How to allow a value to be optimised in the series builder by using dash

Overview

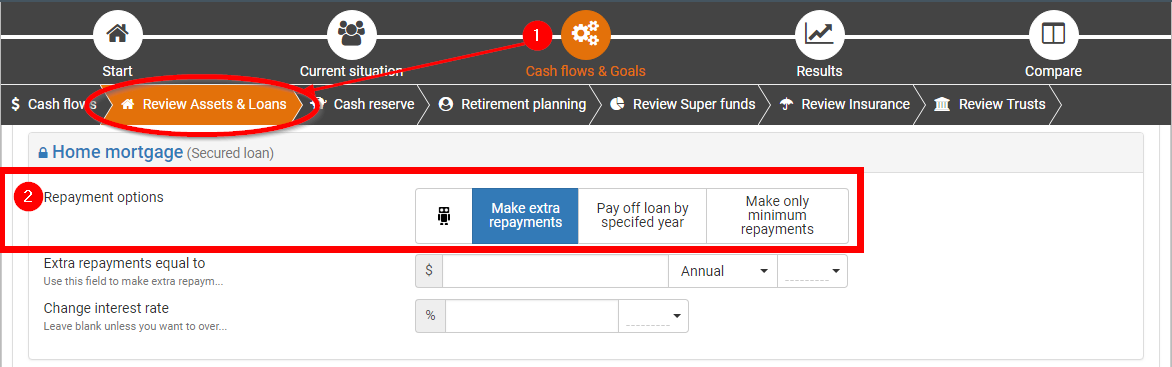

In some fields, you can use the series builder to set a specific value in some years, and put dash ( - ) to let Pathfinder calculate the value in other years when you’re setting instructions for any of the following:

- voluntary super deposits

- loan repayments

- deposits to liquid assets

- withdrawals from liquid assets

- future balances of liquid assets

The dash in the series builder is the same as the 'Robot' button, except it allows you to control when it is applied year-by-year, whereas the robot button universally applies to all years (to find out more about the series builder see How to use the series builder) and to find out more about the optimiser, see What does the 'Robot' button mean?.

How to find out if a field can use 'dash' to optimise

Pathfinder can only optimise in certain fields. If you are unsure whether you can use dash to optimise in a field, check the help under the field:

As a general rule:

- You cannot use dash to optimise in:

- any field in the Current situation

- Income or Expenses at the Cash flows step

- You can dash to optimise at the following steps in fields that relate to making deposits, making withdrawals, setting a maximum or minimum balance or making voluntary super contributions:

- the Review Assets & Loans

- Retirement planning

- Review Super funds steps

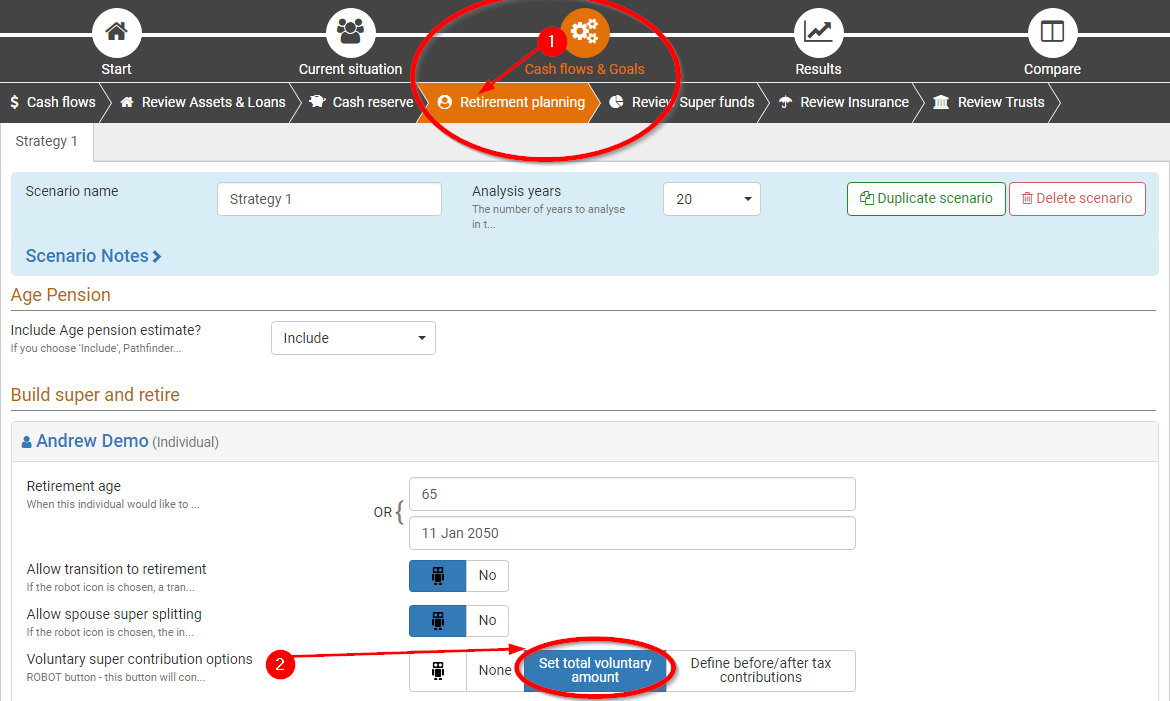

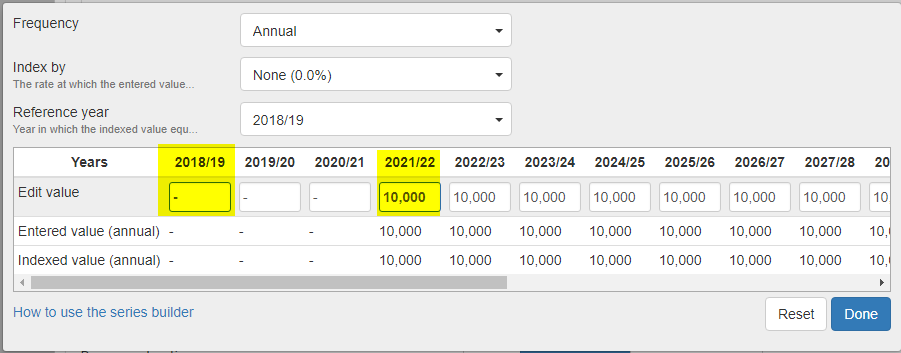

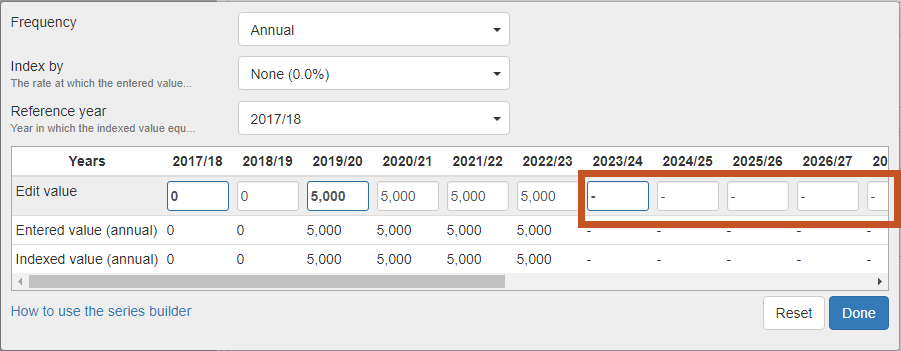

For example, at the Retirement planning sub-step (under the Cashflows & Goals step), you may want to set total voluntary super contributions to be no more than $1,000/year for the first 5 years, and then let Pathfinder work out the optimal contributions after that. In the series builder pop-up, simply put a dash in the years you want to optimise:

Examples of using dash in the series builder

Voluntary super contributions

You can limit super contributions in some years, while the individual is focussed on other priorities and let Pathfinder calculate contributions in other years when super contributions are the first priority. You can use dash in the series builder for the following:

- Maximum total voluntary super contributions

- Exact or maximum pre-tax contributions

- Exact or maximum after-tax contributions

If you let Pathfinder calculate contributions, it will contribute as much as the individual can afford if it will maximise their wealth at the end of the analysis under the given assumptions and other constraints in the case. It will not make contributions if it will cause a shortfall (e.g. if won't make a contribution in the first year, if the individual will need the funds in the second year and they cannot withdraw the funds from super) and it will always keep within the legislated caps and take advantage of bring-forward rules and unused concessional caps, if applicable. Generally, if you choose dash for any voluntary super contributions options, (total, just before tax or just after tax), it’s likely that Pathfinder will contribute as close to the cap as the individuals can afford to do without causing any cash shortfalls.

Example of controlling voluntary super contributions

In this example, the individual does not want to make any super contributions for the first two years (e.g. because they want to focus on repaying their mortgage), and then is willing to contribute up to $5,000 a year if they can afford to do so (e.g. because they feel they are too far from retirement to direct all their spare cash to super) and then from the 7th year onwards is happy to let Pathfinder calculate the contributions. So, to enter this instruction in Pathfinder:

| Instruction | Screenshot | |

|---|---|---|

| 1 |

|

|

| 2 | We would like to control the total voluntary super contribution amount, and let Pathfinder work out whether it's better to make contributions before or after tax (or both), so for the Voluntary super contribution options field, choose the Set total voluntary amount option. | |

| 3 | At the Maximum contributions field, open the series builder by clicking the arrow ▼ Then:

|

|

Loan repayments (e.g. secured loans, unsecured loans, HELP debts)

If an individual has a specific preference for how much extra they want to pay off a loan you can set an exact value, however, if there are cash shortfalls or flexibility is acceptable in some years, you can also use dash to optimise. For loans, you can use dash in the series builder for the following:

- Making extra repayments to secured loans and unsecured loans

- Making voluntary repayments to HELP debts

If you let Pathfinder calculate loan repayments, it will make extra repayments if the individual can afford it and if it will maximise total wealth under the given assumptions and other constraints in the case. Depending on the case, this may mean Pathfinder will not make any extra loan repayments at all or it can make very large repayments, so eyou should check the results to see whether the calculated strategy is acceptable. (Also note that for loans, the 'Pay off loan by specified year' is also a good option).

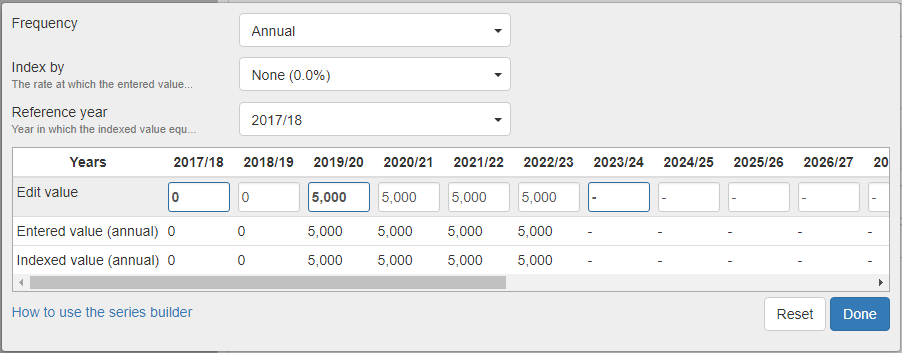

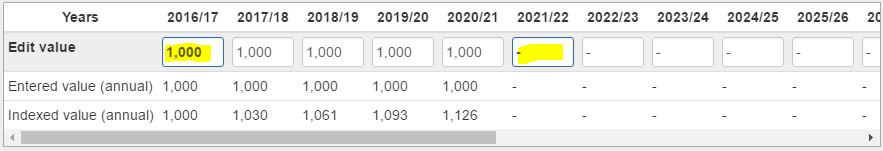

Example of controlling loan repayments and avoiding a cash shortfall

In this example, the individual wanted to make extra mortage repayments of $10,000 a year, however in the intial results, there was a cash shortfall in the first three years, which indicated the the individual couldn't intially afford to make such high repayments. So, to give Pathfinder the flexibility to work out a feasible strategy in the earlier cash-limited years and then set the cilent's preference in the later years, we do the following in Pathfinder:

| Instruction | Screenshot | |

|---|---|---|

| 1 | Go to the Cash flows & Goals step (top menu), then the Review Assets & Loans sub-step. |

|

| 2 | Scroll down the page to find the mortgage you want to control, and for the Repayment options field, choose Make extra repayments | |

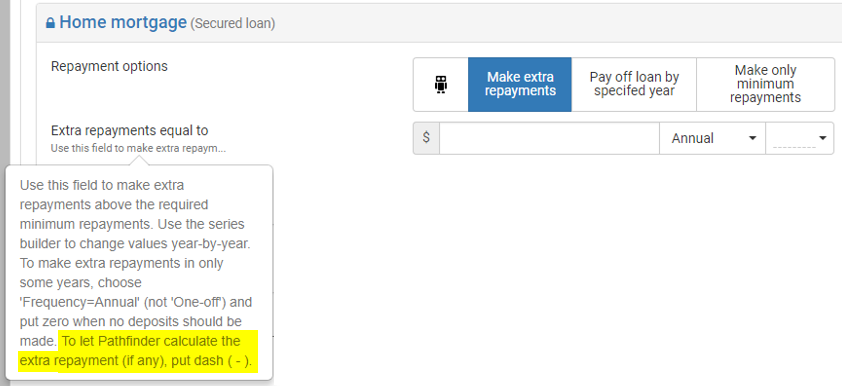

| 3 | In the Extra repayments equal to field, open the series builder by clicking the arrow ▼ Fill in the series builder pop-up as follows:

|

|

Deposits to assets (e.g. Shares/Managed funds and Insurance bonds)

For liquid assets such as Shares/Managed funds and Insurance bonds, you have options to control the deposits, withdrawals and/or balances in some years and let Pathfinder calculate these values in other years. When the field is available, you can use dash in the series builder for the following:

- Set exact, minimum or maximum deposits

- Set withdrawals

- Set a maximum balance

If you let Pathfinder calculate deposits, withdrawals or a maximum balance, it will calculate these values to maximise the individual's wealth at the end of the analysis, within the given assumptions and other constraints in the case. This means it may calculate the deposit/withdrawal/balance to be zero, or it might be larger than expected, so you should check the results are appropriate. It will not do anything that will result in a cash shortfall or that conflicts with other instructions (e.g. minimum investment period).

Example of controlling deposits to shares/managed funds

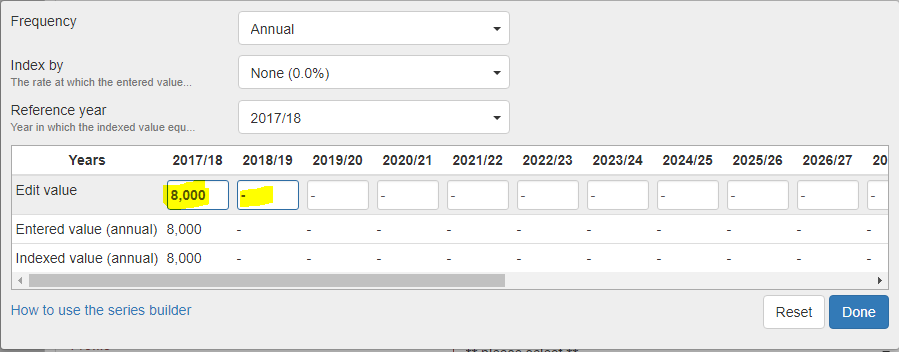

In this example, the individual wanted to make an initial deposit of $8,000 to their new shares/managed fund, and then after that wanted to see what deposits Pathfinder would calculate given competing priorities of paying off their mortgage by a certain date and making voluntary super contributions. To do this in Pathfinder:

| Instruction | Screenshot | |

|---|---|---|

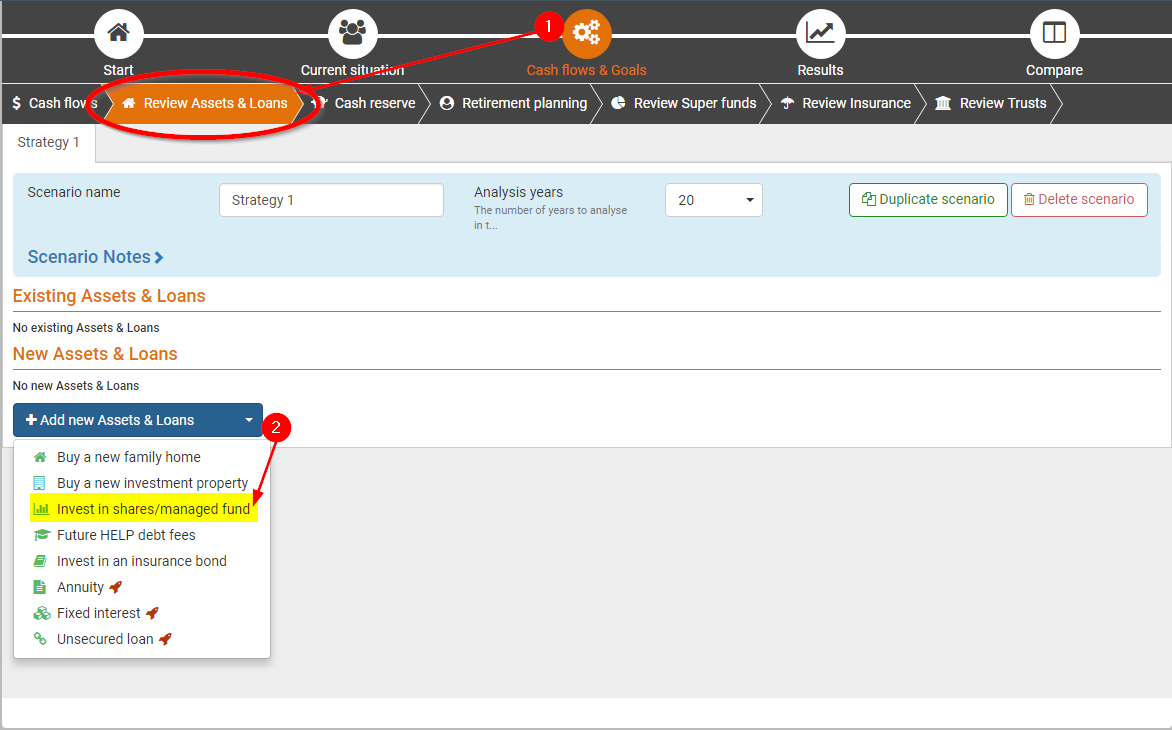

| 1 | Go to the Cash flows & Goals step (top menu), then the Review Assets & Loans sub-step. |

|

| 2 | To add the new shares/managed fund, scroll to the end of the page, click the Add new Assets & Loans button, and select Invest in shares/managed fund | |

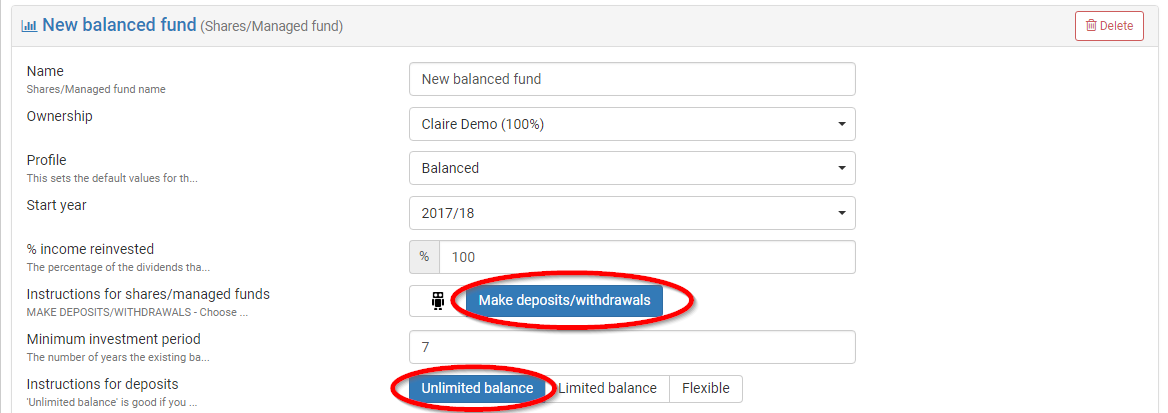

| 3 | Fill in the details for shares/manged funds:

|

|

| 4 | For the Deposit at least field, open the series builder by clicking the arrow ▼ Fill in the series builder as follows:

NOTE: In the results, if Patfhinder deposits more than $8,000 in the first year, then you can fill in the same details in the series builder for the Deposit no more than field. |

|

Why you can’t optimize expenses

You cannot use 'dash' or the 'Robot' in expenses entered at the Cash flows step. However, there are some alternative approaches or rules for 'optimising' an expense.

| What you want Pathfinder to calculate | How to enter this in Pathfinder (For more about entering expenses, see the Expense help page): | |

|---|---|---|

| 1 | Calculate what year an expense should occur to optimise your overall wealth | According to Pathfinder, if you want to spend money that isn't related to an asset or loan, the best year to do this is the last year of the analysis (or, even better, not at all). So, in this situation, expenses should be viewed as a personal preference that needs to be set by the individual, rather than something Pathfinder can calculate. |

| 2 | Calculate the earliest affordable year an expense can occur |

|

| 3 | Assuming that an expense must occur in a particular year, calculate the maximum affordable value. |

|

.png)