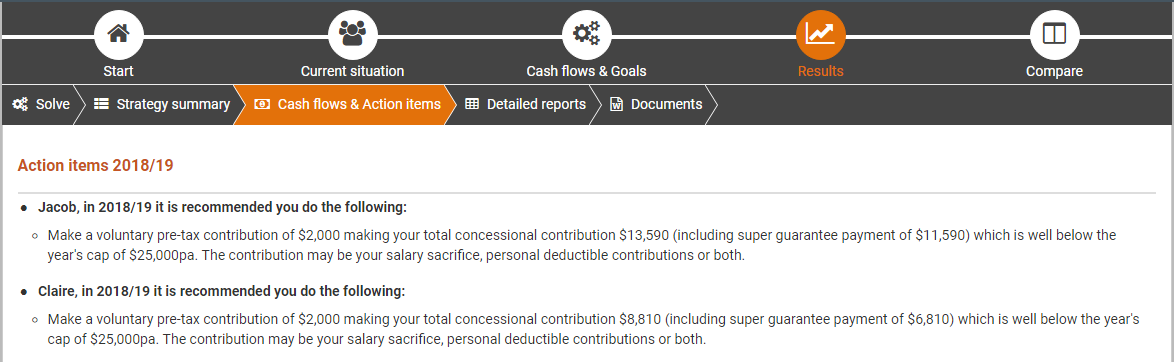

Bullet points are now in the online action items

At the 'Cash flows & Action items' step, the action items are now listed with bullet points, which should make them easier to read. (We lost them for a while but we've dusted them off and put them back - it turned out they'd all rolled under the couch).

Notes for existing users

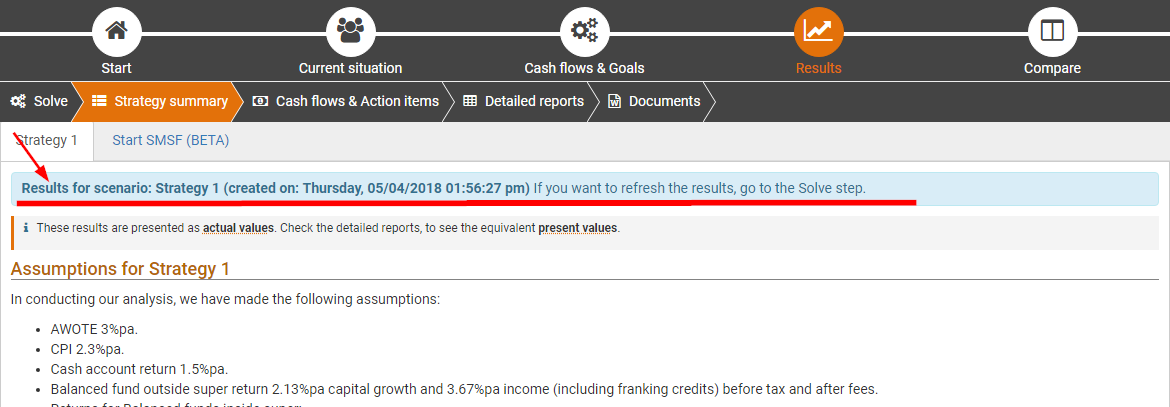

Remember to refresh the results for existing cases

If you have any existing cases in progress, we recommend clicking the Start solve button again for any scenarios where you created results on or before 4 April 2018. This will ensure that all your results are consistent.

The date your results were created is in the blue section at the very top of the Strategy summary step:

Changes to SMSFs

You can now model SMSFs in the websolve (if you'd expressed interest in them before, thanks for your feedback!). If you have been experimenting with SMSFs prior to this release, please note the following changes:

At the Cash flows & goals step, SMSFs are now listed in the Review super funds section (they used to be in the final SMSFs/Trusts step, but this step is now just Trusts).

SMSFs now have a new Auditing fee field listed under the 'Annual administration fee' field in the SMSF. This makes it easier to see the SMSF fees and saves data entry time. If you have a previous case where you entered this fee in the Cash flows > expenses, you can leave it there and put the auditing fee on the SMSF as zero.

In the results, the the SMSF 'Cash account' and 'Cash account (detailed)' reports have been renamed to 'Transaction account' and 'Transaction account (detailed)', this change was made to avoid confusion with an actual cash investment in the SMSF.

If you have an existing, unlocked case with an SMSF:

Make sure you click the Start solve button to refresh the results - this will generate new results with an improved methodology (i.e. you may have different numbers) and more comprehensive SMSF results (i.e. more charts and stuff)

Check at the Solve step for new validation messages - you may need to fill in some new fields

We now have more options for the assets held in the SMSF, so you can review and adjust them at the Cash flows & Goals > Review Super step.

In the results, the Strategy summary has new SMSF sections.

Option names for voluntary super contributions have been made clearer

For the Concessional super deposits options and the Non-concessional super deposits options the following button names have been changed to make them easier to understand:

Specify value has been changed to Set exact contributions

Maximum value hase been changed to Set maximum contributions

The underlying calculations for these buttons has stayed the same.

Adjustments to SDS-only secured loans

We've made some improvements for adding secured loans that are only part of the SDS (e.g. loans secured by shares/managed funds, new loans against existing assets). These are still only available as part of the SDS, but these changes have been made in prepartion for adding them to the websolve in a later release.

Changes to the 'Solve' step

The solve step has been rearranged a little because some new users found this step confusing. The 'Stop solve' button will also only display once a solve is in progress.

We've changed our default start date to 1 July 2018

The default start date of analysis for all cases is now 1 July 2018. For more information (including what to do about existing cases you want to change, or new cases you want to start before the end of 2017/18) see Default start date of analysis is changing to 1 July 2018

Useful links

If you don't have a login, Sign up to Optimo Pathfinder (your first case is free! No credit card required)

Find out more at www.optimofinancial.com.au

.png)